Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Today, smart watches are not mere timepieces; they are more than that. It helps you meet your fitness goals by tracking the steps taken, lets you listen to the music of your choice and even lets you read your text messages from your wrist. As much as it helps you to be productive and connected, it is also prone to damage just like any other gadget. This is where having smart watch insurance is important to ensure minimum disruption to your digital lifestyle.

Table of Contents:

Smart watches have become a popular gadget these days. And due to its design, it is prone to damage, loss or theft. A smart watch insurance policy covers many such eventualities usually not covered during the warranty period. It covers repairing costs incurred due to accidental, liquid damage, along with providing theft protection.

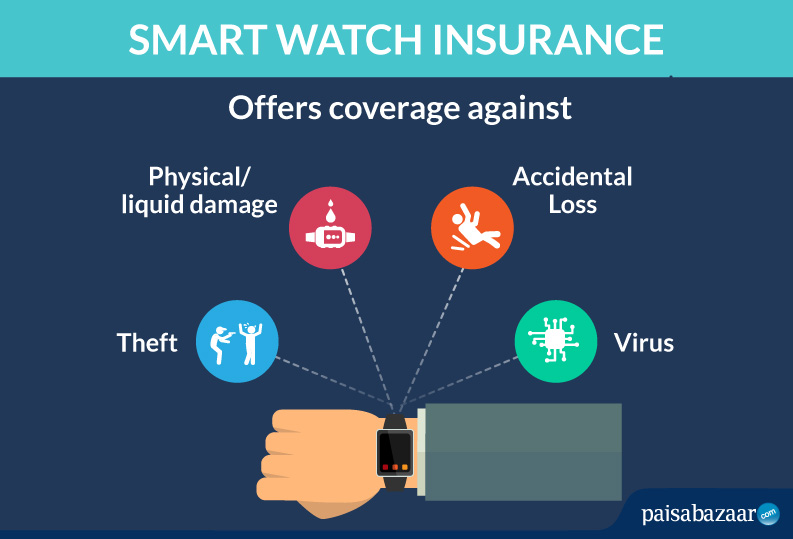

An insurance company providing smart watch insurance offers comprehensive protection in case of the following situations:

Purchasing the smart watch insurance policy involves the following steps:

Eligibility Criteria

This insurance is for anyone who owns a smart watch and wants to protect it from external damage. The policy seeker must provide purchase receipt and other necessary documents to enroll for this insurance policy. It is only valid if the smartwatch is bought in India.

Used, refurbished device and smart watch purchased from outside India are not eligible for smartwatch protection policy.

In case you meet with an eventuality and you need to make a claim, you should follow the correct procedure for getting the claim approved. Let us get acquainted with the steps to apply for the claim:

In order to get the smart watch insurance claim approved, all the documents should be in place. Following are the documents needed to get a compensation:

The insurance company takes 30 days to settle the claim. In case there is a legal dispute regarding the compensation amount or resolution offered by the insurer, it might take more time to settle the dispute.

Though smart watch insurance covers several risks associated with this wearable gadget, the below-mentioned risks are not covered under this policy, also called exclusions:

Not many insurance providers are there to provide smart watch insurance policy in India. Some of the insurance companies offering smartwatch insurance in India are:

A smart watch insurance is an important requirement for people owning an expensive smart watch. Some of the benefits of buying a smart watch insurance are:

Q1. What if there is only cosmetic damage and the smart watch is still functioning?

The compensation is provided only when the damage ruins the routine functionality of the smart watch.

Q2. Is smart watch insurance required when the watch is under warranty?

Yes, smartwatches usually have a warranty period of 12 months which only covers mechanical breakdowns.

Q3. What is the premium for a smart watch insurance?

The premium for smart watch insurance depends on the cost of the watch and the compensation amount expected by the policy seeker. It also depends on the tenure of the policy.

Q4. What is the sum insured for a smart watch insurance?

It depends on the actual value of the smart watch and also the premium the policy seeker is willing to pay.