Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Get your Free Credit Report with Monthly Updates

Let’s Get Started

The entered number doesn't seem to be correct

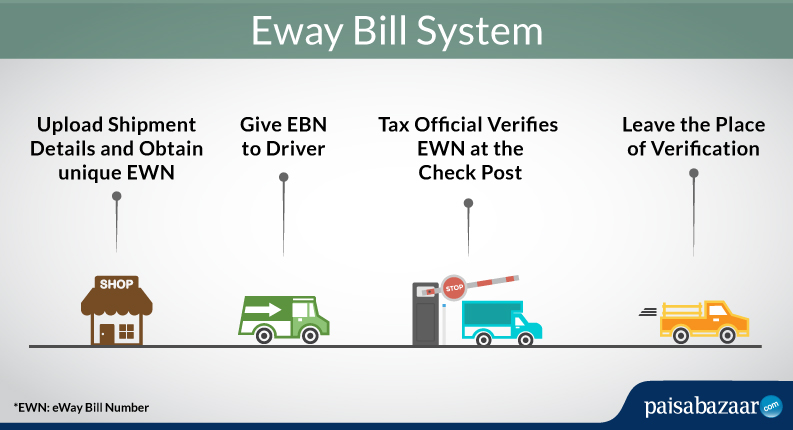

The GST eWay bill is an electronically generated document that has to be carried by the person in charge of transport of goods (both intrastate and interstate). In the following sections we will discuss some key aspects of the current e Way bill system under GST.

Table of Contents :

Under the GST regime, every registered person who is engaged in transporting goods (not necessarily on account of supply) of value more than Rs. 50,000 within or outside the state of origin is required to generate an eWay bill. It is electronically generated by uploading the relevant information about the goods before their transport on www.ewaybillgst.gov.in. Alternatively, eWay bill can be generated through SMS/ e Way bill android app. Each GST eway bill is generated in triplicate and features a unique eWay Bill Number (EBN). The three copies of the GST e way bill are to be distributed as follows – one for the supplier, another for the recipient and the third one for the transporter of the goods.

What’s more, the registered supplier can fill GSTR -1 using the information supplied at the time of e-Way bill generation on the common portal.

The eWay billing system under GST has simplified the process for both the GST registered taxpayers and the unregistered transporters. Under the GST regime, the same eWay bill can be used across all the states and union territories in India. This will result in smoother movement of goods and free trade from one state to another.

On the other hand, during the VAT regime, the Way bill (a delivery note with a unique number) was different for each state. This difference often hindered the movement of goods across states. Additionally, it was difficult for the State and the Central Government officers to cross verify such bills generated independently by each state.

