Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Life is full of various types of risks because of uncertainties. These situations might give rise to unexpected financial needs. In case one is not prepared, this might lead to a big hole in the pocket or create roadblocks in meeting the financial goals of life. However, to overcome such problems and manage the financial risks of life, you can opt for an insurance, which can be classified under different heads.

An insurance provides protection in the form of financial compensation for specified loss, damage, illness or death. To get this coverage, you need to pay a certain amount of money to the insurance company which is called a premium. In simple terms, an insurance is a promise of providing for the uncalled expenses during emergency situations for you and your family. An insurance is of various types and can help in meeting unexpected health expenses, children’s education or marriage expenses, creating a corpus for retirement or for other financial requirements.

Before buying an insurance cover, be it of any type, it is imperative to understand its functioning. In an insurance, a policyholder or the insured pays the premium to the insurance company which agrees to pay the money or sum assured to manage the risks arising out of various situations of life. The insurance policy is taken for a certain duration of time, also called the policy term. This is the basic idea behind insurance, but different types of insurance function differently. However, not all situations are covered by an insurance. These are called exclusions. There are different sets of exclusions for different types of insurance. Let us understand insurance a little more in detail.

A premium is the money paid by the policyholder to the insurance company for getting an insurance policy. The premium is an important aspect to be considered before finalising a policy. Various factors like age and gender, lifestyle, duration of the plan, sum assured or insured play a role in deciding the premium amount. To reap the benefits of an insurance policy, it is important to make timely payment of the premium. In case of a non-payment or a payment delay, the policy can lapse. However, before a policy happens to expire, you usually get a grace period of 30 days to make the payment. The payment mode can be regular or single. A regular payment can be monthly, annually and so on. Let us understand some factors on which the premium depends.

Once you have purchased the required insurance policy, you should be aware of the situations covered under the plan so that you can make claims when needed. An insurance claim is the request made to the insurance company to get coverage for the situations mentioned in the policy. In case of any eventuality, always immediately inform your insurance provider and submit the duly filled in claim form along with other requirements documents. The list of documents will vary for different types of plans.

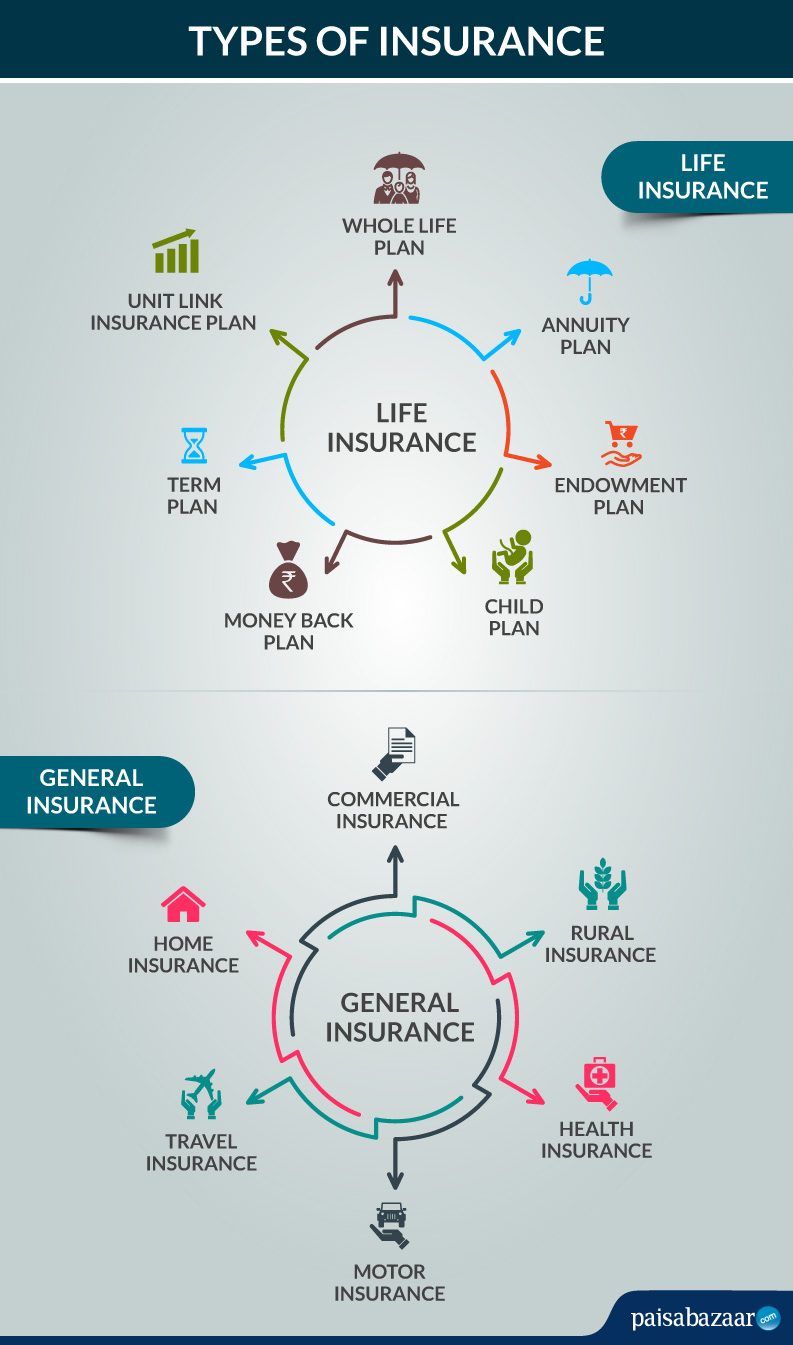

In India, there are broadly 2 main categories of insurance – life insurance and non-life or general insurance.

