Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

After buying an insurance policy from LIC of India, be it a life insurance or a health insurance plan, you need to pay the premium every year. To continue enjoying the benefits of the plan and to avoid the plans from lapsing, it is important to pay the premium on time. LIC premium payment can be done in 2 ways – online or by visiting the LIC branch office. LIC online premium payment can be done via different modes – net banking, credit card, debit card, etc.

Now, let us understand premium and why it is important to make premium payment on time. A premium is the cost paid to the insurance provider to get the financial coverage for various risks. LIC of India premium can be paid monthly, quarterly, annually or semi-annually. Some policies also have the option of a one-time premium payment which eliminates the need of policy renewal every year. LIC premium payment can be done either online or offline. In case the premium is not paid by the due date mentioned in the policy, the plan can lapse and you might not get the coverage benefits when needed.

LIC online premium payment method is easy and hassle free. Here are the steps to calculate premium for LIC life insurance and health insurance policies.

LIC online premium payment can be done for all of the available plans and policies. In order to ascertain the premium amount to be paid towards any of the LIC life and health insurance policies, the following factors need to be considered:

Age of applicant: Age directly affects the premium amount. Higher the age, higher the premium and vice-versa. This is so because with age, health risks increase. This also increases the chance of filings claims under a life insurance policy, making the plan expensive. Thus, the insurance company charges higher premium from an older person. To make it simple, premium for a 34-year-old person will be higher compared to the premium for a 25-year-old, person, if we ignore other factors at present.

Gender of applicant: For a life insurance, premium is usually lower in case of females and higher for males. This is so because females have a higher life expectancy compared to males. Thus, women life longer than men. Looking at this scenario, there is a higher chance for an insurance company to provide death benefits for males and thus, his premium is higher.

Life cover (sum assured): The sum assured is the coverage amount or the death benefit the family gets on the sudden demise of the policyholder. Thus, higher the sum assured, higher the premium amount and vice-versa. A life cover of Rs. 50 lakh will need a higher premium amount than a cover of Rs. 25 lakh.

Policy term chosen: A policy term is the duration for which the policyholder gets the coverage against the risks. So, if the policy term is longer, the premium amount will be higher.

Smoking habit: Smoking habit plays an important role in deciding the premium amount for a life insurance because of the health risks related to smoking. Thus, a higher premium for smokers and a lower premium for non-smokers.

No. of Lives Insured: In health insurance plans by LIC, there are two options available, i.e. individual plan and family-floater plan. Premium for a family floater plan in numbers will be higher than for an individual plan but when we compare it in terms of lives insured, a family floater health plan will be more cost effective.

Let’s understand how factors like policy term and life cover (sum insured) affect the premium amount:

Name of the plan: LIC Jeevan Arogya

Age: 30 years

| Sum Insured

(in Rs.) |

Policy Term | Annual Premium

(in Rs.) |

| 50 lakh | 30 years | 12,500 |

| 1 crore | 30 years | 25,000 |

| 50 lakh | 35 years | 14,600 |

| 1 crore | 35 years | 29,200 |

Age: 40 years

| Sum Insured

(in Rs.) |

Policy Term | Annual Premium

(in Rs.) |

| 50 lakh | 20 years | 19,400 |

| 1 crore | 20 years | 38,800 |

| 50 lakh | 25 years | 22,900 |

| 1 crore | 25 years | 45,800 |

LIC of India provides various options to choose from in order to make premium payments.

Online

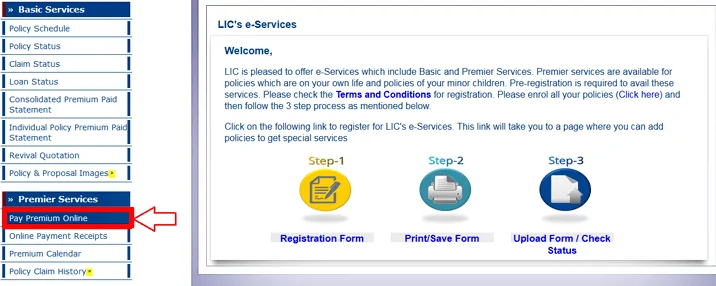

LIC Website: Net banking, credit card, debit card

Via Franchisee: Suvidha Infoserve, Easy bill pay, AP online & MP online (online government portal for residents of Andhra Pradesh and Madhya Pradesh), Paytm, Instapay and CSC

