Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Running your own business and owning an office is a thing of great pride. However, it is also important to protect your office and yourself from any unforeseen events that can hinder the functioning of your business. To safeguard yourself from such risks, one can opt for office insurance.

Table of Contents:

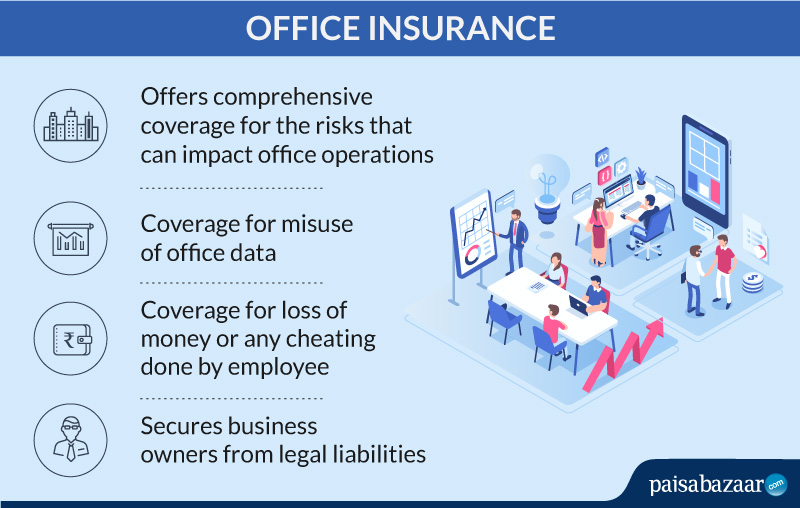

Office Insurance offers comprehensive coverage for the risks associated with threats which can impact office operations.

It covers not only the office property, but also the loss of money or any cheating done by employees. The insurance is usually offered as office package policy to cover the risks arising from various untoward incidents.

It is available as a package policy which includes protection against:

Entrepreneurs can opt for any of the following extended Office Insurance plans.

Read More: What is Commercial Insurance – Coverage, Claim & Exclusions

It is easy to get an office insurance. Let us understand how this insurance works and how people can get the best out of it.

Office Insurance policy is eligible for small, medium and large-scale business owners who have:

The insurance companies ensure that the claim process goes smoothly and conveniently. The following steps are followed to settle an office insurance claim:

The documents required for claiming an office package insurance are:

An office insurance claim can be settled within 30 days of claim intimation. If any arbitration is involved, it might take more time to settle the claim.

An office insurance protects the office and its owner from various risks; however, it does not cover financial loss or damage caused to the property or employees due to reasons like:

With fast-paced development, people in India are getting aware about the need to protect their businesses and offices from various perils which might hamper their work. Thus, many people are now purchasing office package insurance, which can also be customised to suit the needs of the customers. Some of the companies providing office insurance in India are:

An office insurance ensures that business owners get sustainable growth in their business amidst risks and uncertainties. This protection plan comes with the following benefits:

FAQs

FAQsQ1. Can the policyholder cancel office insurance?

Yes, the policyholder needs to submit a written document to cancel the policy.

Q2. What assets are covered under office insurance?

Office premises, staff and customers are covered under office insurance.

Q3. What is the indemnity period for office insurance?

This is the time duration within which the policyholder can claim for business insurance costs.

Q4. What is the policy period of office insurance?

The duration of the policy period is 12 months.