Commercial insurance or business insurance is a type of insurance that covers risks related to any business. There are various kinds of insurance policies available in the market to help different businesses get financial coverage for various business risks. It could be insurance for a shop, mall, factory, warehouse or a vehicle.

Table of Contents:

- Types of Commercial Insurance

- Coverage

- Claim Process

- Exclusions

- Important Aspects

- FAQs

What is Commercial Insurance?

Commercial insurance offers protection to businesses from any unforeseen issues. Some of the most common insurance policies are shopkeepers’ insurance, warehouse insurance, transit insurance, product and public liability insurance, employee liability insurance, marine insurance, property insurance and many more. These policies provide a safety net to business owners in case of any problem.

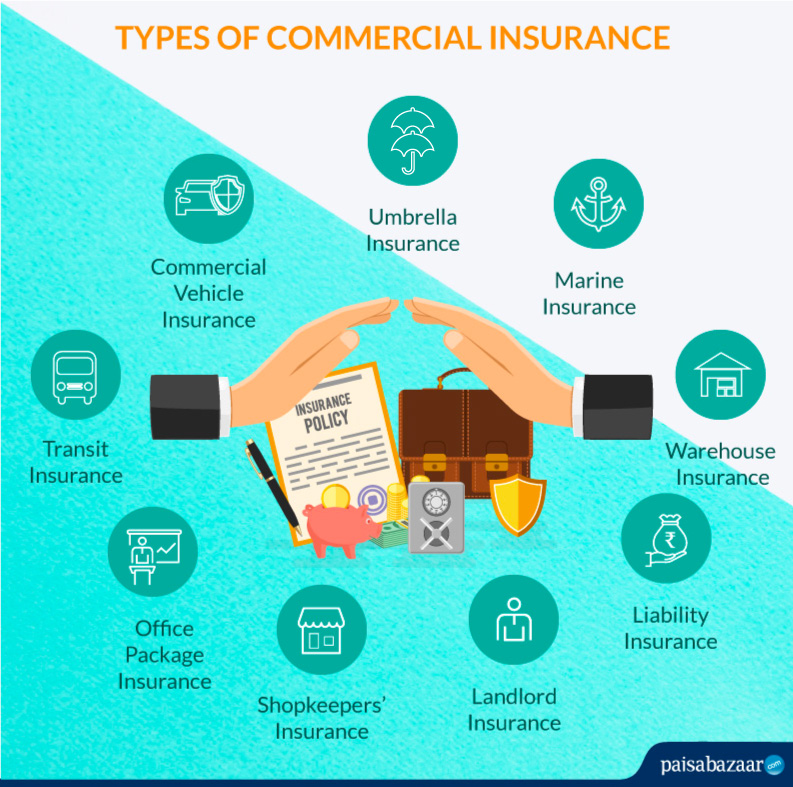

Types of Commercial Insurance

Let us look at some of the types of commercial insurance available in India that can help minimise and handle various risks related to businesses.

1. Shopkeepers’ Insurance: Shopkeepers’ insurance policy is an ideal choice for retail shopkeepers dealing in grocery, apparels, small restaurants, sweet shop, etc. The comprehensive policy covers all the risks and contingencies faced by small or mid-sized shop owners. It covers the losses related to following issues:

• Fire & Allied Perils

• Burglary and housebreaking

• Machinery breakdown

• Personal accident

2. Transit Insurance: When valuable business goods are transported from one location to another, for example, from supplier’s factory to the retail outlet, you should consider transit insurance to cover any loss due to damage or loss of the consignment. The responsibility of taking the transit insurance policy must be determined in the sales contract, and the insurance must be taken well before goods leave the supplier’s premises. Transit insurance only applies to the goods transported over land. Following are the goods which are covered under transit insurance:

• Packaging material

• Manufactured goods

• Raw materials

3. Commercial Vehicle Insurance: Vehicle owners who are in the business of transporting passengers or goods must take commercial vehicle insurance that covers the commercial vehicle against various types of external damage. Some of the important features of commercial vehicle insurance are:

• Death or bodily injury caused by the use of the vehicle

• Any damage to the property because of the use of the vehicle

4. Liability Insurance: This policy offers protection to businesses and individuals from risk that they may be held legally and liable for, especially in the case of hospitals and business owners. For example, a factory owner may face a liability claim from the employees who gets electrocuted inside the factory. The employee liability insurance may help in such a situation and handle the treatment costs along with legal costs, if any arise.

