Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Agriculture sector holds a significant position in the Indian economy. Conditions like variations in weather, pest attack, erratic rainfall and humidity affecting agricultural produce is a common problem in India. Thus, it is important to get a coverage in the form of crop insurance for the yield and yield-based losses. Crop insurance is a way to reduce farmers’ distress and to promote their welfare.

Table of Contents:

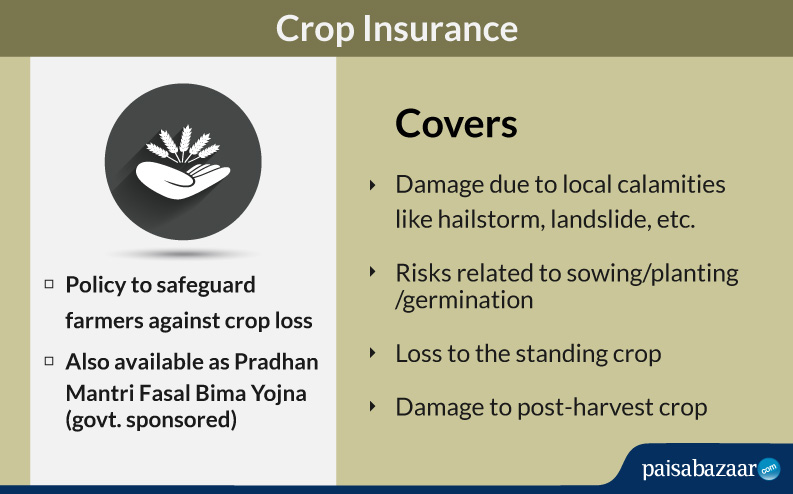

Crop Insurance is a comprehensive yield-based policy meant to compensate farmers’ losses arising due to production problems. It covers pre-sowing and post-harvest losses due to cyclonic rains and rainfall deficit. These losses lead to reduction in crop yield, thus, affecting the income of farmers. In India, crop insurance is offered in the form of Pradhan Mantri Fasal Bima Yojna.

Pradhan Mantri Fasal Bima Yojna is a crop insurance scheme sponsored by the Government of India. The policy was launched in 2016. It aims to provide financial aid to farmers in case of crop loss or damage. Thus, it helps to reduce farmers’s stress and keep them motivated to continue with farming as an occupation.

The risks covered in the scheme include prevention of sowing or planting of seeds, damage to the standing crop due to non-preventable risks like drought, flood, landslide, etc. along with post-harvest losses. This policy can be purchased from a selected set of insurance companies like SBI General Insurance and HDFC Ergo General Insurance.

Also Read: Rural Insurance: Coverage, Claim & Exclusions

Crop insurance is categorised into 3 types:

Also Read: Kisan Suvidha Bima and its Coverage, Claim & Exclusions

Following stages of the crop loss are covered under crop insurance:

Also Read: Weather Insurance

Compulsory Component: If farmers have applied for Seasonal Agriculture Operations (SAO) credit or loans from the financial institution for the notified crops, they will be covered compulsorily

Voluntary Component: Crop Insurance is option for those farmers who fall under non-loanee farmers. If they wish to, they can register and avail benefits from the government scheme

There are two scenarios in which the claim can be processed – I) Wide Spread Calamities and II) Local Calamities,

In the first case, the company would work out the claim settlement once the government puts forth actual yield data. The company would directly settle the claim with the insured without any intimation from the policyholder.

In the case of local mishap, the insured (i.e. the farmer) is required to intimate to the company not later than 24 hours of the event. This can either be done via concerned financial institution or directly.

Some of the key documents that are required by the farmers to make claims under crop insurance are mentioned below:

Generally, the insurance company settles the claim within 30-45 days before the end of the risk period for seasonal crops provided all the required documents have been submitted to the insurance company.

Exclusions are situations not covered or not fit for claim by the insurance policy. An insurance provider is not liable to pay if the loss takes place due to the following conditions:

This insured himself needs to renew their crop insurance policy by either doing it through online or directly visiting the branch. One also needs to make sure the premium should be paid to the company before the due date

Some of the insurance companies offering crop insurance in India are:

Let us look at some of the advantages of buying crop insurance:

Q1. How is crop loss ascertained in a particular area of land?

Individual assessment is generally conducted in the insured area for ascertaining loss at pre-sowing and post-harvest stages along with crop cutting experiment.

Q2. What is the premium amount one needs to pay for crop Insurance?

The rate of insurance charges payable by the farmer is very nominal given below:

| Types of Crop | Premium % |

| Kharif | 2% of Sum Insured |

| Rabi | 1.5% of Sum Insured |

Q3. How is the maximum sum insured or the cover limit of crop insurance under the government scheme calculated?

Sum Insured would be equal to Scale of Finance per hectare multiplied by the area of the notified crop proposed for insurance. However, Sum Insured for areas that are irrigated and non-irrigated would be separate.

Delay in crop loan disbursal under Prime Minister’s Crop Insurance Scheme may prevent many farmers from enjoying the crop insurance benefits given with the scheme. The insurance scheme got closed for the year on July 31. However, only 39% of the target received the crop loan from the government. This year, 1.09 crore policies were issued compared to 95 lakh in 2018, but only 4% farmers got both crop loan and insurance.

Lending process for this year will continue in spite of the insurance scheme being closed, though the farmers will not get the mandatory insurance cover. As of now, crop loan of Rs. 17,000 crore have been given to 22 lakh farmers, of which only 8.7 lakh farmers got the benefit of both insurance and crop loan.

The Government of India recently announced that under crop insurance, more than Rs. 9,000 crore was paid to 80 lakh farmers in the Kharif season of 2018. Under crop insurance, the Central Government provides Pradhan Mantri Fasal Bima Yojna (PMFBY) and Restructured Weather-Based Crop Insurance Scheme (RWBCIS) to safeguard the interests of the farmers. This is a cumulative figure of the two schemes – PMFBY and weather index-based RWBCIS.

The Pradhan Mantri Fasal Bima Yojna pays claims as per the yield (harvest) data submitted by the respective state government. On the other hand, Restructured Weather-Based Crop Insurance Scheme works on the data provided by weather stations (Meteorological Department).

The government has also brought about certain changes in the crop insurance schemes. Village panchayats are now given the responsibility to go ahead with claim calculations and submit the report on the same. This is done with the aim of reaching the grassroots level and thus, providing better financial protection to farmers.

The government is also planning to put a ceiling on crop insurance premium which will lead to increased affordability for farmers.