Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Life insurance is considered an important part of financial planning because it provides financial security to the family in case of the sudden death of the main earning member of the family. The most basic form of life insurance is a term insurance.

Table of Contents:

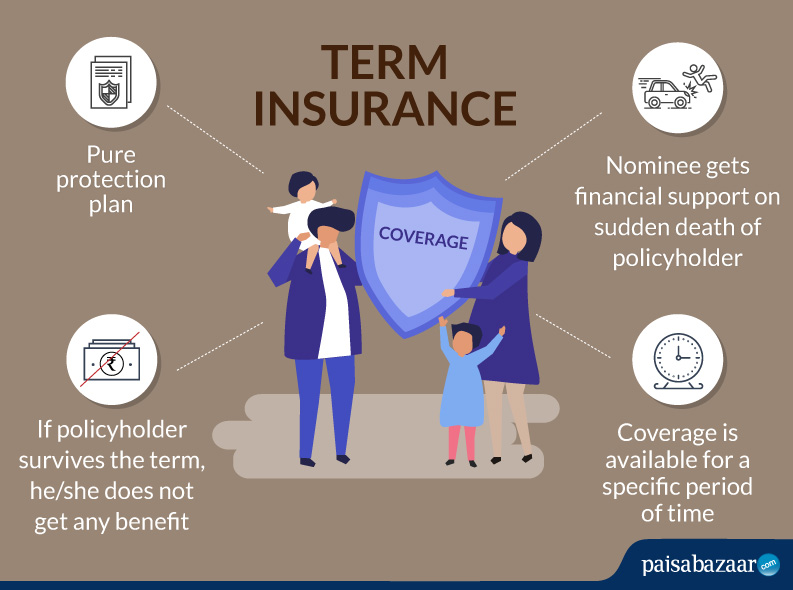

In a term insurance, the nominee or beneficiary gets an assured amount, if the policyholder happens to pass away during the term of the policy. Thus, the coverage is available only for a specific period of time. And in case the policyholder survives the term, he/she does not get any benefit.

Thus, a term insurance provides financial security to the family even when the bread-winner is not around. This can help manage not just the daily expenses, but also repay loans and fund other requirements like children’s education and wedding. The beneficiary or the nominee can take the assured amount or sum assured either in one go or in instalments. A term insurance is considered an affordable plan considering the fact that it gives high coverage even for a small amount of premium.

A premium is the money that you pay to an insurance company to get the insurance or the coverage. It is an important deciding factor while selecting an insurance plan. The premium paid for a term insurance is considered cheap, given the kind of comprehensive coverage provided by a term plan.

Before buying a term insurance, compare the premium of various plans. This can be done by using a premium calculator, an online tool to calculate the premium. However, the calculator does not give the exact premium amount, but an estimate of the amount. The premium calculation of a term plan depends on various factors. These are:

| Particulars | Details |

| Entry Age | 18 years-65 years |

| Maturity Age | 75 years |

| Minimum Sum Assured | Rs. 50,000 |

In case of any eventuality, you need to make claims the correct way so that you do not miss out the benefits. Let us look at the process.

Once you have approached the insurance company, you should keep the documents in place to avoid any claim rejection. The documents required vary with case to case. Let us look at some common documents required for claim.

A term plan does not cover all situations. These are called exclusions. In case the death occurs under certain circumstances, the nominee does not get the claim amount. This varies from company to company. Some of these cases are:

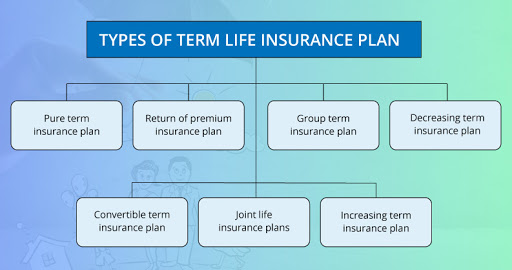

Before finalising the type of term insurance plan, understand certain aspects to take an informed decision.

A term insurance plan is one of the cheapest plans. It aims to financially secure the family, in case of the sudden demise of the main earning person of the family. Some of the other advantages of the plan are:

Q1. What is an ideal life insurance cover?

It should be at least 15-20 times the annual income of the policyholder.

Q2. Are there any riders available under term insurance plan?

Yes. There are many riders available under term insurance plans – Accidental Death Benefit Rider, Critical Illness Rider, Waiver of Premium Rider, Hospital Cash Rider and others.

Q3. What benefits will I get on maturity under term insurance plan?

There is no such benefit as on maturity under term insurance plan. Policyholders can only avail death benefit in the form of sum assured.

Q4. Can I change the premium amount during the term of the policy?

No. Policyholders need to pay the same premium amount for the entire policy term.

Q5. Can I avail more than one term insurance plan?

Yes. Policyholders can avail more than one term insurance plan.

Q6. Is term insurance available for NRIs?

Yes, NRIs can also avail term insurance plans.