Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Forming an HUF or a Hindu Undivided Family is one of the effective and legal ways of tax saving. Let’s understand what is an HUF, how is it formed and how can you save tax by forming an HUF through this article. Table of Contents : What is an HUF? How can you save tax…

When the amount of taxes paid by an assessee exceeds his/her actual tax liability for a particular FY, then the Income Tax Department returns the ‘excess tax’ in the form of Income Tax refund. In case you have filed your return and are eligible for a refund, you can check your income tax refund status…

What is an Income Tax Notice? Did you receive an Income Tax notice and are wondering how to respond to it? Or maybe you are wondering what an income tax notice is? Or perhaps you want to know when is an income tax notice is issued? Don’t worry we got you covered. Read on to…

Income Tax Filing is the process of declaring your taxable income, deductions, and tax payments for the applicable FY. The last date for filing ITR is usually 31st July of the applicable AY. However, it was extended till 31st August for AY 2019-20, i.e. for FY 2018-19. Filing ITR is an annual affair, but most…

Can I file income tax return (ITR) after the due date? What will be the consequences or penalty for ? Will I be charged some penalty? These are some of the questions that might come to your mind, when you miss the due date to file ITR. Read on to find the answers to these…

Forms 15G and 15H are declaration forms that can help you prevent TDS on your fixed deposit interest income. Notably, PAN is mandatory to avail the tax benefits through these forms. Form 15G is for individuals below 60 years and Hindu Undivided Families (HUF), whereas Form 15H is for individuals aged 60 years and above….

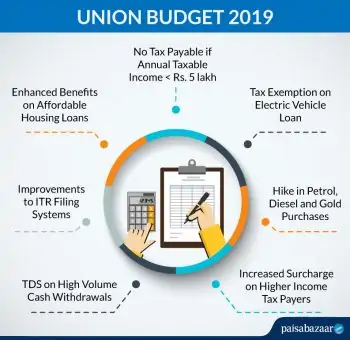

The Union Budget has been announced and was broadly built on the base provided by the Interim Budget 2019 presented on 1st February 2019. The following are some of the key Budget 2019 announcements made by Finance Minister Nirmala Sitharaman that are expected to impact the common man. Affordable Housing Home Loan Benefit Affordable housing…

ITR Filing is one of the most important dates of the financial calendar and as the final step, it requires you to e-verify your ITR subsequent to submission of your returns for the applicable financial year. The task of ITR verification needs to be completed within 120 days of submission of your income tax returns…

The Income Tax Department has announced the availability of Income Tax Return (ITR) Forms 1 through 4 on the official Income Tax e-filing website. This means that the income tax return filing season has officially begun and as of now 31 st July 2019 is the deadline for AY 2019-20 ITR filing. There are a…

If you have changed jobs during the financial year, you will receive multiple Form 16 tax statements. Income Tax Form 16 is a key document for filing your Income Tax return as it contains details of your income earned, TDS deductions, tax saving investments data and more. In the following sections, we will provide some…