5. Warehouse Insurance: Businesses in which majority of the functions are dependent and happens in multiple warehouses may consider buying a warehouse insurance. It covers natural calamity, fire and similar unforeseen situations. Moreover, you can get the compensation against human-made hazards like theft and burglary.

6. Marine Insurance: When goods are shipped to international destinations through the sea, it undergoes several changeovers. It travels by rail, road, water and perhaps airways as well. It also changes many hands before it reaches the final destination. The shipowners take Hull and Machinery insurance to protect the ship’s basic structure and machinery. The cargo owners take marine cargo insurance to protect the consignment under transit. The marine policy may cover specific time-frame or the voyage or both. Make sure to strike the correct balance between adequate coverage and reasonable insurance premium to avail optimum coverage for your cargo.

7. Office Package Insurance: This type of insurance protects one’s office and everything under the roof, including the infrastructure. It offers protection to the office premises, in case of any damage due to fire, theft, burglary, earthquake, etc. It also provides personal accident coverage. One should understand all the points that are included and excluded in the policy. For instance, the policy does not cover any problem arising due to illegal activity or war-like situation.

Coverage under Commercial Insurance

Various types of commercial insurance offer coverage for various cases and situations. Let us understand some types of coverage provided by various insurance companies.

- Home insurance covers the house and the content inside the structure

- Group health insurance covers medical expenses during hospitalisation

- Liability insurance covers costs of lawsuits and other damage to person or property due to your business, profession or vehicle

- Transit insurance offers coverage for loss or damage to any cargo during transportation

The above mentioned list is not limited to these points. The complete list is available on the official website of various insurance companies.

Claim Process

In case of any unforeseen damage, you need to immediately inform the insurance company about the eventuality through its 24/7 insurance helpline. You should be aware of the claim process and follow it properly in order to avoid any claim rejections. However, the claim process and the documents required vary for different insurance companies and plans. Here is a basic understanding of how to go about the claim process.

- Inform the insurance company, if you need to make the claim

- Provide the details like policy number and other documents, including duly filled in claim form

- Provide the witnesses, proofs, FIR copy, medical reports, etc., as per the requirement of the type of your insurance plan

- On receiving the documents, a surveyor from the insurance company will verify all the details

- If accepted, the claim is processed within the stipulated time, else it might be rejected

Exclusions under Commercial Insurance

While offering coverage, insurance companies do not include all cases and situations. The damage and loss that are not covered by the insurance firms are called exclusions. There are different sets of exclusions for different insurance types and plans. The list mentioned here does not include all the exclusions. To know them in detail, please visit the official website of that particular insurance provider.

- For any insurance policy, any regular wear and tear or wilful negligence is not covered

- Any loss due to war or war like perils is not covered

Companies Offering Commercial Insurance Plans in India

With more awareness, an increasing number of people are now considering buying various types of commercial insurance for their business needs and requirements. Some of the companies selling different types are:

• HDFC ERGO

• New India Assurance

• Bajaj Allianz

• Bharti AXA

• United India Insurance

• ICICI Lombard

• TATA AIG

Important Aspects

Not all insurance companies provide all kinds of insurance policies and the coverage varies from company to company. According to your need, make sure to examine all terms and conditions of the insurance policy that suits your specific business needs. Some of the points to be considered are:

- Make sure not to underestimate the valuation of the property under insurance. You may save a few hundred rupees but may land up in huge losses in case of an unfortunate event

- Make a complete declaration of the nature of your business, your perceived risk and probable causes of loses. The insurance company may reject your claim, if significant information is not disclosed or misrepresented while taking the policy

- Avoid exaggerated or false claims, as it can result in denial of the insurance. The serious misleading claims are considered fraud, and the insurance company may file police complaints against such an act

Advantages of Commercial Insurance

To safeguard your business and property from any unseen circumstances and to handle the associated financial risks, it makes sense to opt for commercial insurance. Some of the advantages are:

- If you are running a company or owning an office, you would need insurance to protect your premises and employees. For this, you can select the appropriate type of commercial insurance for yourself. This protects you from all possible financial risks

- In case your business deals with commercial vehicles, you cannot ignore commercial vehicle insurance. This gives you a chance to manage the heavy costs incurred in case of any accident or eventualities

- In case your profession or business happens to deal with clients or third party, a liability insurance under commercial insurance is a must in order to manage the losses and any costs for legal issues