Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

It is important to stay updated with the latest EPF interest rate 2024-25 to check how much interest you're getting on Employees' Provident Fund corpus and how to calculate the total rate on it. You can also check the historical EPF rates to know how consistent EPF has been in helping employees earn on their PF savings. The EPF interest rate for the Financial Year 2024-25 is 8.25%

Get your Free Credit Report with Monthly Updates

Let’s Get Started

The entered number doesn't seem to be correct

Employees’ Provident Fund (EPF) is a retirement benefit scheme where the employee contributes 12% of his/her basic salary and dearness allowance every month. The employer also contributes an equivalent amount (8.33% towards EPS and 3.67% towards EPF) to the employee’s account. The employee can withdraw the accumulated corpus at the time of retirement and also during the service period under some conditions and for specific purposes.

The money contributed earns interest at a rate announced by the government every year. Read on to find out more about the current EPF interest rate for FY 2024-25, interest calculation method and more.

| Table of Contents: | ||

| EPF Interest Rate | EPF Contribution | Calculate Interest on EPF |

| Interest on Inactive EPF Accounts | FAQs | Latest News on EPF Interest Rate |

The EPF interest rate for the Financial Year 2023-24 is 8.25% |

The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance. The review of the EPF interest rate for a financial year is set at the end of that financial year (most probably in February but may go up to April or May).

The EPF interest rate for FY 2023-24 was also 8.25%

Here is a brief overview of EPF interest rate history or EPFO interest rate history:

| Year | EPF Interest Rates |

| 2023 -2204 | 8.25% |

| 2022 – 2023 | 8.15% |

| 2021 – 2022 | 8.10% |

| 2020 – 2021 | 8.50% |

| 2019 – 2020 | 8.50% |

| 2018 – 2019 | 8.65% |

| 2017 – 2018 | 8.55% |

| 2016 – 2017 | 8.65% |

| 2015 – 2016 | 8.80% |

| 2013 – 2015 | 8.75% |

| 2012 – 2013 | 8.50% |

| 2011 – 2012 | 8.25% |

| 2010 – 2011 | 9.50% |

| 2005 – 2010 | 8.50% |

| 2004 – 2005 | 9.50% (9% Interest + 0.5% Golden Jubilee bonus interest) |

| 2001 – 2004 | 9.50% |

| 2000 – 2001 | 12% (April-June, 2001) and 11% (July 2001 onwards) on the monthly running balance |

| 1989 – 2000 | 12.00% |

| 1988 – 1989 | 11.80% |

| 1987 – 1988 | 11.50% |

| 1986 – 1987 | 11.00% |

| 1985 – 1986 | 10.15% |

| 1984 – 1985 | 9.90% |

| 1983 – 1984 | 9.15% |

| 1982 – 1983 | 8.75% |

| 1981 – 1982 | 8.50% |

| 1979 – 1981 | 8.25% |

| 1978 – 1979 | 8.25% + 0.5% bonus (for members who did not withdraw any amount from their PF during 1976-1977 & 1977-1978) |

