Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

HDFC Bank provides variants of current accounts to meet every kind of requirement from different individuals, be it a small entrepreneur, a large corporate, trust, housing society, professional etc. With HDFC Bank Current Account, one can efficiently and conveniently manage cash and carry out bulk transactions hassle-free. HDFC Bank Current Account offers a host of services such as local clearing, dynamic limit, instant cash withdrawal and deposits, funds transfers and more.

| Table of Content |

Below mentioned table shows the list of online current account variants provided by HDFC Bank. It is to be noted that HDFC Current Account minimum balance requirement varies from one account to another. Hence this factor is to be kept in mind while choosing the type of HDFC Bank current account.

| HDFC Current Account | Primary Features |

| Max Advantage Current Account |

|

| Ascent Current Account |

|

| Activ Current Account |

|

| Plus Current Account |

|

| Premium Current Account |

|

| Regular Current Account |

|

| Smartups for Startups |

|

| Saksham Current Account |

|

| E-Commerce Current Account |

|

| Current Account for Professionals |

|

| Agri Current Account |

|

| Government / Institutional Current Account

(HDFC Zero Balance Current Account) |

|

| RFC– Domestic Account |

|

| Exchange Earners Foreign Currency Account |

|

The customers get the privilege of free NEFT, RTGS and IMPS transactions plus free and unlimited DD at bank location.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Metro and Urban: Rs.5 lakh

Rural and Semi-Urban: Rs.2.5 lakh |

| Non-Maintenance Charges | Metro and Urban: Rs.8000 per quarter

Rural and Semi-Urban: Rs.4000 per quarter |

| Cash Deposit Limit | Free up to 12 times of current month AMB |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to 12 times of current month AMB |

| Cheque Leaves | Free up to 100 cheque leaves |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | Free up to 150 transactions |

| DD / PO | Free |

| NEFT / RTGS / IMPS transactions | Free |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship Firms, Private & Public Limited Companies |

Get up to 100 cheque leaves for free and local and intercity cheque collection and payments free for unlimited value.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Metro and Urban: Rs.50,000

Rural and Semi-Urban: Rs.25,000 |

| Non-Maintenance Charges | Rs.3000 per quarter |

| Cash Deposit Limit | Free up to 10 times of current month AMB |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to 10 times of current month AMB |

| Cheque Leaves | Free up to 100 cheque leaves |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| DD / PO | 50 DD / PO for Rs.1 lakh of balance maintained |

| NEFT / RTGS transactions | Free |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship Firms, Private & Public Limited Companies |

This account comes with a low minimum balance requirement of just Rs,10,000. Get 500 cheque leaves free per month.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.10,000 (all locations) |

| Non-Maintenance Charges | Rs.1500 per half year |

| Cheque Leaves | 500 leaves free per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship Firms, Private & Public Limited Companies |

The customers get the advantage of cash deposit limit of Rs.10 lakh and free cash withdrawal from home branch.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.1 lakh |

| Non-Maintenance Charges | Rs.50,000 and above: Rs.1500 per quarter

Less than Rs.50,000: Rs.6000 per quarter |

| Cash Deposit Limit (Home Branch) | Rs.10 lakh or 50 transactions |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Rs.1 lakh per day |

| Cheque Leaves | 300 cheque leaves free per month |

| DD / PO | Free up to 50 DD / POs per month |

| NEFT / RTGS | Free |

| Account Closure Charges | Beyond 12 months: Free |

Avail free NEFT, RTGS and IMPS transactions plus free cash withdrawal from home branch.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.25,000 |

| Non-Maintenance Charges | Rs.1800 per quarter |

| Cash Deposit Limit | Free up to Rs.3 lakh per month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to Rs.25,000 per day |

| Cheque Leaves | Free up to 100 cheque leaves |

| DD / PO | Above Rs.1 lakh – Free |

| NEFT / RTGS / IMPS transactions | Free through net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship / Partnership, Partnership Firm, Limited Company, Trust, Foreign Institutional Investor, Foreign National residing in India, Limited Liability Partnership, Association / Club |

This variant comes with a low minimum balance requirement of Rs,10,000. Get NEFT and RTGS transactions free via net banking.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.10,000 |

| Non-Maintenance Charges | Rs.1500 per quarter |

| Cash Deposit Limit | Free up to Rs.2 lakh per month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Charges at Rs.2 / Rs.1000, min Rs.50 per transaction |

| Cheque Leaves | Nil |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | Maximum of 50 transactions per month |

| DD / PO | Above Rs.1 lakh – Free |

| NEFT / RTGS transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship / Partnership, Limited Company / Limited Liability Partnership, Trust / Association / Club / Society |

