Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Living a healthy and protected life has become quite expensive today. Certain medical emergencies can lead to financial crisis within no time. One solution to manage emergency medical expenses is to get a health insurance plan. Today, majority of Indian companies offer health insurance policies to their employees in the form of group health insurance to help employees get financial support for emergency medical spending.

Table of Contents:

What is Group Health Insurance Policy?

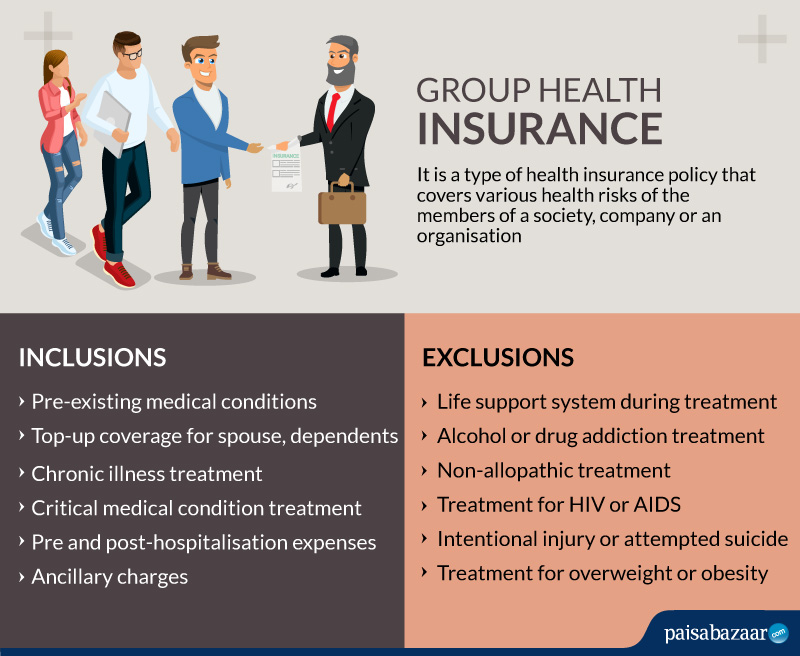

What is Group Health Insurance Policy?A health insurance policy that offers comprehensive health coverage to the members of a society, company or an organisation is called a Group Health Insurance policy. All major corporations, including private, public and government organisations, offer group health insurance to their employees. Thus, the plan provides financial support to the group members to manage various health risks. The insured pays a lower premium for a group health insurance compared to other insurance policies because of the risks being divided in the group.

The wider and extensive coverage offered by a group health insurance plan makes it popular among the corporations. Below are the features and coverage provided by a group insurance plan.

Riders or top-ups are additional features that an individual can opt for along with the group plan. These riders add more value to the existing plans. Some of the riders include:

Accidental cover:

In case of accident leading to deaths, the plan provides financial support to carry on with life.

Critical illness cover: The insurer pays lump sum to the policyholder in case of diagnosis and treatment of critical illnesses like cancer.

Certain cases and situations are not covered by group health insurance plans. Thus, these common exclusions are not entertained by the claims department of any insurance company. This is not a complete list as the exclusions might vary for different companies.

In case of hospitalisation or medical need covered by the insurance company, it is important to file claims on time.

Here are some documents required for filing claims. The insurance provider might ask for other documents as per the case.

Q1. When can I use the sum provided in the top-up scheme?

You can use the amount offered by the top-up plan only when the sum of the actual group health insurance plan is exhausted.

Q2. Can I claim insurance for hospitalisation of less than 24 hours?

Yes, group health insurance policies cover the costs incurred in day-care treatment.

Q3. What should I do if I get admitted to non-network hospitals?

You can get reimbursement in case you get admitted to non-network hospitals. You may need to provide the necessary documents like the bills paid for the treatment in order to get the claim money.