Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Note: The information on this page may not be updated. For latest updates, click here.

With the implementation of GST from 1st July, 2017, all business entities are required to register at the GST portal in order to file GST returns. The GST portal is designed such that taxpayers no longer need to physically visit tax departments to complete formalities such as registration, assessment, request for refund, etc. Moreover, GST facilitation centers are located across India for the convenience of taxpayers.

However, several doubts pertaining to GST portal exist. Some of them are mentioned below:

In the following sections we will discuss the login procedure and the various services available at the GST portal:

Table of Contents :

The official website for all GST-related services is www.gst.gov.in. The GST portal or GSTN portal provides basic information about GST, including the details of the GST Act and its evolution. It also offers a range of services, including GST registration of the entities, GST filing interface, offline GST tools, grievance redress and much more.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

New taxpayers should use their GSTIN (GST Identification Number) and password, generated at the time of GST registration to log on to the GST portal.

Step 1: Visit https://www.gst.gov.in. Click on the ‘Login’ link at the top right-hand corner of the home page.

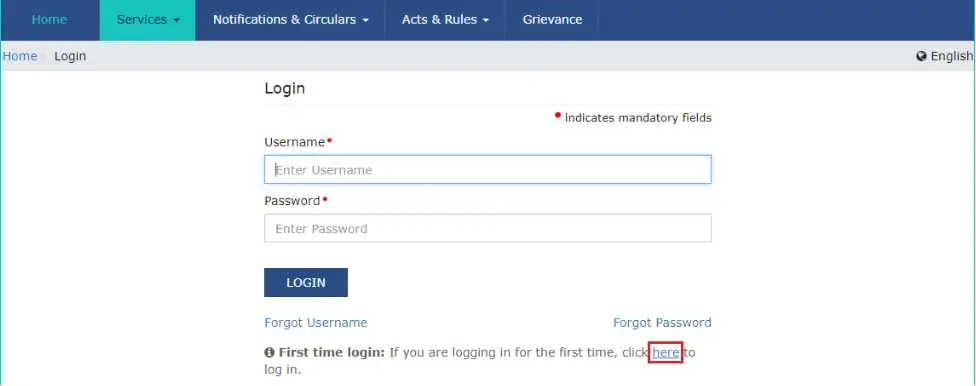

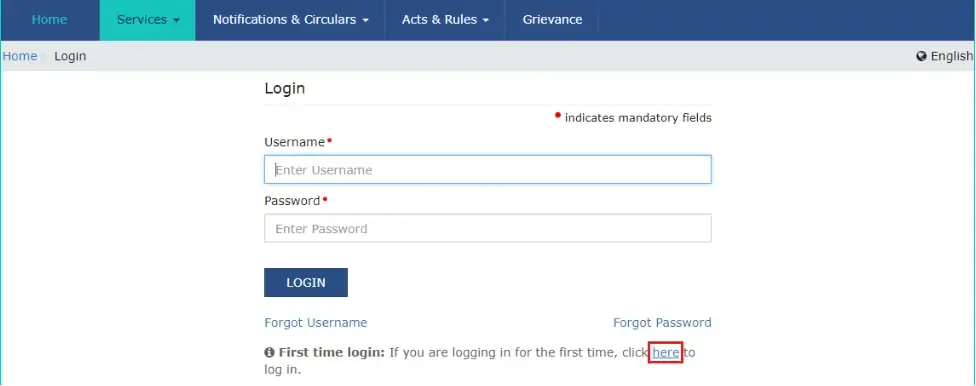

Step 2: Subsequently the login page is displayed as shown below.

First-time login option is present at the bottom of the page that says “First time login: If you are logging in for the first time, click here to login”.