This account requires no maintenance of balance for the first 2 quarters. Get a free cash withdrawal limit of Rs 5 lakh per month.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Zero AQB requirement for first 2 quarters |

| Non-Maintenance Charges | Rs.1800 per quarter |

| Cash Deposit Limit | Free up to 12 times current month AMB |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to Rs.5 lakh per month |

| Cheque Leaves | Free 100 cheque leaves per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | Maximum of 200 transactions per month |

| DD / PO | Free up to 50 DD / POs per month |

| NEFT / RTGS / IMPS transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Proprietorship, Partnerships, Limited Liability Partnership (LLP), Private limited companies and Limited companies |

The users get 500 cheque leaves for free. The account comes with the average half yearly balance requirement of Rs.10,000.

| Primary Features | Charges |

| Average Half Yearly Balance (HAB) | Rs.10,000 |

| Non-Maintenance Charges | Rs.1500 per half year |

| Cash Deposit Limit | Free up to 12 times current month AMB |

| Cheque Leaves | Free 500 cheque leaves |

| DD / PO | Unlimited Free |

| NEFT / RTGS / transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, HUF, Sole Proprietorship Firms, Partnership Firms, Private & Public Limited Companies |

The variant provides free cash withdrawal (from home branch) to the users. Get 300 cheque leaves free per month.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.25,000 |

| Non-Maintenance Charges | Rs.1800 per quarter |

| Cash Deposit Limit | Higher of Rs.3 lakh per month or 6 times of AMB of current month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to Rs.1 lakh per day |

| Cheque Leaves | 300 cheque leaves free per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | Maximum of 200 transactions per month |

| DD / PO | Up to 50 DD / POs free per month |

| NEFT / RTGS / IMPS transactions | Free |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | HUF, Sole Proprietorship, Partnership / Limited Liability Partnership, Private / Public Limited Company |

This account variant is ideal for large value transactions. Get a cash deposit limit of Rs.10 lakh per month and minimum balance requirement of Rs.10,000.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.10,000 |

| Non-Maintenance Charges | Rs.1500 per quarter |

| Cash Deposit Limit | Rs.10 lakh per month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | No free limits |

| Cheque Leaves | 50 leaves per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | 75 |

| DD / PO | Free up to 30 DD / POs each free per month |

| NEFT / RTGS transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

Free NEFT and RTGS transactions via net banking plus get monthly cash deposit limit of Rs.10 lakh.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Rs.10,000 |

| Non-Maintenance Charges | Rs.1500 per half year |

| Cash Deposit Limit | Rs.10 lakh per month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | No free limits |

| Cheque Leaves | 50 leaves per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | 100 |

| DD / PO | Free above Rs.50,000 |

| NEFT / RTGS transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Resident Individual, Hindu Undivided Family, Sole Proprietorship/Partnership, Limited Company/Limited Liability Partnership, Trust/Association/Club/Society |

This is a zero balance HDFC Current Account. Get a free cash deposit limit of up to Rs.50 lakh per month.

| Primary Features | Charges |

| Average Quarterly Balance (AQB) | Zero |

| Non-Maintenance Charges | Nil |

| Cash Deposit Limit | Free up to Rs.50 lakh per month |

| Cash Withdrawal (Home Branch) | Free |

| Cash Withdrawal (Non-Home Branch) | Free up to Rs.1 lakh per day |

| Cheque Leaves | Free 500 cheque leaves per month |

| Local & intercity cheque collection & payments | Free (unlimited value) |

| Bulk Transaction Limit | Maximum of 300 transactions per month |

| DD / PO | Free |

| NEFT / RTGS transactions | Free via net banking |

| Account Closure Charges | Beyond 12 months: Free |

| Eligible Customers | Trusts, Associations, Societies, Clubs, Non-Profit Organisations, Government Organisations |

This variant can be opened in 3 currencies. The users can get a free monthly account statement.

| Primary Features | Charges |

| Available in currencies | USD, EUR and GBP |

| Currency Conversion | Can be converted to local money anytime |

| Foreign Exchange | Retain foreign exchanges in currency in which it is earned |

| Account Statement | Free monthly account statement |

| Eligibility Criteria | Resident Indian National with an existing HDFC Bank Savings or Current Account |

This variant is available in 17 currencies. The users have the privilege to easily track funds via free monthly statement.

