Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

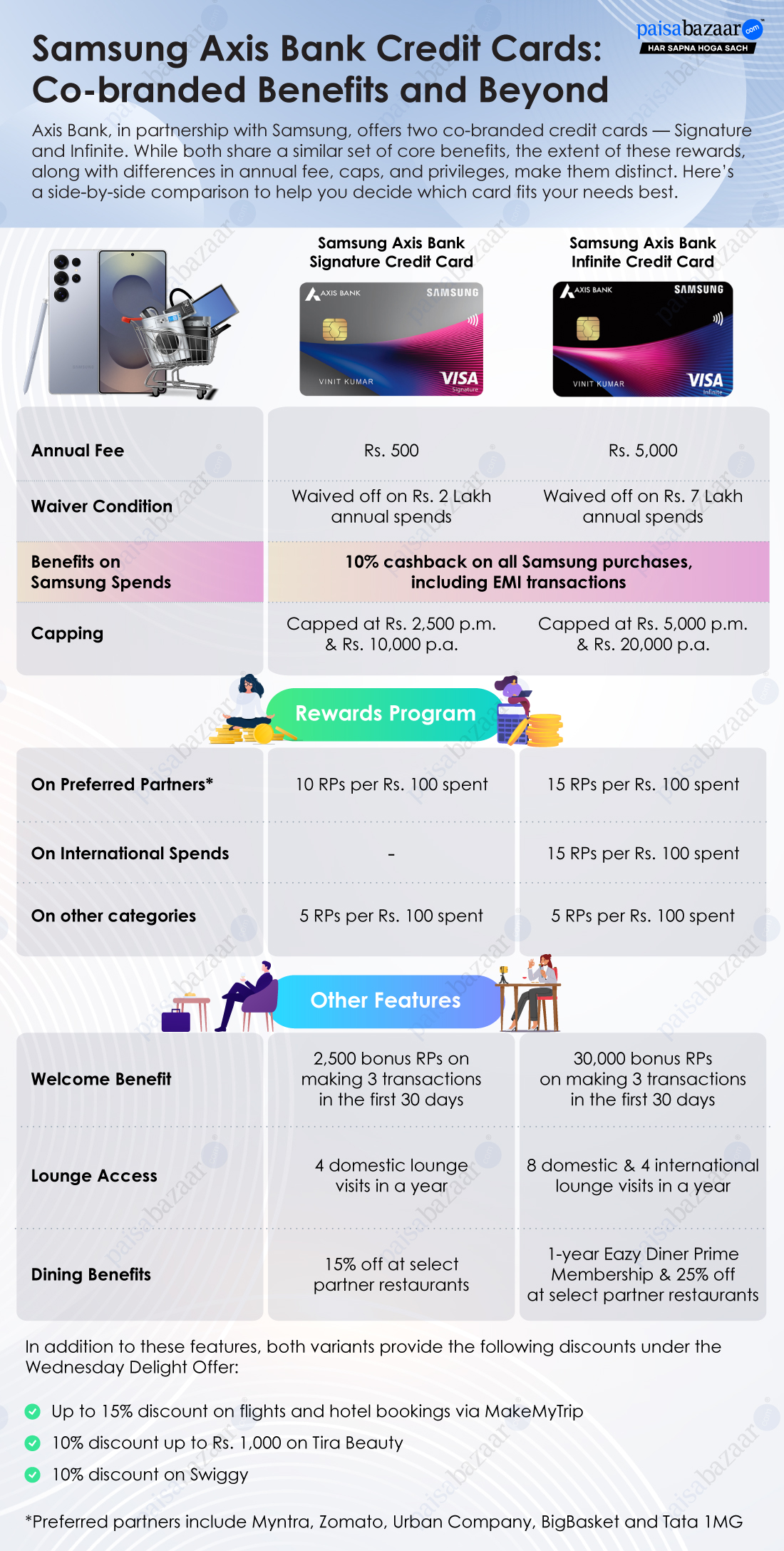

Axis Bank offers two co-branded credit cards in collaboration with Samsung – Samsung Axis Bank Signature and Samsung Axis Bank Infinite, priced at Rs. 500 and Rs. 5,000, respectively. It is the first and only co-branded card partnership for Samsung, and it truly stands as a strong proposition for brand loyalists. Cardholders get 10% instant discount on all Samsung purchases, along with accelerated rewards across popular everyday brands like Zomato, BigBasket and more.

While the core benefit of 10% discount remains consistent across variants, they differ significantly in the form of capping, annual fees and the extent of other benefits. If you are planning to get a new credit card for your Samsung spends but confused between the two options, read the detailed comparison below to understand key differences.