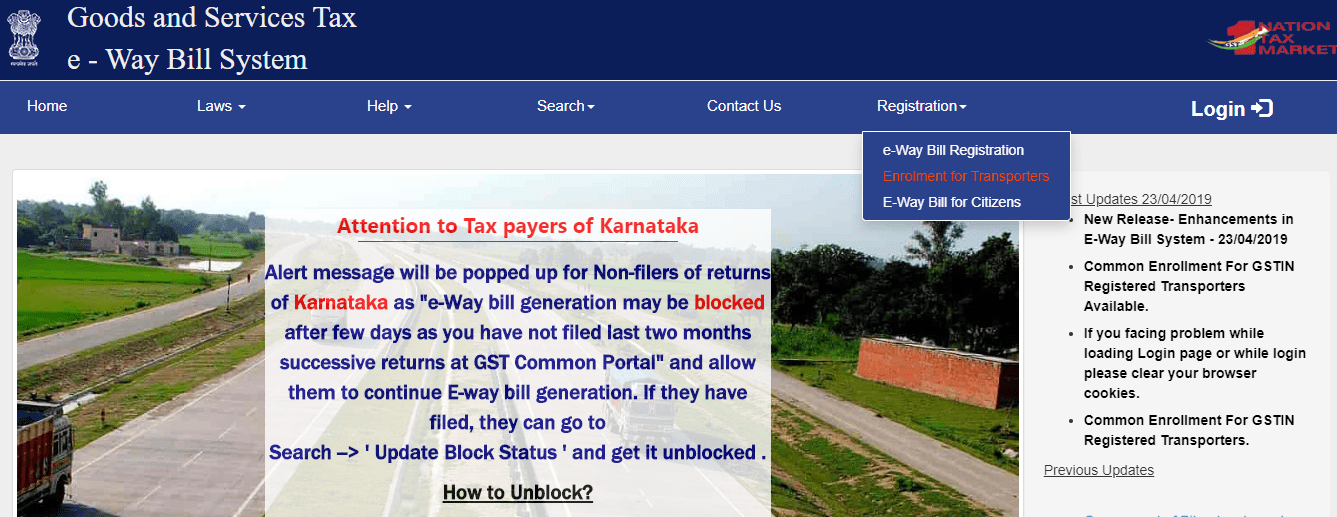

The following are the key steps if you want to enroll for the eway bill system as a GST registered transporter:

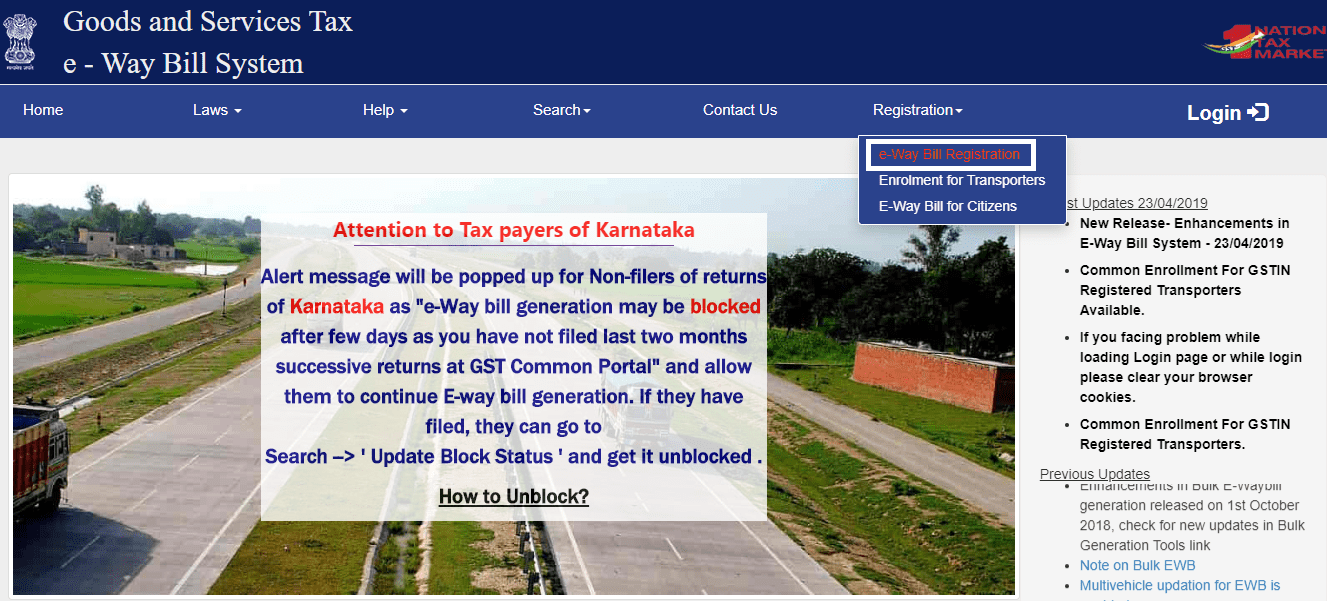

Step 1: Visit the e-way bill portal.