Via Official Merchant: Premium Point, Life Plus, Retired LIC Employee collection

Via Authorized Banks: Axis Bank and Corporation Bank

Offline

Bill Pay, ATM and National Automatic Clearing System (NACH)

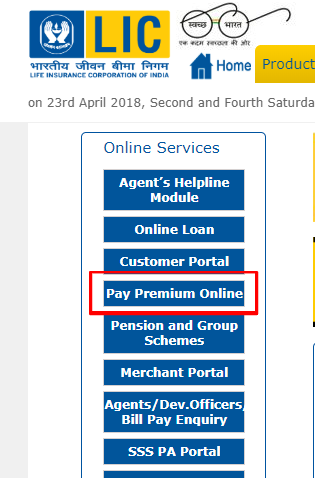

Follow the steps mentioned below for online payment

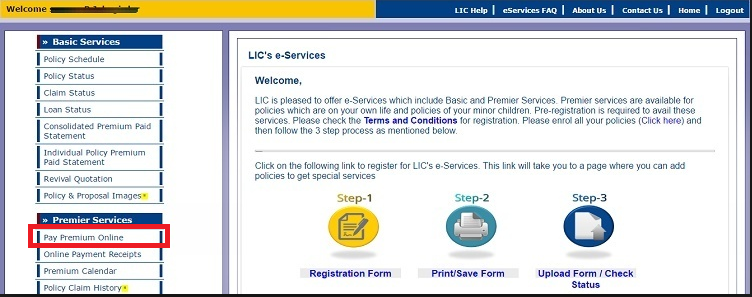

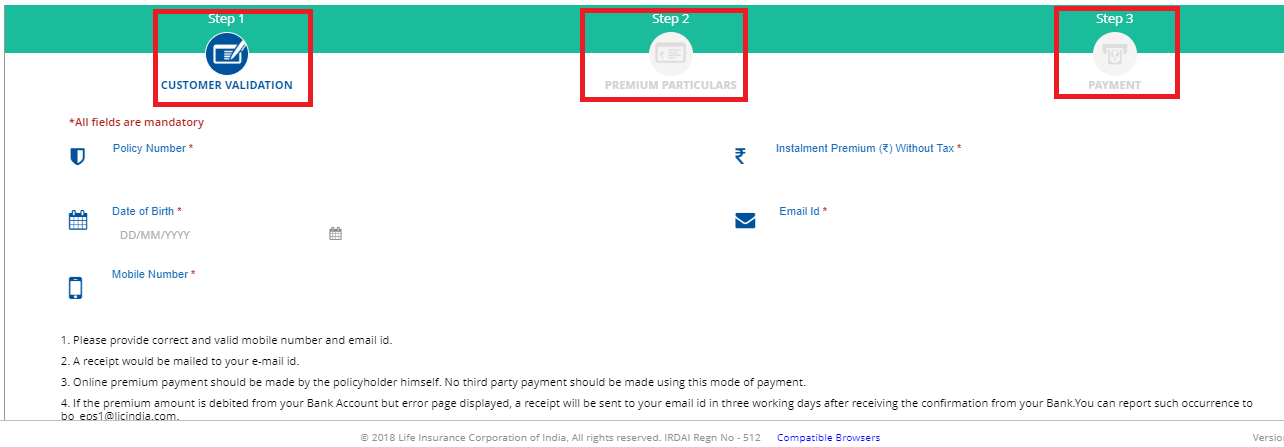

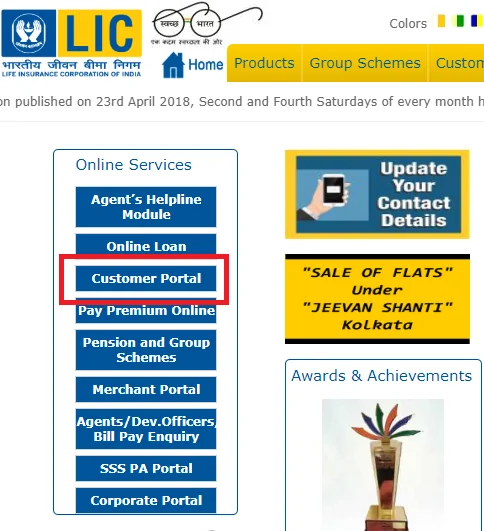

For Registered Users:

For Registered Users:

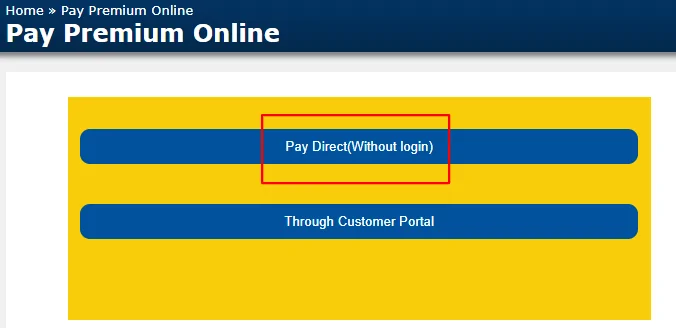

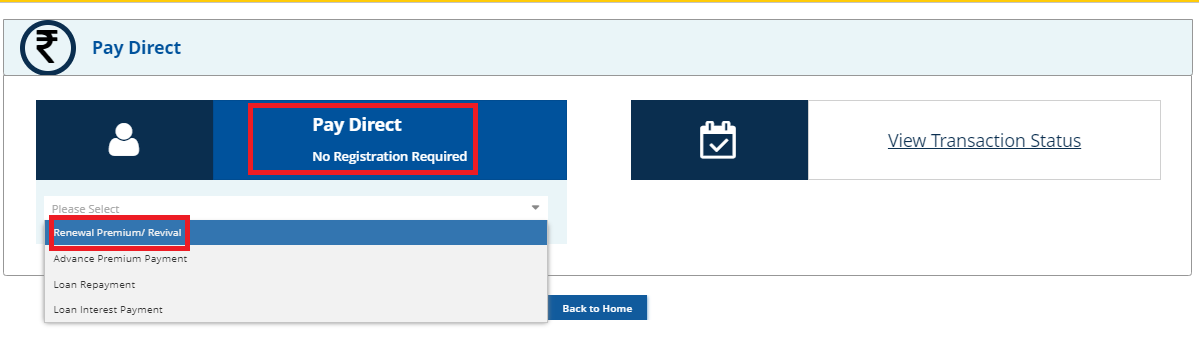

For Non-registered Users:

Offline Premium Payment Method for LIC policies:

If online method is not working for you or you prefer the traditional way of payment, visit the LIC branch office and pay your premium directly at the branch. This can be done via cheque or through debit or credit card.

In order to download the premium receipt, you need to login to the LIC online portal. Steps for the same are mentioned below:

In order to revive a lapsed policy, i.e. to activate a policy that has been deactivated due to non-payment of premiums on time, you need to follow the steps mentioned below:

Let us look at some important points to keep in mind while taking care of premium payment.

FAQs

Q1. How to pay LIC premium online?

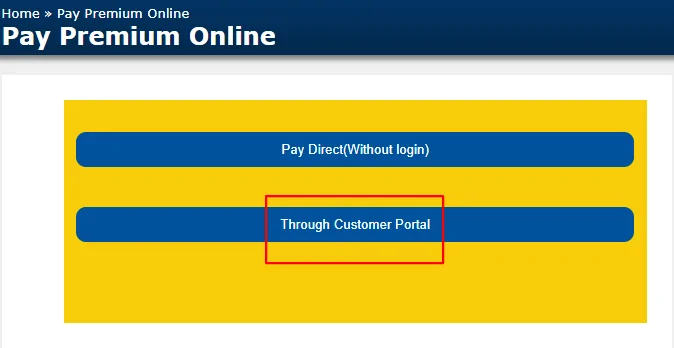

Go to the website and click on Premium Payment. Choose Pay Direct (without login) or Through Customer Portal. Choose renewal premium payment from the drop-down list OR login to the customer portal using your username and password and pay premium from the option given in your profile.

Q2. What is the customer care number of LIC?

Customer care number of the company is 022 6827 6827.

Q3. How to check the policy status?

To check your LIC policy status, you can login to the customer portal using your credentials. You need to select the policy from your profile to get status report.

Q4. How to pay the premium after due date?

LIC of India gives a 15-days grace period which starts after the last date of premium payment. You can pay the premium within this period. If you fail to do so, you need to visit the branch office of LIC and get assistance there.