Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Home loan is a major financial commitment for homebuyers but, at the same time, it also entails huge risks for the bank. This is the reason why banks are very apprehensive about extending home loan to people who are close to retirement, regardless of their financial standing.

A majority of homebuyers opt for home loans to fulfil their dream of owning a house. However, what if the buyer has enough funds to pay for the house in full? Should he still take a home loan? It is quite a debated topic among property experts. When you have extra funds to spare, why […]

You might have seen quite a few advertisements recently that show that home loans are now available for interest rates as low as 8.5% per annum. These rates are indeed among the lowest in history and it is definitely a good time to invest in a property of your choice. However, before you get inspired […]

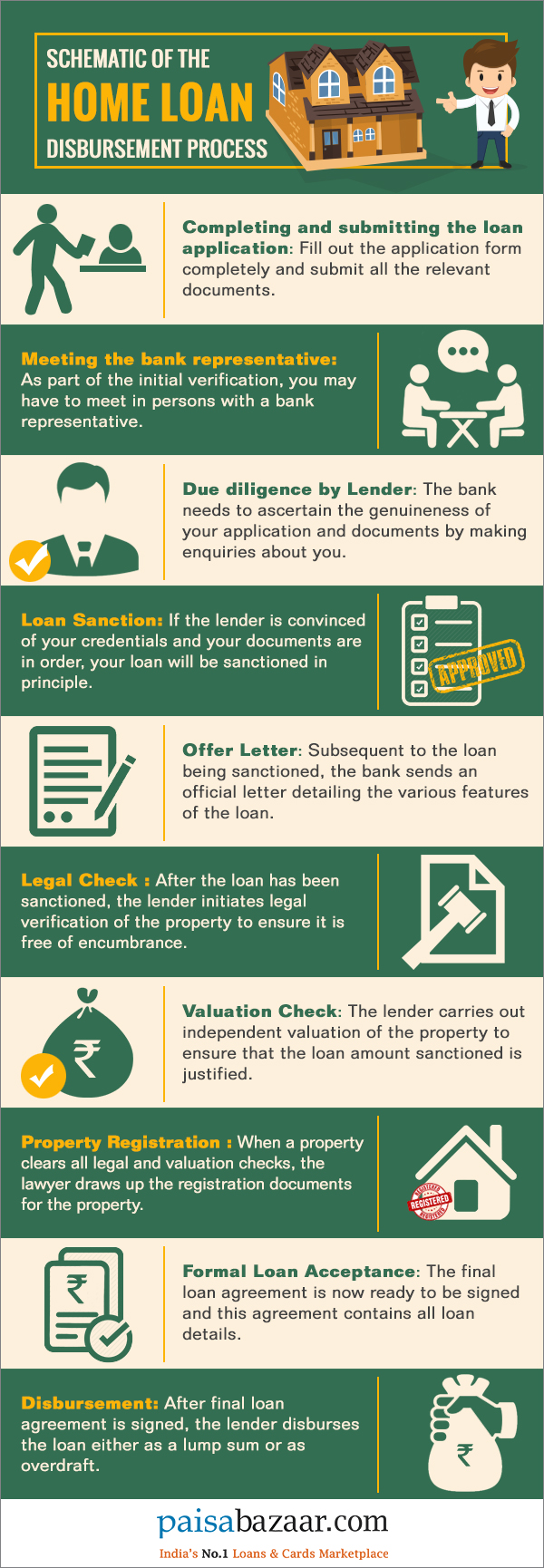

In the following infographic, we have provided a step-by-step guide regarding the various steps that follow after you have submitted your home loan application with the financial institution.

The huge surge in bank deposits due to demonetisation has led to banks reducing lending rates to the lowest in the last 6 to 8 years. Leading the pack, is SBI which has reduced its home loan rates by 50 basis points (bps) to as low as 8.5 per cent (fixed). Even, HDFC, the largest […]

For most people, a home loan EMI is usually the largest monthly EMI payment liability that they have to manage in their lifetime. Moreover, a home loan is a long term commitment (usually 20 years or more) and keeping up with regular EMI payments may not be easy if you lose your job, incur losses […]

Owning our own home is a dream for most of us. However, skyrocketing property prices across the country make buying a residential property difficult, especially early in life.

Buying a home often tops the list when it comes to the aspirations of an average Indian. After all, who wants to keep paying rent all their life? But the skyrocketing property prices in cities, as well as small towns, make home-buying a pricey affair for the mid-income professionals. To assist them, banks and NBFC have […]

Prime Minister Narendra Modi’s vision, when he came to power in 2014, was to provide houses to poor families by the time India completes its 75th year of independence. This vision culminated into the Pradhan Mantri Awas Yojna: an effort to provide homes to the needy.

how to sell mortgaged property in india? how to buy a mortgaged property? *Read here: Tips and Tricks to Buy/sell a Mortgaged Property in India.