Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Everybody works hard to meet the basic needs of life. Apart from this, people also save money to purchase valuables like gold, watches, expensive pieces of art, electronics, etc. One of the valuables that an individual protects is the watch that can be either antique, expensive or being passed on as a family memento. Various international brands manufacture watches that use gold, silver, diamonds and platinum. The cost of such watches is exorbitantly high and hence, the need for watch insurance.

Table of Contents:

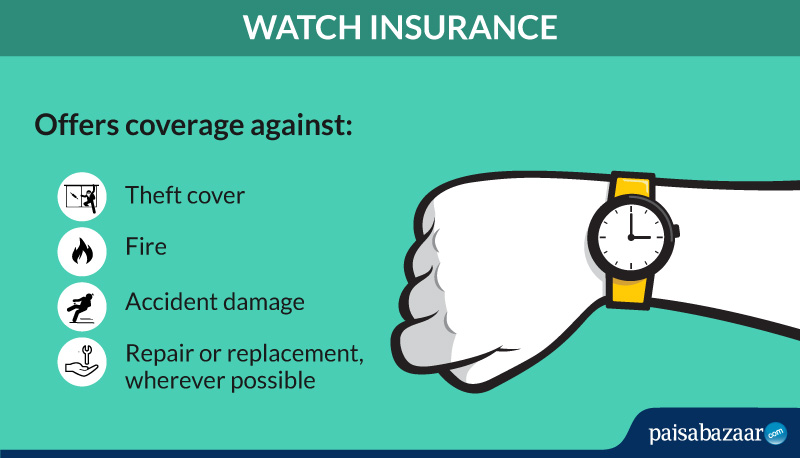

Watches with gold, silver and diamonds are sold across globe and are highly expensive items. Since these watches are very fragile, many private and national insurance companies in India offer watch insurance under Household Insurance Policy that protects valuables stored at home or any location within specified territorial limits from various perils like fire, theft, and burglary etc. under the all-risks policy.

Some private companies in India have started providing special or custom insurance solutions for watches in India.

Some of the watch retailers provide watch insurance immediately after the purchase of the watch. Insurance companies in India offer watch insurance under different policies, such as Fine Arts and Valuables Insurance Policy and All Risk Insurance Policy. Let us look at the coverage provided:

To understand watch insurance better, you should be aware as to how the insurance works so that you don’t miss any important aspect. Let us look at how it functions:

Watch insurance is for anybody who wishes to protect her/his fine timepieces and luxury watches from various risks and problems.

Below are the general steps to be followed by the policyholder or the insurance company when a loss or damage to the insured watch or timepiece is reported to the insurance company:

While filing a claim process, you should keep all the required documents in place so that the claim is not rejected. The documents are:

Watch Insurance claim can be settled within 30 days of claim intimation. If any arbitration is involved, it might take more time to settle the claim.

Insurance companies always mention some exclusions under the watch insurance policies. These are cases not covered under the watch insurance. Some of them are:

Watch insurance can be offered as a stand alone insurance policy as well as a part of another insurance. In India, it is mostly provided as a part of another policy. Some of the insurance companies providing watch insurance in India are:

Before finalising a watch insurance policy, it makes sense to understand all the points so that you get the best deal. Let us look at some of the aspects relating to watch insurance:

In order to protect a valuable item like watch, you should consider buying a watch insurance. Let’s review some of the benefits offered under watch insurance in India:

Q1. Does any insurance company also provide repair of the watch or time-piece from the store where it has been purchased?

Yes, some private companies make compensation for repair directly to the store from where the watch has been purchased, but the customer may have to pay some additional fees, if applicable.

Q2. Can a watch insurance policy be cancelled by an insurance company during the cover period or policy term?

Yes, the insurance company can cancel the policy by providing a notice period to the policyholder and process the refund of the premium amount based on a pro-rata basis or the rate applicable.

Q3. Does the insurance company provide cover to digital watches sold by technology companies like Apple, Casio, etc.?

Yes, insurance companies usually provide coverage to all the smart watches or digital watches provided by such brands in India. One must check with the insurance company about a particular model to be covered under the insurance cover.

Q4. Will the insured wristwatch have an insurance cover if one is travelling from Delhi to Mumbai by air?

Yes, some insurance companies provide transit insurance that covers the watch with the protection cover from various risks while travelling anywhere in India. Some additional rider benefits may include any loss or damage to the watch caused by the aircraft, other aerial devices and articles dropped there from.

Q5. Can an insurance company provide an immediate protection cover for a watch as soon as it is purchased from a reputed store?

Yes, some private insurance companies provide such a facility. Even retail stores also have business arrangements with some private insurance companies in India that provide an immediate insurance cover to the watch at the time of purchase from the store.