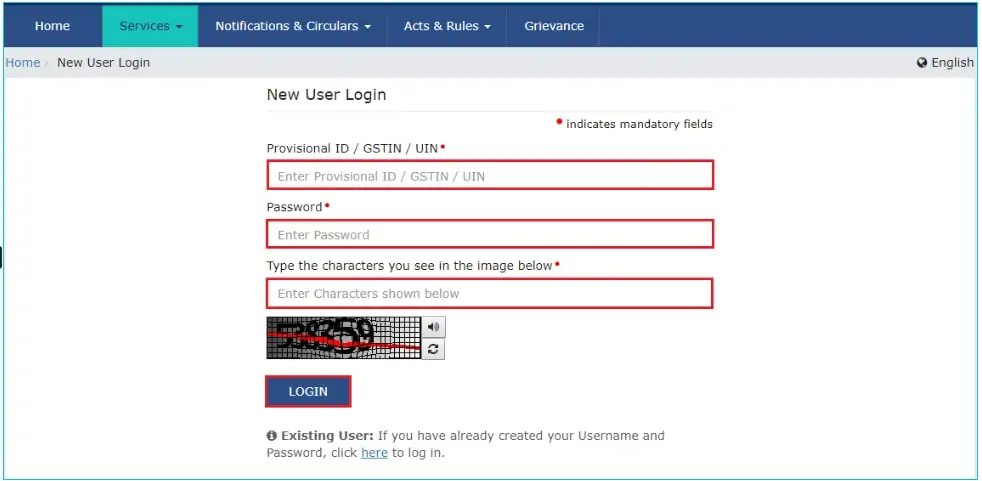

Step 3: Next the ‘New user’ login page is displayed. Enter the Provisional ID/ GSTIN/ UIN (Unique Identification Number) and the password received at the time of registration via an e-mail. Also enter the captcha code and click the login button.

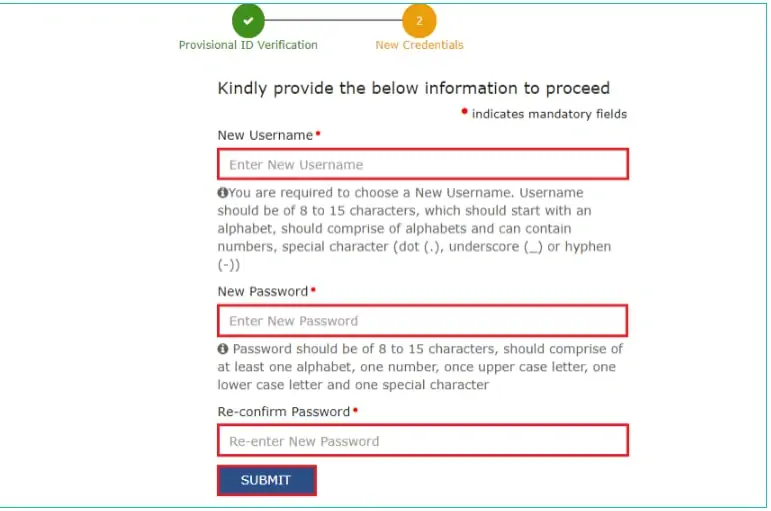

Step 4: The following page appears after entering the new credentials. Create a new username and password for subsequently logging in the GST portal and click “Submit”.

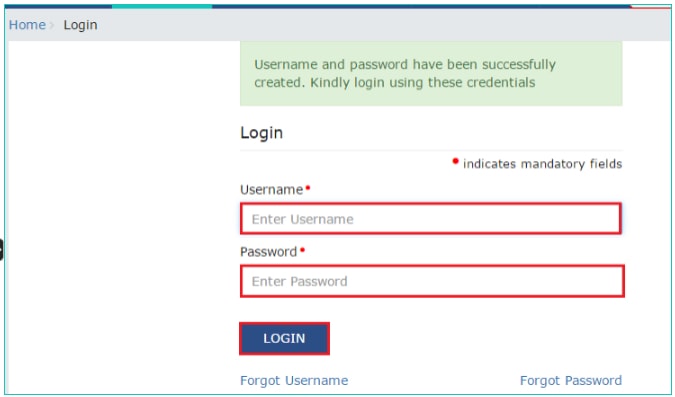

Step 5: On the next page, a confirmation message is displayed upon successful creation of the username and password. You can now log on to the GST portal using your new password.

Step 5: On the next page, a confirmation message is displayed upon successful creation of the username and password. You can now log on to the GST portal using your new password.

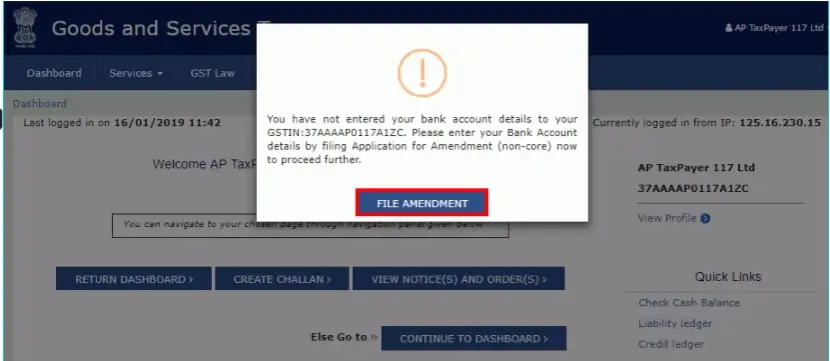

Step 6: When you login for the first time, a message to file non-core amendment application appears as a pop-up message. Click ‘FILE AMENDMENT’ option. This allows you to add your bank account details for completing the transactions that will be required at the time of GST filing.