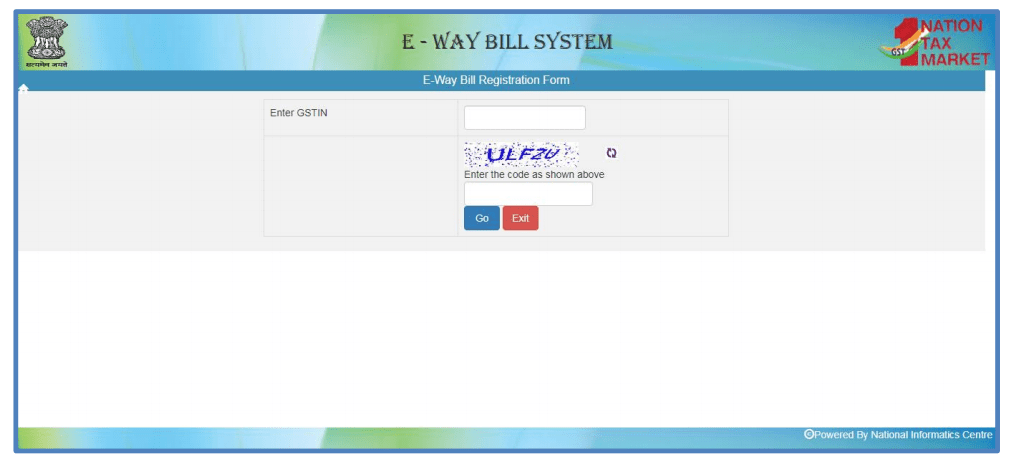

Step 2: Click “e-Way Bill Registration” under the Registration tab. This will direct you to the following eWay bill registration form.

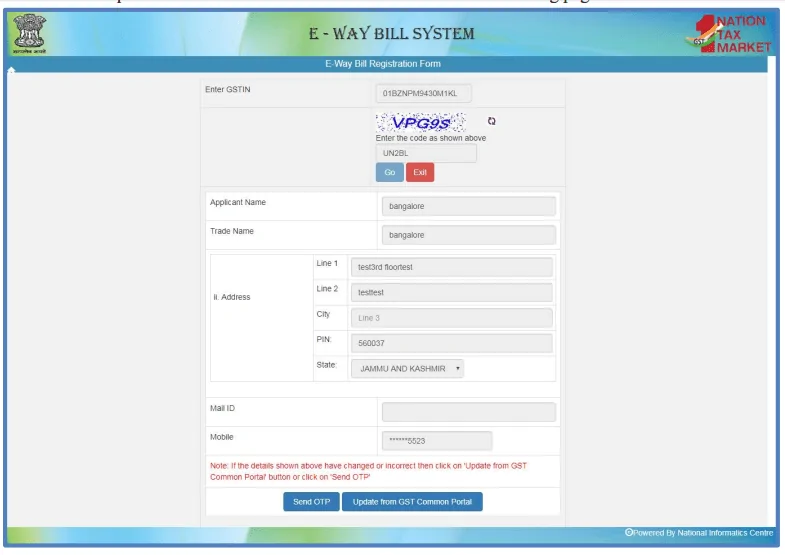

Step 3: Enter your GSTIN and the displayed captcha. Click Go and you will be redirected to the following page.

Step 4: Applicant name, Trade name, Address, Mail ID and Mobile Number are auto populated once your GSTIN number along with displayed captcha. If the details have been changed or are incorrect, click “Update from GST Common Portal”.

Step 5: Click on “Send OTP” to receive an OTP on the registered mobile number. Now enter this OTP and click on “Verify OTP” to validate your credentials.

Step 6: Finally, you need to provide a User ID or username of your choice to login in future. Once, the system validates the entered values, you can use this registered username and password to work on the system.

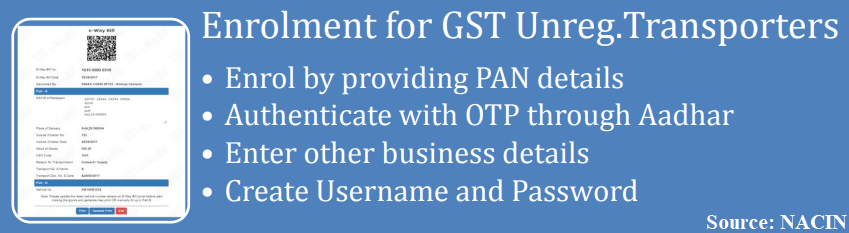

Being registered under GST is not mandatory for enrolment with the GST ewaybill system. The following are the key steps if you want to enroll for the eway bill system as a GST unregistered transporter:

Step 1: Visit the e Way bill portal.