This is the most common type of insurance. It works on the common principle that the insured pays a premium for coverage to the insurance company. In return, the company pays the sum assured to the family of the insured on his/her sudden death. Other additional benefits offered, also called riders, along with the coverage help make it a comprehensive package. However, there are certain situations not covered under the plan that are called exclusions. There are 7 types of life insurance policy.

All non-life insurance plans are clubbed under general insurance. Here, the insurance company provides financial coverage for various risks in life, such as health problems, travel issues, etc. There are different types of general insurance plans.

A life insurance is of 7 types. Let us understand them and how they function

There are various types of general insurance. Each has its own purpose and need. Let us understand them to take a informed decision before buying one when needed.

Also called vehicle insurance, it offers financial protection against any loss, theft or damage to cars, two wheeler, trucks and other vehicles. There are 2 types of motor insurance coverage – comprehensive coverage and third party coverage. As part of third party coverage, it extends financial aid for any accidental death or bodily injury to others on the road. On the other hand, a comprehensive coverage includes protection to both the owner, the insured car and the third party. Apart from the regular coverage, additional benefits or add-on coverage offered with the insurance make it a complete package. This is further segregated into 3 categories – car insurance, two wheeler insurance and commercial vehicle insurance.

It is not easy to save a huge sum like Rs 10-12 lakh from your salary to meet your medical expenses whenever needed. To manage such situations, you need a health insurance which provides coverage against rising medical expenses, including treatment and hospitalisation. One can choose from a number of health plans like cancer insurance and dental insurance. A health insurance has 2 broad categories – indemnity plans and fixed benefit plans. These are further divided into various types.

Home is a place where we feel the most secure and warm. Thus, it makes perfect sense to insure the safety zone called home. A home insurance offers protection against damage or theft that may affect your house and/or its belongings. There are various types of home insurance available, viz.:

A travel insurance plan ensures that while travelling (be it domestic or abroad) you stay financially covered to manage any untoward incident. These situations include loss of ticket or baggage, cancellation of flight, trip delay, emergency medical situations, etc. In the absence of a travel insurance, in case you encounter such circumstances, you might waste your time and money in dealing with them instead of enjoying or utilising your trip. Let us look at various types of travel plans available in India.

Rural areas cover the most of Indian land and to cover the financial risks faced by people in these ares, there is rural insurance. People involved in manufacturing and tertiary sectors, primary sector also need financial protection. Farmers form the backbone of any economy and to be in healthy side, their backbone (financial aspect) should be well taken care of. There are various types of rural insurance plans available in the insurance sector that one can benefit from. These are:

This is the extended branch of insurance. Here you will find all the insurance plans that are not contained in the aforementioned categories. Plans like mobile insurance, laptop insurance, title insurance, jewellery insurance, business liability insurance, etc. find place in this column. A commercial insurance usually covers various risks involved in managing business. These can include plans like marine insurance which is designed to provide financial assistance to water vehicles like cargo, ships, submarines, etc. in case of loss or damage to these. Other plans can be shopkeeper’s insurance, engineering insurance, worker’s compensation insurance, professional liability insurance and so on. Here are some of the types of commercial insurance provided in India.

An insurance is important for managing various risks of life. There are various types of insurance plans available in India. There are some companies that offer only life insurance, while some provide only non-life insurance plans. Before zeroing in on a particular company for purchasing your plan, always check their latest Claim Settlement Ratio (CSR). A CSR is the total claims paid compared to the total claims received in a financial year.

|

Life Insurance Providers |

|

| Life Insurance Corporation of India | Aviva Life Insurance Company India Ltd. |

| HDFC Life Insurance Co. Ltd. | Sahara India Life Insurance Co. Ltd. |

| Max Life Insurance Co. Ltd. | Shriram Life Insurance Co. Ltd. |

| ICICI Prudential Life Insurance Co. Ltd. | Bharti AXA Life Insurance Company Ltd. |

| Kotak Life Insurance Co. Ltd. | Future Generali India Life Insurance Company Limited |

| Aditya Birla Sun Life Insurance Co. Ltd | IDBI Federal Life Insurance Company Limited |

| TATA AIA Life Insurance Co. Ltd. | Canara HSBC OBC Life Insurance Company Limited |

| SBI Life Insurance Co. Ltd. | Aegon Life Insurance Company Limited |

| Exide Life Insurance Co. Ltd. | DHFL Pramerica Life Insurance Co. Ltd. |

| Bajaj Allianz Life Insurance Co. Ltd. | Star Union Dai-Ichi Life Insurance Co. Ltd. |