While both the Axis Bank credit card variants offer 10% discount on all Samsung Purchases including EMI transactions, their capping differs, as shown below:

| Card | Monthly Capping | Annual Capping |

| Samsung Axis Bank Signature Credit Card | Rs. 2,500 | Rs. 10,000 |

| Samsung Axis Bank Infinite Credit Card | Rs. 5,000 | Rs. 20,000 |

So, how does this impact cardholders? Let us understand with an example.

Consider a user who makes the following purchases – each purchase made in different billing cycles. Here is how the monthly capping will work.

| Month | Product | Price | Discount @10% | Final Saving on Signature Variant | Final Saving on Infinite Variant |

| April | Samsung Galaxy S25 Ultra (256 GB) | Rs. 1,23,499 | Rs. 12,349.90 | Rs. 2,500* | Rs. 5,000* |

| May | Samsung Double Door Refrigerator | Rs. 50,990 | Rs. 5,099 | Rs. 2,500 | Rs. 5,000 |

| May | Samsung Smart Oven | Rs. 18,960 | Rs. 1,896 | Nil** | Nil** |

| September | Samsung Galaxy Watch 8 | Rs. 32,999 | Rs. 3,299.90 | Rs. 2,500 | Rs. 3,299 |

| September | Samsung Sound Bar | Rs. 28,990 | Rs. 2,899 | – | Rs. 1,701# |

| October | The Frame 4K Smart TV | Rs. 63,990 | Rs. 6,399 | Rs. 2,500 | Rs. 5,000 |

| November | Front Load Washing Machine | Rs. 40,990 | Rs. 4,099 | – | – |

| December | Galaxy Tab S10 Lite | Rs. 30,990 | Rs. 3,099 | – | – |

Here are a few important points to note about the above example:

*Since the actual discount value is beyond the monthly capping, cardholders will only get a discount up to the defined caps of Rs. 2,500 and Rs. 5,000 respectively.

**Since the cardholder has already made a purchase in May and reached the monthly capping, the new transaction made in May will not get any discount.

#As the previous transaction in September has already covered a portion of the monthly discount, only the remaining amount will be given as discount. (Rs. 5,000 – Rs. 3,299 = Rs. 1,701)

Also, by October, both cards have reached their annual capping, so no discount can be availed on the purchases made in November and December.

Both Samsung Signature and Infinite Credit Cards are strong picks for customers who prefer Samsung gadgets and appliances. The key differentiator lies in annual spends and reward capping. If your yearly Samsung spends are likely to stay within ₹1 lakh, the Signature variant makes sense with its lower annual fee. However, for heavy spenders making frequent or big-ticket Samsung purchases, the Infinite variant is better suited. While it comes with a higher annual fee, the value unlocked through rewards and benefits can far outweigh the cost—provided the card is maximised effectively.

In addition to offering discount on Samsung purchases, both credit cards provide accelerated rewards on select partners namely Myntra, Zomato, Urban Company, BigBasket and Tata 1MG.

The Samsung Infinite Card also offers 15 EDGE Reward Points per Rs. 100 spent on international transactions.

Beyond these, both co-branded credit cards offer the base reward rate of 5 EDGE Reward Points per Rs. 100 spent.

Apart from the general features and benefits, Axis Bank also runs Wednesday Delight offer under which cardholders get the following benefits:

| Benefits | Signature | Infinite |

| Welcome Benefit | 2,500 bonus RPs on making 3 transactions in the first 30 days | 30,000 bonus RPs on making 3 transactions in the first 30 days |

| Lounge Access | 4 domestic lounge visits in a year | 8 domestic & 4 international lounge visits in a year |

| Dining Benefits | 15% off at select partner restaurants | 1-year Eazy Diner Prime Membership & 25% off at select partner restaurants |

The benefits extend well beyond the Samsung ecosystem. Accelerated rewards on partner platforms add strong everyday value, especially since many popular spend categories are covered. The Infinite variant further enhances the proposition with international travel perks, including faster rewards on foreign spends and complimentary airport lounge access—features typically expected in this fee range. While these are valuable add-ons, your primary deciding factors should be the Samsung discounts and the bonus reward categories, as they deliver the core advantage of these cards.

Both Signature and Infinite variants deliver solid value, but the right choice depends on how much you spend within the Samsung ecosystem. The Signature card is cost-effective for moderate buyers, while the Infinite card is best suited for frequent or high-value shoppers who can maximize its higher capping. If Samsung products form a major part of your lifestyle, these cards ensure your loyalty translates into meaningful savings and rewards.