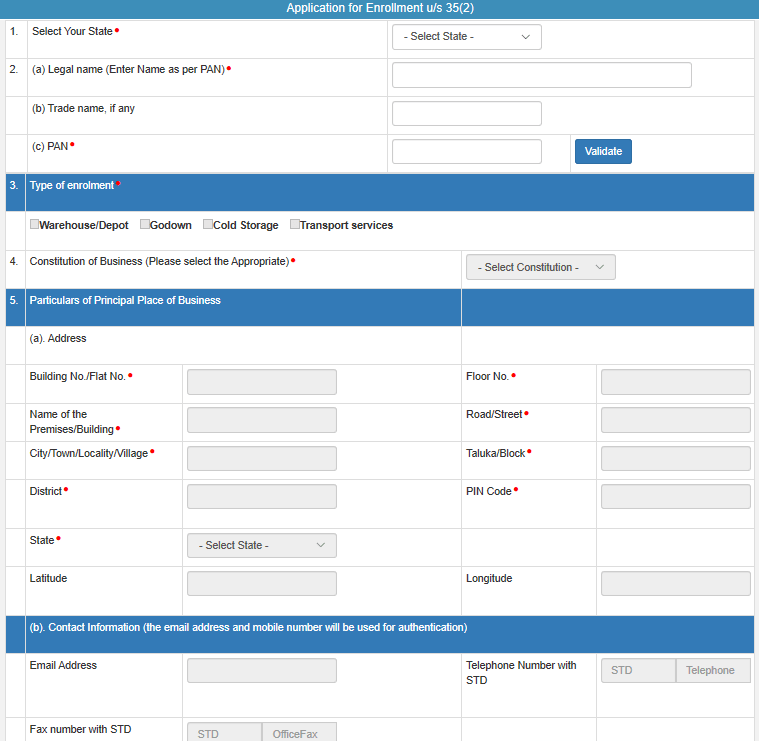

Step 2: Click “Enrolment for Transporters” under the Registration tab and you will be directed to the following Enrollment Form u/s 35(2). Select your state; enter your PAN and business details; create username and password for future login.

Step 3: Provide declaration regarding the correctness of the information by clicking on the checkbox.

Step 4: Click on “Save” button and the system will generate your 15-digit TRANS ID.

You can provide this TRANS ID to your clients. This TRANS ID has to be entered in the e-way bill, which will allow the transporter to enter the vehicle number and authorize the movement of goods.

RFID stands for Radio Frequency Identification Device. It uses radio waves to capture and read the information on a tag attached to an object. The advantage of an RFID tag is that it can be read from a distance of several feet and the tag itself does not require a separate power source.

Under the e-Way bill system, an RFID tag is attached to the vehicle transporting the goods. It is generally embedded in the windshield (front facing window) of the truck. The RFID pulls details of the goods being transported from the eWay bill. As a result, whenever the truck passes an RFID reader on a highway, its details are fetched on the e Way bill portal. This makes the verification process faster as tax officials can track the vehicle without stopping it.

The RFID tag can be obtained from the distribution centers assigned for each jurisdiction across the country. The list of RFID distribution centers across Uttar Pradesh can be found here.

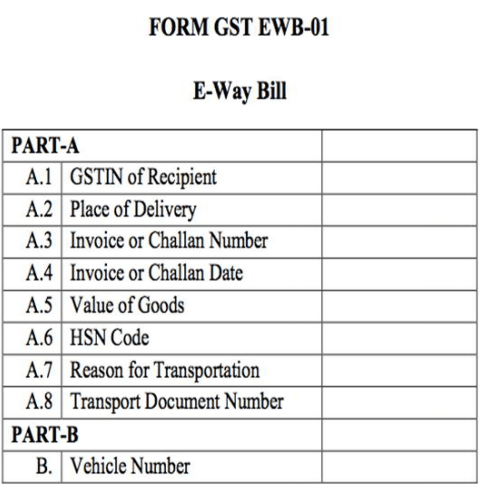

Form GST EWB-01 is used to generate the E-Way bill. It is divided into the following two parts:

Form GST EWB-01 is used to generate the E-Way bill. It is divided into the following two parts:

PART A-

PART B – Vehicle Number i.e. number plate of the vehicle being used to transport the goods.