Step 6: When you login for the first time, a message to file non-core amendment application appears as a pop-up message. Click ‘FILE AMENDMENT’ option. This allows you to add your bank account details for completing the transactions that will be required at the time of GST filing.

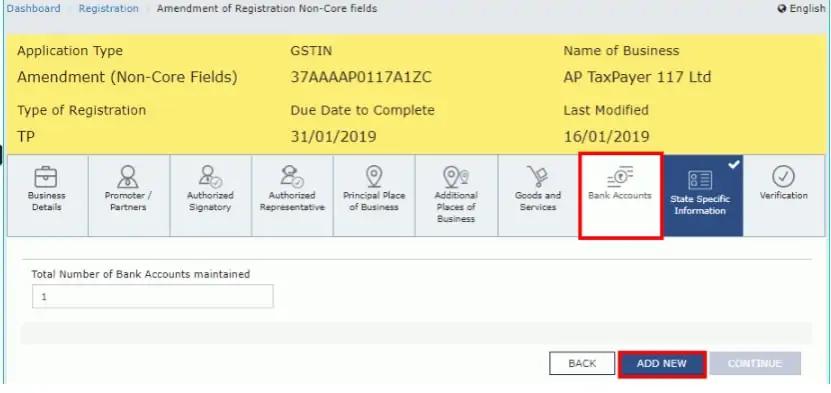

Step 7: Subsequently, a page with the application form in an editable format will be displayed.

You can edit the bank account details by clicking the ‘Add New’ button under the ‘Bank Accounts’ menu.

You can edit the bank account details by clicking the ‘Add New’ button under the ‘Bank Accounts’ menu.

GST Expert Assistance by PaisabazaarFinding it difficult to avail online services related to GST? Paisabazaar’s offline stores provide expert assistance for GST services. Get step-by-step expert guidance for GST registration, GST filing and GST certificate. Once your GST is set up, you can apply for a business loan to scale your business through Paisabazaar. |

The users who have not registered or are not liable to register under GST Act have to first apply for a Temporary User ID to log on to the GST Portal. The User ID and password thus generated are then used to login. Please note that such unregistered users can only avail limited services from the GST Portal, such as tracking application status, viewing ledgers, creating challan, etc.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Steps for First-Time GST login (Unregistered Users)

Following is the step-by-step guide to generate the temporary user ID and password. Once, you generate the credentials, follow the steps to login as mentioned above.

Step 1: Visit the official GST Portal

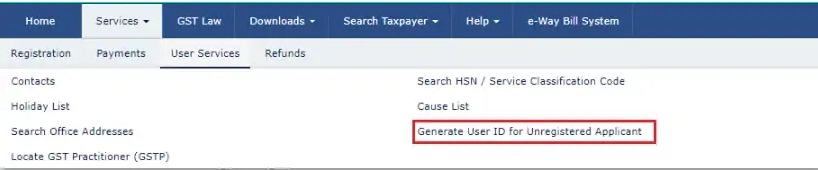

Step 2: Click Services > User Services > Generate User ID for Unregistered Applicant, as shown in the following image.

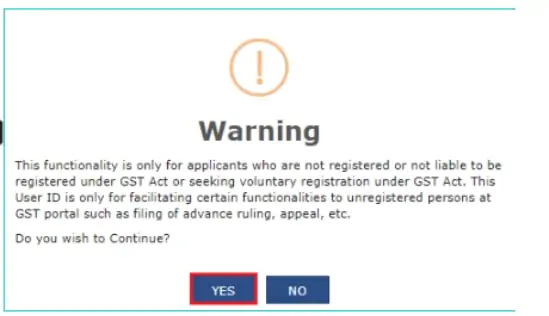

Step 3: Go through the warning message and select “Yes” to accept the terms and conditions.