| Primary Features | Charges |

| Available in currencies | 17 currencies- USD, EUR, GBP, CAD, SAR etc. |

| Currency Conversion | Can be converted to local money anytime |

| Foreign Exchange | Retain foreign exchanges in currency in which it is earned |

| Account Statement | Track funds via free monthly statement |

| Eligibility Criteria | Resident Indian National with an existing HDFC Bank Savings or Current Account |

|

Account Type |

Primary Features | |||

| Average Quarterly Balance (AQB) | Non-maintenance charges

(per quarter) |

Cash Deposit |

Cash Withdrawal (non-home branch) |

|

| Max Advantage Current Account | Rs.5 lakh (metro & urban) | Rs.8000 (metro & urban) | Free up to 12 times of current AMB | Free up to 12 times of current AMB |

| Ascent Current Account | Rs.50,000 (metro & urban) | Rs.3000 | Free up to 10 times of current AMB | Free up to 10 times of current AMB |

| Activ Current Account | Rs.10,000 | Rs.1500 (per half year) | NA | NA |

| Plus Current Account | Rs.1 lakh | Rs.1500 (for Rs 50,000 & above) | Rs.10 lakh | Rs.1 lakh per day |

| Premium Current Account | Rs.25,000 | Rs.1800 | Free up to Rs.3 lakh per month | Free up to Rs.25,000 per day |

| Regular Current Account | Rs.10,000 | Rs.1500 | Free up to Rs.2 lakh per month | Charges at Rs.2 / Rs.1000 |

| Smartup Alpha Current Account | Zero | Rs.1800 | Free up to 12 times of current AMB | Free up to Rs.5 lakh per month |

| Saksham Current Account | Rs.10,000 (HAB) | Rs.1500 per half year | Free up to 12 times of current AMB | NA |

| E-Commerce Current Account | Rs.25,000 | Rs.1800 | Free up to 6 times of current AMB | Free up to Rs.1 lakh per day |

| Current Account for Professionals | Rs.10,000 | Rs.1500 | Rs.10 lakh per month | NA |

| Agri Current Account | Rs.10,000 | Rs.1500 per half year | Rs.10 lakh per month | NA |

| Government / Institutional Current Account | Zero | NA | Free up to Rs.50 lakh per month | Free up to Rs.1 lakh per day |

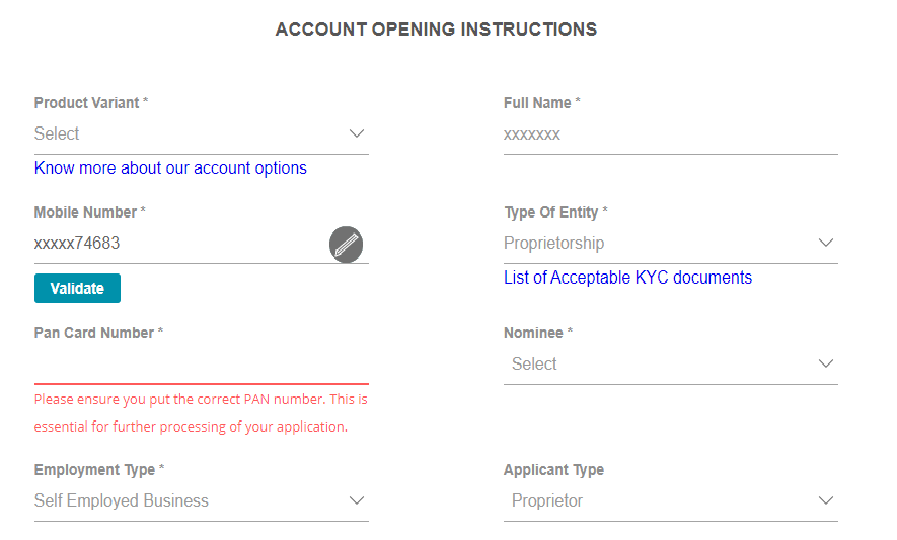

The customers can apply for HDFC Bank Current Account online as well as offline. Below listed are the steps one needs to follow for HDFC Bank current account opening.

Online

Offline

The customers can visit the nearest HDFC Bank branch and fill the HDFC Bank Current Account opening form and submit it will all the required KYC acceptable documents.

| HDFC Current Account documents (common) |

|

Below mentioned is the list of documents required to establish proof of the existence of the business:

| Proof of Existence (Business) |

|

| Proof of Address for business |

|

| For NRI Customers (additional documents) |

|

| For Limited Liability Partnership |

|

| For Companies |

|

Q. Is there any HDFC Zero Balance Current Account?

A. Yes, SmartUp Alpha Current Account and Government / Institutional Current Account are both Zero Balance Current Accounts offered by HDFC Bank.

Q. How can one check HDFC Current Account status?

A. One can check the HDFC Current Account opening status by contacting the bank’s customer care or directly visiting the nearest bank branch for the details.

Q. What is HDFC Bank Current Account interest rate?

A. HDFC Bank does not provide any interest rate on any of the current account variants offered by the bank.

Q. What are HDFC Current Account charges on non-maintenance of balance?

A. The non-maintenance charges differ from one current account variant to another.