Q1. What is a eWay bill?

Ans. E-way bill or FORM GST EWB-01 is an electronic bill used after GST implementation for transport of goods valued at more than Rs. 50,000. It is generated on the eWay bill portal and is available to supplier / recipient / transporter as well as the tax officials as evidence for movement of goods.

Q2. What is the common eWay bill portal?

Ans. www.ewaybillgst.gov.in is the common portal for eWay Bill System. This government portal can used for the creation and verification of GST way bills generated for transporting goods within India.

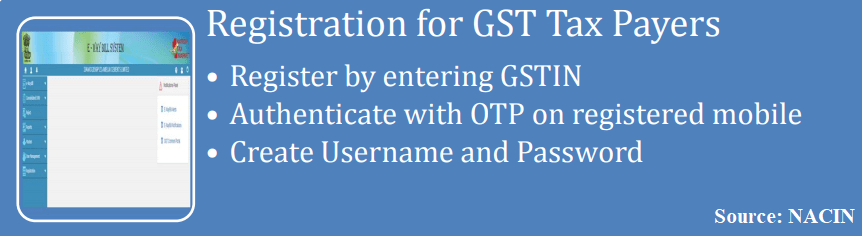

Q3. How can a taxpayer under GST register for e-Way bill ?

Ans. Taxpayers under GST can register on the eWay bill portal using his/her GSTIN. After you enter GSTIN, an OTP is sent to your registered mobile number for authentication to create username and password.

Click here to read the step by step procedure for registration on the Government eWay bill portal (www.ewaybillgst.gov.in), if you are a taxpayer under GST.

Q4. How can an unregistered transporter enrol in the eWay bill system?

Ans. Transporters who are not registered under GST can also enrol under the e-Way system by providing their PAN and business details.

Click here to read the step by step procedure for enrolment at eWay bill portal, if you are an unregistered transporter.

Q5. What is the threshold for eWay bill generation?

Ans. An e-Way bill should be generated whenever the value of goods in a consignment exceeds Rs. 50,000. However, for generation of eWay bills in Tamil Nadu and Delhi, the threshold is Rs. 1 lakh. Due to this difference, it is necessary to visit the commercial tax website for each State/Union Territory in order to verify rules related to e way bill generation.

Q6. Is eWay bill required for transport within the same state?

Ans. Yes, an eWay bill should be generated for transport of goods within the same state (intra-state), if the value of consignment exceeds Rs. 50,000 (Rs. 1 lakh for Delhi and Tamil Nadu). It is also necessary to generate eway bill for inter-state transport of goods valued beyond this threshold limit.

Q7. Is generating an eWay bill mandatory?

Ans. It is mandatory to generate an eWay bill when the value of consignment is greater than Rs. 50,000. Failure to generate the e Way bill in such a case can lead to a penalty.

Q8. What is RFID in eWay bill?

Ans. RFID stands for Radio Frequency Identification Device. Under the eWay billing system under GST, an RFID is attached to the truck carrying the goods to be transported. This tag fetches the information from the eWay bill and helps stakeholders as well as transportation officials track the movement of goods without the need for physical verification. As a result, tax officials can complete the verification process without stopping the vehicle.

Q9. How is the GST eWay bill different from the VAT Way bill?

And. Under the GST regime of One Nation-One Tax, single eWay bill is valid across all the states and union territories within India. This is in contrast to the system where separate Way bills needed to be mandatorily generated by every state and UT under the VAT regime.

Q10. What are eWay bill masters?

Ans. A large chunk of repetitive information needs to be filled out when generating an eWay bill. This can be very time consuming. The GST eway bill system allows the creation of masters under the heads of customers, suppliers, products and transporters. Use of masters allows various details to be auto populated leading to significant reduction in the time taken to generate the GST way bill document.