Step 4: The following page is displayed for registration of an unregistered applicant. Fill out the form and click “Proceed”:

Step 4: The following page is displayed for registration of an unregistered applicant. Fill out the form and click “Proceed”:

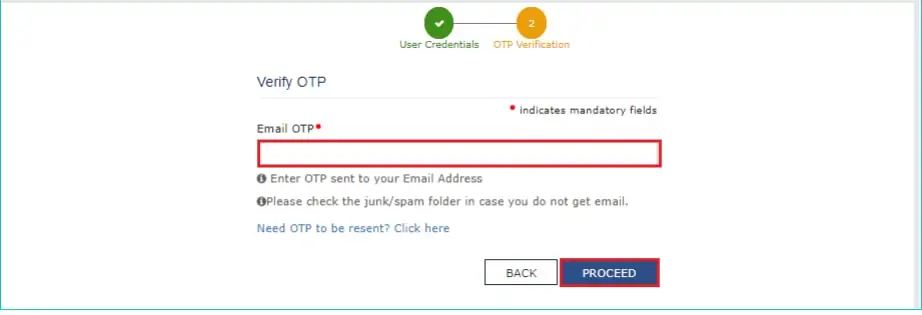

Step 5: You will receive an OTP on the e-mail address mentioned on the “New Registration for Unregistered Application” page. Enter this OTP in the following “Verify OTP” page and click “Proceed”.

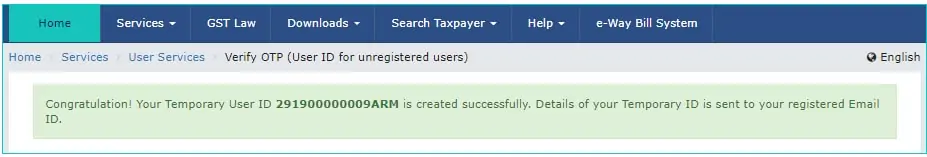

Step 6: After correctly entering the OTP, you will receive a message saying that the temporary user ID has been created and details are sent to the registered e-mail ID.

Step 7: Use the temporary ID and the password sent to your registered e-mail ID to login to the GST portal.

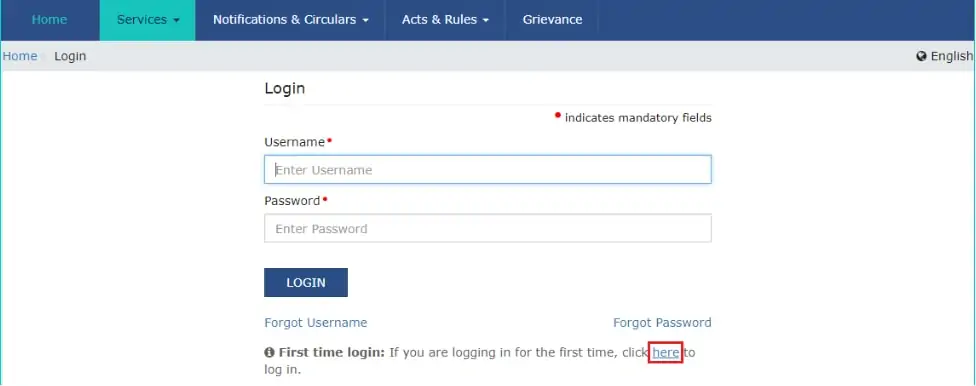

The existing users shall observe the following steps to log in the GST portal.

Step 1: Visit the GST Portal Home Page

Following is the image representing the layout of the homepage before logging in. Select ‘Login’ option in the top right-hand corner of the home page.

Step 2: The following login page is displayed. Enter your username and password to login.

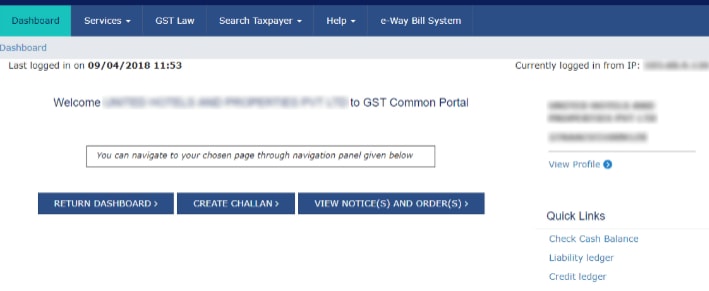

Step 3: You will be directed to the dashboard, as shown in the following image. The dashboard view allows you to access your profile, view orders and notices, and create a payment challan in a matter of a few clicks.