| 1977 – 1978 | 8.00% |

| 1976 – 1977 | 7.50% |

| 1975 – 1976 | 7.00% |

| 1974 – 1975 | 6.50% |

| 1972 – 1974 | 6.00% |

| 1971 – 1972 | 5.80% |

| 1970 – 1971 | 5.70% |

| 1969 – 1970 | 5.50% |

| 1968 – 1969 | 5.25% |

| 1967 – 1968 | 5.00% |

| 1966 – 1967 | 4.75% |

| 1965 – 1966 | 4.50% |

| 1963 – 1964 | 4.25% |

| 1957 – 1963 | 4.00% |

| 1955 – 1957 | 3.50% |

| 1952 – 1955 | 3.00% |

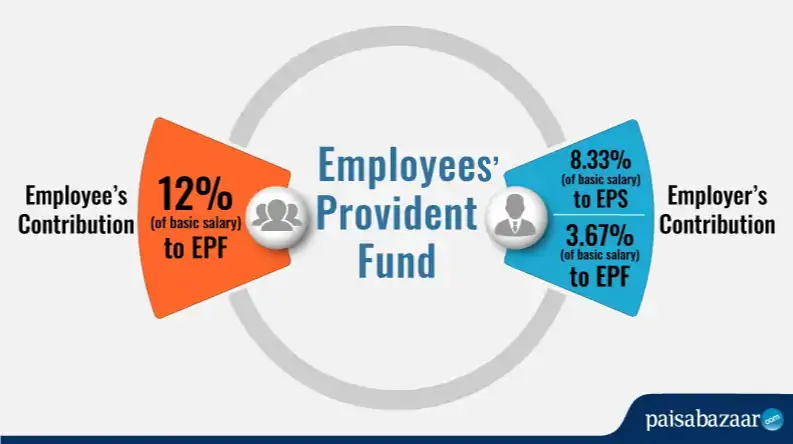

EPF Contribution consists of two parts depending on the entity that makes the contribution – Employee’s contribution and Employer’s contribution.

The employee makes a contribution of 12% of basic salary + dearness allowance towards his EPF account. The employee has to make a lower 10% contribution in case the establishment has less than 20 employees or for industries such as (a) Jute (b) Beedi (c) Brick (d) Coir and (e) Guar gum Factories.

The employer makes a contribution of 8.33% towards the EPS (Employees’ Pension Scheme) account of the employee. Another 3.67% is added to the EPF account of the employee. The employer also makes 0.50% of contribution towards the EDLI (Employees’ Deposit Linked Insurance) account of the employee.

The employer has to pay an additional charge for administrative accounts at a rate of 0.50% with effect from 1st June 2018. The minimum administrative charge is Rs. 500 and if there is no contribution for a specific month, the employer has to pay a fee of Rs. 75 for that month.

EPF interest is calculated every month but is deposited in the account at the end of the financial year. The following example explains the interest calculation on the EPF of the employee:

The following example explains:

Example of calculation of interest for a financial year-

Basic Salary + Dearness Allowance = Rs. 15,000

Employer’s contribution towards EPF = Employee’s contribution – Employer’s contribution towards EPS = Rs. 550

The EPF rate of interest FY 2024-2025 is 8.25%.

When calculating interest, the interest applicable per month is = 8.25%/12 = 0.687%

Assuming the employee joined service on 1st April 2024, contributions start for the financial year 2024 – 2025 from April

| Total EPF Contribution for April = Rs. 2,350 |

| Interest on the EPF contribution for April = Nil (No interest for the first month) |

| EPF account balance at the end of April = Rs. 2,350 |

| Total EPF Contribution for May = Rs. 2,350 |

| Total EPF contribution for May = Rs. 4,700 |

| Interest on the EPF contribution for May = Rs. 4,700 * 0.687% = Rs. 32.289 |

*The interest will be calculated every month but will be deposited only at the end of the financial year (on 31st March 2025 in this case)

In FY 2011-12, the EPFO had suggested to stop paying interest to EPF accounts in which negligible or no contributions are made for more than 3 years. However, this decision has been rolled back in 2016.

Consequently, even the accounts which are lying inactive for more than 3 years will be credited with interest earned according to the existing rates. Nonetheless, you will not earn interest if your account has become inoperative i.e. after the end of scheme tenure; when you have attained the age of 58 and haven’t withdrawn the EPF balance.

Here a few key things that you need to know about EPF, EPS and EDLI:

| Employees’ Provident Fund (EPF) | Employees’ Pension Scheme (EPS) | Employees’ Deposit Linked Scheme (EDLI) |

Ans. According to the specifications of The EPF Act of 1952, interest is credited to the member’s account as per the monthly running balances with effect from the last day of each financial year.

Ans. According to the recent interest rate revision rolled out by the Finance Ministry, the EPF interest rate remains unchanged at 8.25% p.a. in FY 2024-2025 as the previous FY 2023-2024.

