Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

While a salary account is a type of savings account, certain aspects make it different from its parent (savings A/c). Thus, compare the features and benefits of both types well before closing your salary account or converting it into a savings account.

State Bank of India has waived off the requirement of maintenance of Average Monthly Balance (AMB) for all Savings Bank Accounts. The bank has also decided to reduce the interest rate on the savings account to 3 percent per annum, irrespective of the amount deposited by the account holder. Further, SBI has also waived SMS…

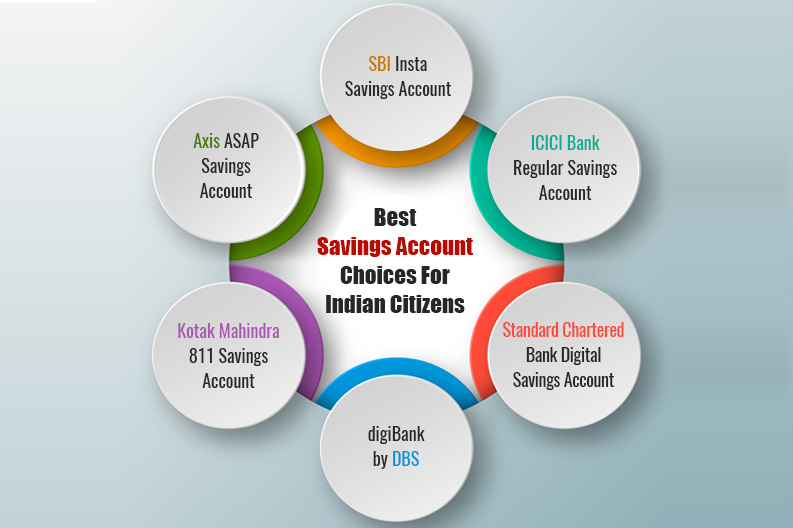

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information. Savings accounts are a great way to save funds for the future. Modern savings accounts are feature-packed and offer quick links to pay bills, make instant transactions, etc. to the account holder as soon…

Your ideal savings bank account should offer good interest rates, flexibility in deposit and withdrawal, areasonable minimum balance mandate in the account, personalised services and overall convenience. You chosen bank savings account should also ensure the following: Safety of your money Prompt andexcellent customer service/support Internet Banking Mobile Banking Phone Banking Substantial number of […]

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information. Indian banks have a substantial presence abroad, be it public sector banks or private banks. There are a total of 185 branches of domestic banks across the globe as per RBI, with a major…

SBI, the country’s largest public sector bank has halved the daily cash withdrawal limit on ATMs from Rs. 40,000 to Rs. 20,000 owing to increasing instances of fraud and to encourage digital and cashless transactions among its customers. The withdrawal limit per card swipe is Rs 10,000 but you can swipe your card multiple times…

The Supreme Court on Wednesday i.e. September 26, 2018 said that while Aadhaar Card will continue to be mandatory for filing of income tax returns (ITR) & permitted linking of Aadhaar with PAN, but Supreme Court rules Aadhaar not mandatory to open savings bank accounts. Thus, as per the latest judgement by the Supreme Court…

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information. State Bank of India removed the limit on cash deposits on customers in branches other than the home branch. The Bank tweeted on 11th September, 2018, “Good news SBI customers! Now, the upper cap…

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information. India Post Payments Bank is providing QR cards to all account holders. These cards are similar to ATM cards and can be used to withdraw money from IPPB accounts. However, these specialized cards do…