A host of services can be availed by clicking on the ‘Services’ tab once you login to the GST portal.

1. Registration: Under this tab, you can amend the registration core fields, opt for composition levy, etc. The following image shows the list of services available under the “Registration” tab of the GST dashboard.

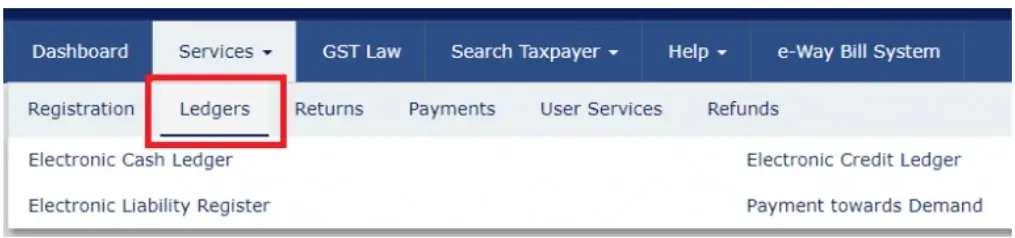

2. Ledgers: Under this tab, you can access the electronic cash ledger, credit ledger, etc. The following image shows the available facilities under the ‘Services’ tab of the GST dashboard.

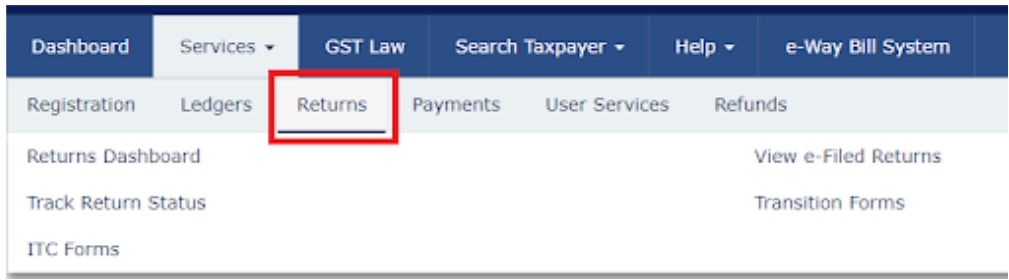

3. Returns: Under this tab, you can access the return dashboard, track return status, etc. Following image shows the services under the ‘Returns’ tab of the GST dashboard.

3. Returns: Under this tab, you can access the return dashboard, track return status, etc. Following image shows the services under the ‘Returns’ tab of the GST dashboard.

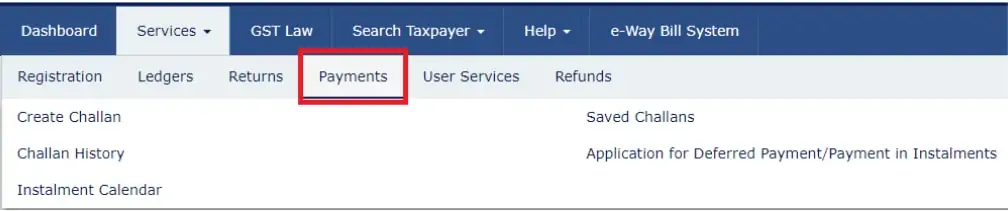

4. Payments: Under this tab, you can create challan, view saved challans, etc. Following image shows the services under the Payments tab of GST dashboard.

