Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

The Central Government has decided to pay for the employer’s contribution towards EPF and EPS accounts of the members to boost job creation in the formal sector under the Pradhan Mantri Rojgar Protsahan Yojana (PMRPY). However, this facility can be availed for only three years by the employers. Even if an employee changes his job,…

Do you feel that you are paying a huge chunk from your income on taxes? There are high chances that you do not have an efficient tax plan! A defined tax saving plan can help you benefit from tax exemption and earn tax-free income. The tax-saving season, starting from 1st April, is approaching for both salaried…

Good news for Employee Provident Fund (EPF) subscribers! From the next fiscal, EPF account holders would not need to file EPF transfer claims while switching jobs as the process would be automated. How EPF Transfers would work from FY 2019-20 According to a senior labour ministry official, Employee Provident Fund Organization (EPFO) is currently testing…

EPF subscribers often face confusions regarding operations and services available under the scheme. In order to address, process and resolve the consumer’s issues, the EPFO has formulated various platforms & robust grievance management systems. There are online as well as offline platforms ensuring efficient monitoring of all the complaints. So, if you also have some…

To invest in NPS through Paisabazaar, Click Here Already have an NPS account through us? For Subsequent Contribution, Click Here To Set up SIP, Click Here Note: The information on this page may not be updated. For latest information, click here. India’s National Pension System (NPS) Tier 2 account offers a choice between 8 different pension fund…

On 13th May 2020, the Government announced a reduction in the EPF contribution rate from 24% to 20% of the salary, for private sector firms, for the next three months. As a consequence of this change, it is believed that employees will be able to benefit from a higher take-home salary and employees will be…

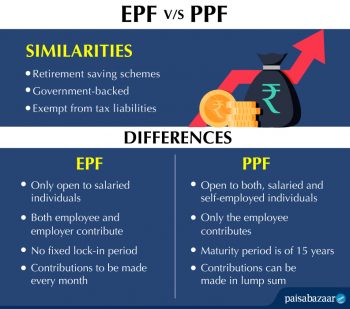

Employees’ Provident Fund (EPF) and Public Provident Fund (PPF) are the two most popular retirement saving schemes in India. Since both are government backed and long-term retirement products, there is a lot of confusion among the investors regarding these investment products. Therefore, if you are planning for building a large retirement corpus, it becomes important…

The Pradhan Mantri Jeevan Jyoti Bima Yojana was started by the then Finance Minister, Mr. Arun Jaitley in the annual financial budget of 2015. The scheme was actually launched by the Prime Minister, Mr. Narendra Modi in Kolkata considering the fact that as of the mentioned year (May 2015), only 20% of the country’s population…