| PNB MetLife India Insurance Co. Ltd. | IndiaFirst Life Insurance Company Ltd. |

| Reliance Nippon Life Insurance Co. Ltd. | Edelweiss Tokio Life Insurance Company Limited |

|

Non-Life (General) Insurance Providers |

|

| Apollo Munich Insurance Co. Ltd. | Max Bupa Health Insurance Co. Ltd. |

| Aditya Birla Health Insurance Co. Ltd | National Insurance Co. Ltd. |

| Bajaj Allianz Allianz General Insurance Co. Ltd. | Raheja QBE General Insurance Co. Ltd. |

| Bharti AXA General Insurance Co. Ltd. | Reliance General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Reliance Health Insurance Ltd. |

| CIGNA TTK Health Insurance Co. Ltd. | Religare Health Insurance Co. Ltd |

| DHFL General Insurance Co. Ltd. | Royal Sundaram General Insurance Co. Ltd. |

| Edelweiss General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

| Future Generali India Insurance Co. Ltd. | Shriram General Insurance Co. Ltd. |

| HDFC ERGO General Insurance Co. Ltd. | Star Health & Allied Insurance Co. Ltd. |

| ICICI LOMBARD General Insurance Co. Ltd. | Tata AIG General Insurance Co. Ltd. |

| IFFCO TOKIO General Insurance Co. Ltd. | The New India Assurance Co. Ltd |

| Kotak General Insurance Co. Ltd. | The Oriental Insurance Co. Ltd. |

| Liberty General Insurance Ltd. | United India Insurance Co. Ltd. |

| Magma HDI General Insurance Co. Ltd. | Universal Sompo General Insurance Co. Ltd.

|

|

Health Insurance Providers |

|

| National Insurance Co. Ltd. | The New India Assurance Co. Ltd |

| The Oriental Insurance Co. Ltd. | United India Insurance Co. Ltd. |

| Bajaj Allianz General Insurance Co. Lt. | Bharti AXA General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Future General India Insurance Co. Ltd. |

| HDFC ERGO General Insurance Co. Ltd. | ICICI Lombard General Insurance Co. Ltd. |

| IFFCO Tokio General Insurance Co. Ltd. | Kotak Mahindra General Insurance Co. Ltd. |

| Liberty General Insurance Co. Ltd. | Magma HDI General Insurance Co. Ltd. |

| Raheja QBE General Insurance Co. Ltd. | Reliance Health Insurance Co. Ltd. |

| Royal Sundaram General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

| Shriram General Insurance Co. Ltd. | TATA AIG General Insurance Co. Ltd. |

| Universal Sompo General Insurance Co. Ltd. | Aditya Birla Health Insurance Co. Ltd. |

| Apollo Munich General Insurance Co. Ltd. | Cigna TTK Health Insurance Co. Ltd. |

| Max Bupa Health Insurance Co. Ltd. | Religare Health Insurance Co. Ltd. |

| Star Health Insurance | |

|

Travel Insurance Providers |

|

| Bajaj Allianz General Insurance | Bharti AXA General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Future Generali India Life Insurance Company Limited |

| HDFC ERGO General Insurance Co. Ltd. | ICICI Lombard General Insurance Co. Ltd. |

| IFFCO Tokio General Insurance Co. Ltd. | Shriram General Insurance Co. Ltd. |

| Apollo Munich Insurance Co. Ltd. | TATA AIG General Insurance Co. Ltd. |

| National Insurance Co. Ltd. | United India Insurance Co. Ltd. |

| New India Assurance Co. Ltd. | Universal Sompo General Insurance Co. Ltd. |

| Oriental Insurance Co. Ltd. | Religare Health Insurance Co. Ltd. |

| Reliance General Insurance Co. Ltd. | Star Health and Allied Insurance Co Ltd |

| Royal Sundaram General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

When you decide to buy an insurance policy, there are certain pointers to hover through in order to gain the best out of this decision. Let’s look at these in a little detail:

There are a number of advantages of buying an insurance policy. Some of these are:

Q1. How is Surrender Value calculated?

Surrender Value is a pre-decided percentage of premiums paid. For e.g. if the premium paid totals to Rs. 50,000 and the percentage charged is 30% , then at the end of 4 years, you get Rs. 45,000.

Q2. What are the documents required for making a claim?

Usually you need to submit the filled in Claim Form, medical reports & bills (for health insurance claims), FIR copy, policy document, copy of Registration Book (for motor insurance), passport sized photographs and ID proofs. There can be some addition or omission of the documents mentioned above for different plans and policies.

The insurance industry in India grew 14% in August 2019 compared to 22% during the same month last year. The decline of 8% in this sector puts light on the fact that the Indian insurance sector is not growing as expected.

However, as per experts, this industry is expected to grow in the next five-six years and give double digit returns. The year-on-year (YoY) growth for private players was a mere 11% in August 2019, which is half of its 22% contribution in July. On the other hand, LIC of India witnessed a spectacular growth of 18 percent over 2018.

Also, LIC’s increasing market share is proving to be a major hindrance for private players who depend mainly on ULIPS for their growth and the equity market played a spoilsport in this regard.