Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

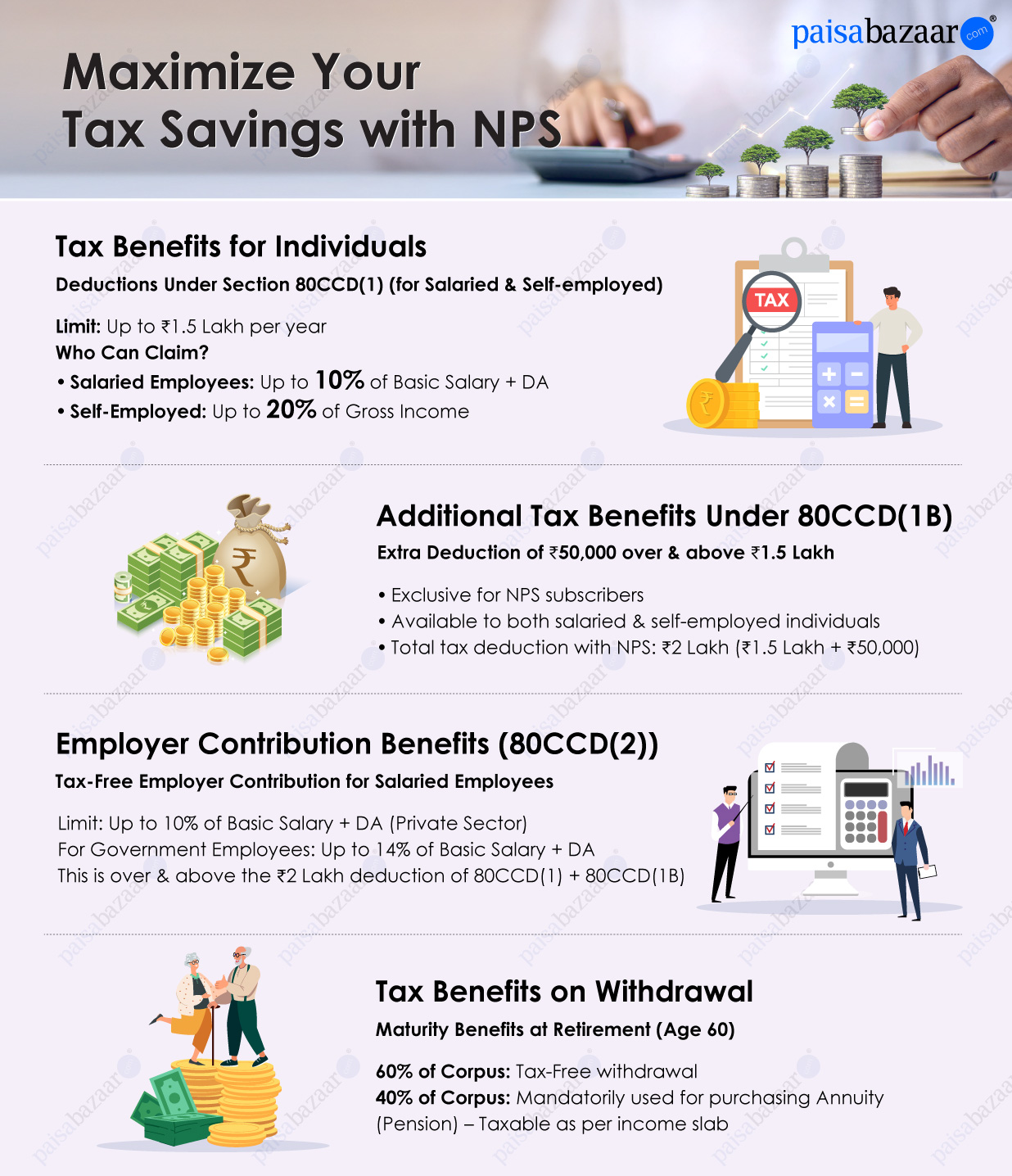

NPS or National Pension System is an effective instrument that helps in securing the future financially through smart retirement planning and save on taxes simultaneously. Irrespective of the tax regime you follow – the new or old regime, NPS can help you save taxes as per various provisions in the Income Tax Act 1961. Let us explore how an individual, salaried or self-employed, can utilise this financial instrument to save on taxes.