Ans. Till the date of retirement, the EPF balance is exempted from tax payments. But, interest credited after retirement stands taxable as an ‘income from other sources. However, as per Budget 2021, if the deposits in EPF and VPF are more than Rs. 2.5 lakh in a financial year, then the interest earned on the contributions exceeding Rs. 2.5 lakh will be taxable.

Ans. The current EPF interest rate for FY 2024-2025 is 8.25% whereas the rate of interest for PPF FY 2025-26 is 7.10%

Read more on PPF (Public Provident Fund) – Eligibility, Tax Benefits, Interest Rate 2025

Ans. An individual gets interest on EPF for up to 3 years post retirement. After 3 years of no contribution to the EPF account, it tends to become inoperative and won’t earn any interest.

Ans. Under normal circumstances, an employee can withdraw the principal amount including accrued interest upon retirement. Moreover, anyone above 54 years of age is allowed to withdraw 90% of the accumulated balance. Also, in case an individual remains unemployed for 2 months or more, he/she is entitled to withdraw the entire accumulated balance on that date.

Following the finance ministry’s approval, the labour ministry declared an interest rate of 8.1% on Employees’ Provident Fund Organisation (EPFO) deposits. This interest rate of 8.1% for 2021-2022 is the lowest in more than 40 years and is a significant cut from 8.5% credited in 2020-21 and 2019-20. However, it will enable EPFO to credit interest in the accounts of more than sixty million EPFO members earlier than usual in 2021-2022. Also, the 8.1% interest rate has been decided based on EPFO’s income which is expected to be Rs 76,768 crore this year and will enable the retirement fund body to be in a surplus of Rs 450 crore.

As per a recent update, from April 1, 2022, interest accrued on EPF contributions will be taxable unlike earlier. For non government employees, interest earned on EPF contributions exceeding Rs. 2.5 lakh will liable to be taxed starting April 1, 2022. For government employees, the limit has been set at Rs. 5 lakh.

Amidst the outbreak of COVID-19 Pandemic in India, the Finance Minister Nirmala Sitharaman announced on 26th March that the government will pay the entire Employees Provident Fund (EPF) contribution for the next 3 months for both the employer and the employee (12 per cent each) for certain section of employees.

Further announcing the coronavirus economic relief package, she adds that this contribution is for those establishments that have a maximum of 100 employees and a majority of them earn less than Rs. 15,000. “Government ready to amend the regulation of EPF due to this pandemic so that workers can draw up to 75% non-refundable advance from credit in PF account or 3 months salary, whichever is lower.”

THE new EPF interest rate was announced by the Union Labour Minister Santosh Gangwar on March 4th, 2021. The interest rate for the scheme has been retained for the current financial year at 8.50%.

“The EPFO has decided to provide 8.50 percent interest rate on EPF deposits for 2019-20 in the Central Board of Trustees (CBT) meeting held today”, states Gangwar.

Earlier in the year 2016-17 and 2018-19, the EPFO had given an 8.65% rate of interest to the subscribers. It was 8.80% in 2015-16.

Recently, an update regarding the hike in Employees’ Provident Fund interest rates to 8.65% has been rolled out by the Labour Minister Santosh Gangwar. He reported that the Labour Ministry will notify about the change very soon and more than 6 crore subscribers are going to be benefitted from this rise.

Currently, under PF withdrawal claims, the EPFO is entitled to pay 8.55% interest for 2018-19. It was in February that the Central Board of Trustees under EPFO had a discussion with the Labour minister which resulted in an agreement on the raise of interest rate on EPF to 8.65% for 2018-19.

Immediately after the concurrence of the Finance Ministry, the EPFO will be directing over 136 field offices to credit the interests and settle the claims of the account holders. Moreover, according to the previous financial year records, the interest rate was 8.7% which means there would have been a deficit of Rs.158 crore. And there will be a surplus of Rs.151.67 crore after the provision of 8.65% interest rate.

As per the statement released by the Labour and Employment Minister, Santosh Kumar Gangwar, EPFO has started crediting interest @ 8.5% for the year of 2019-2020. The total interest amounting to around Rs. 1,000 crore would reach the accounts of around 6 crore EPF members.