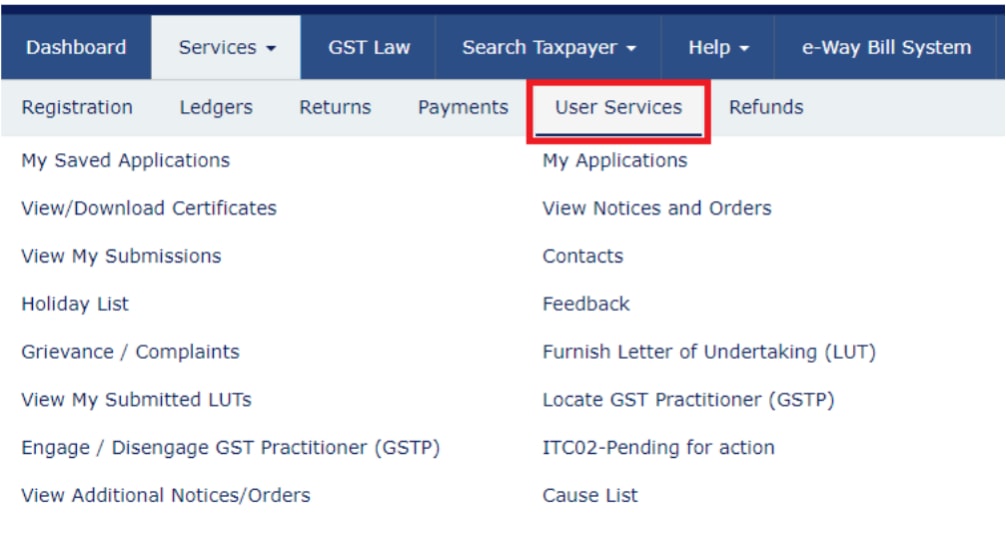

5. User Services: Under this tab, you can avail a long list of services, such as viewing notices and orders. Following image shows the list of services available under the User Services tab of GST dashboard.

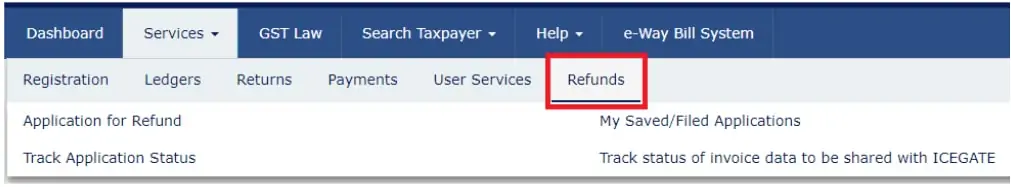

6. Refunds: Under the “Refunds” tab, you can apply for a refund, track its status, etc. Following image shows the services under the Refunds section of the GST dashboard.

Note: The remaining tabs, namely GST Law, Search Taxpayer, Help and e-Way Bill System offer the same services after login as those available before login.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Q1. Which is the government website for GST?

The government GST portal is www.gst.gov.in. It is also called GST portal / GSTN portal. It not only provides basic information about GST including its history and evolution but also offers a range of services, including GST registration of the entities, their GST filing and the medium to process GST refunds.

Q2. How can I login for the first time to GST portal?

Ans. Steps for first-time login to GST portal varies for registered and unregistered users.

Click here, if you are a registered user to login to the GST portal.

Click here, if you are an unregistered user to login to the GST portal.

Q3. Can I login the GST portal using TRN?

Ans. No, you cannot log on the GST portal using the Temporary Reference Number (TRN). However, you can track your registration application status using TRN by following these steps:

Once you complete the registration process, you will receive the credentials on your registered e-mail ID to login to the GST portal.

Q4. How do I check my GST return online?

Ans. Once you login the GST portal, you will be directed to the dashboard. On the dashboard view, click on the “Services” tab. Under this tab click Returns> Track Return Status to check your GST return status.

Q5. How do I get my GST number online?

Ans. In order to get a GST number, you will have to first register for GST. This can be done online by following these steps:

Step 1: Visit the official GST Portal

Step 2: Click Services>Registration> New Registration

Step 3: Fill out the form and click proceed.

Step 4: An OTP will be sent to your registered mobile number and e-mail address to verify your contact details

Step 5: Once the verification is done, you will receive a Temporary Reference Number (TRN) on both your registered mobile number and e-mail address

Step 6: Fill out the second part of the form using the received TRN

Step 7: Track your registration application status using the TRN

You will receive the GST number, once your GST registration is approved.

Q6. Who should register for GST?

Ans. Following is the list of those who should register for GST:

Q7. How is GST calculated?

Ans. Different goods and services have different GST rates, as per the GST commodity tariff schedule. You can calculate GST on them by following these steps:

Step 1: Check the HSN for the relevant goods and services

Step 2: Once you know the HSN, check the GST rate

Step 3: Calculate GST as per the applicable GST rate

Read more about calculation of Input Tax Credit for GST here.

Q8. What is GST?

Ans. Goods and Services Tax (GST) is one comprehensive tax for the entire nation. It has replaced a number of indirect taxes in India, including central excise duty, state VAT, additional duties of customs and entertainment tax to name a few. The main features of GST are:

Q9. What are the various types of GST?

Ans. There are 3 types of GST:

Q10. What are the various services available on the GST portal?

Ans. A host of services are available on the GST portal ranging from registration, accessing ledgers, making payment via a challan to tracking the GST return status. Additionally, several services are listed under the tab ‘User Services’. Know more about various GST Services.