Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Life insurance provides financial security to the family by helping to manage daily expenses and other financial requirements in case the breadwinner happens to pass away. There are different types of life insurance plans and you can pick one as per your need and financial planning. A whole life insurance is a type of life insurance that offers coverage for the entire life.

Table of Contents:

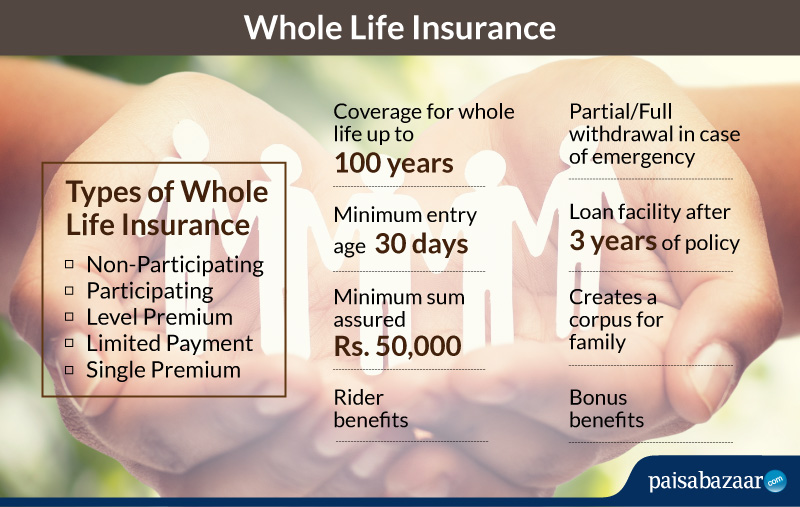

A whole life insurance policy provides coverage for the whole life, i.e. up to 100 years. It guarantees death benefits or the money assured to the nominee on the sudden demise of the policyholder anytime till the maturity age (100 years).

Thus, the insured is covered till his demise, provided all the premium amounts are paid. And if the insured crosses the maturity age, the policy automatically matures after which the policy holder gets survival benefit along with maturity benefit.

There are different types of whole life insurance policy. After a thorough evaluation of the features and benefits of the policy, select the type as per your need and affordability.

| Particulars | Details |

| Entry Age | 30 days-60 years |

| Maturity Age | 100 years |

| Minimum Sum Assured | Rs. 50,000 |

| Minimum Premium | Rs. 500 (Monthly) |

Always keep the required documents in place for a smooth purchasing process. Some of the common ones are:

Note: This is a non-exhaustive list.

Follow the steps given below to file claims in case of any eventuality covered under the plan:

As per the IRDAI regulations, all insurance companies are required to settle claims within a span of 30 days from the date of receipt of all the documents needed for proper assessment of claims.

Riders are additional benefits provided with the insurance plans. These help extend the coverage of the plans and can be availed on payment of some extra amount. Some of the riders available with whole life insurance policy are:

A whole life insurance policy offers comprehensive coverage, but it does not cover all cases and situations. These are called exclusions. Death occurring under certain situations do not qualify for claims. Some of them are:

Note: This is not an exhaustive list. Situations can change as per the plan and/or insurance company.

While checking and comparing various whole life insurance plans, consider the important aspects in order to reap the maximum benefits.

It is better to be prepared for any kind of eventuality in life. And life insurance is one such safety belt. Some of the benefits of whole life insurance are:

To reap maximum benefits it is advised to continue with the policy till the end of it. But if need be, you may surrender the policy. On surrender you will be paid with Guaranteed Surrender Value that is usually acquired after 2 year’s full premium payment is in place. Once this is paid, all other benefits become void and policy terminates.

Yes, the proceeds of a whole life insurance policy are non-taxable as per the Section 10(10D) of the Income Tax Act, 1961.

If that happens, the insurance company shall send you a notice asking for complete set of documents and if you fail to do so after the notice, your claim shall stand void.If that happens, the insurance company shall send you a notice asking for complete set of documents and if you fail to do so after the notice, your claim shall stand void.