Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

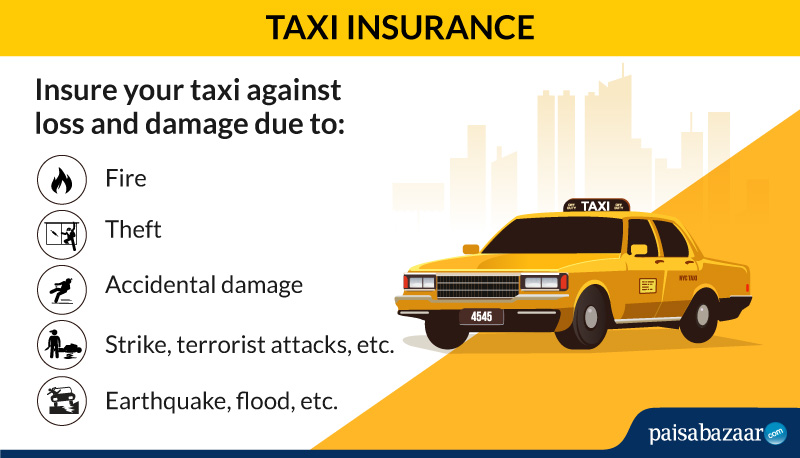

Owning or driving a taxi can bring in various types of complications and issues, including accidents. An insurance is a must for any type and number of taxi you own – whether you own an entire fleet of taxi or just a single taxi. A taxi insurance usually falls under the commercial vehicle insurance policy.

Table of Contents:

While carrying passengers in a taxi, the vehicle is exposed to various risks and complications which can add to your financial liability. Thus, to cover all such risks, you need a taxi insurance, which is a part of commercial vehicle insurance. The taxi insurance will ensure protection against accidents and any damage to the vehicle.

Let us see how a taxi insurance is classified and what all it covers:

Third Party Insurance Cover: According to the Motor Vehicles Act, 1988, this is the minimum coverage which every taxi owner must have. However, now this is a mandatory coverage which every vehicle insurance should include. Under this, the taxi owner needs to pay compensation to the third party, in case of any accident or damage. This insurance scheme covers

Comprehensive Insurance Cover: This provides higher level of benefits to both the car owner and the third party involved in the accident. This policy covers the following:

Also Know About Car Insurance: Coverage, Claim & Renewal

A taxi insurance offers coverage against mishaps occurring on Indian roads and third party liability. Let’s look at coverage offered:

The policy holder can pay some extra premium and increase the extent of the policy to include the following:

A taxi insurance is a type of commercial vehicle insurance in India that functions in the following manner:

Availing a taxi insurance is a must once you buy the vehicle and plan to ferry passengers. A taxi insurance is a must for:

In case of any eventuality, you will have to file a claim with the insurance company which is an easy and quick process. However, you should be aware of the steps so that you don’t waste time and manage the claim in a hassle-free manner. Let us look at the steps:

You should be sure of the required documents to be submitted to settle any claims for a taxi insurance. The necessary documents:

One should be careful while buying a taxi insurance or commercial car insurance and understand all the cases where coverage is not provided. Some of these exclusions are:

The taxi insurance is paid within 30 days of claim intimation. If the claimant is not satisfied with the resolution and the case is raised in the court of law, then it might take more time to settle the claim.

Almost all general insurance companies in India offer taxi insurance under commercial insurance. Some of the insurance companies providing taxi insurance in India are:

Before purchasing a taxi insurance, you should understand all the aspects relating to the insurance in order to get the best deal. It is important to keep the following facts in mind while choosing a taxi insurance:

One should understand that a taxi insurance is a must for any vehicle used as a taxi. Some of the advantages of taxi insurance are:

Q1. What is the minimum premium amount for taxi insurance?

The minimum premium amount is Rs. 50.

Q2. How is the value of the vehicle calculated under taxi insurance?

The value of the taxi/vehicle is calculated based on the basis of the manufacturer’s listed selling price and the depreciation value, which is deducted every year from the price.

Q3. What is IDV?

IDV is Insured Declared Value. This is the maximum amount an insurance company is liable to pay in case of any loss or theft of the vehicle.

Q4. How is the premium for taxi insurance calculated?

The premium for taxi insurance is calculated on the following factors:

Q5. What are the clauses for cancellation of taxi insurance?

The policyholder can cancel the insurance plan if no claim has been made during the tenure of the policy.

Q6. Is it possible to transfer the ownership of taxi insurance?

Yes, the ownership of the insurance plan can be transferred.