Salaried employees can file ITR as per the old tax regime and the new tax regime. While taxpayers following the new regime have fewer options to save taxes, those adhering to the old regime have numerous options to invest and save on taxes. But only NPS allows a taxpayer to save on taxes irrespective of the regime one follows. Let us understand how you can save taxes through NPS if you are a salaried individual.

Suggested Read: National Pension System

There are three provisions for salaried employees to save taxes under the Old Regime –

1. Up to Rs. 1.5 Lakh under Section 80CCD(1)You can invest 10% of your basic salary + DA up to a maximum of Rs. 1.5 lakh in NPS Tier 1 and claim the total amount as a deduction under Section 80CCD(1). 2. Rs. 50,000 under Section 80CCD(1B)This section allows you to claim an additional deduction of Rs. 50,000 in addition to your investments under Section 80CCD(1) if you invest in NPS Tier 1. 3. Employer’s Contribution under Section 80CCD(2)

|

Thus, if are a private sector employee and your basic + DA is Rs. 10 lakh, you can claim up to Rs. 1 lakh under Section 80CCD(1), Rs. 50,000 under Section 80 CCD(1B) and Rs. 1 lakh under Section 80 CCD(2), contributing a total of Rs. 2.5 lakh under NPS as a deduction and lowering your taxable income.

In case you are a Central Government employee and your basic + DA is Rs. 10 lakh, you can claim up to Rs. 1 lakh under Section 80CCD(1), Rs. 50,000 under Section 80CCD (1B) and Rs. 1.4 lakh under Section 80 CCD(2), contributing a total of Rs. 2.9 lakh under NPS as a deduction and lowering your taxable income.

Also Read: Section 80C of the Income Tax Act

When you choose the new regime for filing Income Tax Returns, you lose out on NPS investment deductions under Section 80CCD(1) and 80CCD(1B). However, you are still eligible for NPS benefits under Section 80CCD(2).

As per this section, your employer can contribute 10% of your basic salary + DA under NPS, and you can claim it asa deduction if you are a private sector employee. Central Government employees can claim a deduction of 14% of their basic + DA contributed by the Central Government.

Thus, if your basic + DA is Rs. 10 lakh, you can claim a deduction of up to Rs. 1 lakh under the new regime and Rs. 1.4 lakh if you work for the Central Government.

Self-employed individuals can also benefit from NPS and claim a deduction in their taxable income. If you are self-employed, you can claim deductions under two sections of the Income Tax Act, 1961.

1. Up to Rs. 1.5 lakh under Section 80CCD(1)You can claim up to 20% of your gross income, subject to a maximum of Rs. 1.5 lakh. This comes under the overall deductions limit of Rs. 1.5 lakh under all Sections of 80CCE. 2. Up to Rs. 50,000 under Section 80CCD(1B)In addition to deductions under Section 80CCD(1), you can claim an additional deduction up to Rs. 50,000 under this section. |

Thus, self-employed individuals can claim a maximum deduction of Rs. 2 lakh (Rs. 1.5 lakh + Rs. 50,000) if their gross income exceeds Rs. 7.5 lakh.

Employers and corporations can claim a deduction against their contribution towards NPS for their employees. Under Section 36(1)(iv)(a), an employer can claim a deduction against its contribution up to 10% of basic salary + DA for the employee. This can be grouped under business expenses in the company’s profit and loss account.

Read More: National Pension System (NPS) Returns for Tier 1 & Tier 2

When an employee retires at the age of 60, the NPS matures and the employee can claim his NPS to withdraw one part and purchase an annuity using the second part.