Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

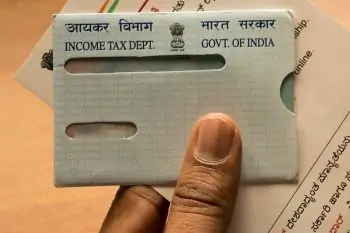

Central Board of Direct Taxes (CBDT) has confirmed that it is not going to extend the deadline for linking PAN with Aadhaar card. The current deadline is set at March 31st, 2021. Beyond this date, all PAN cards not linked with Aadhaar would likely be deactivated and people using a deactivated PAN for regular transactions…

PAN (Permanent Account Number) is a unique 10-character code assigned to each entity carrying out financial activities in India. It also acts as a valid proof of identity for various purposes such as all financial transactions above ₹ 50,000, mutual fund investments, buying properties and other such activities. Are there incorrect details in your PAN…

In 2017, under Section 139AA of the Income-Tax Act, 1961, introduced by the Finance Act, it is mandatory to quote Aadhaar number or the enrolment ID of Aadhaar application form while filing for the Income Tax Return as well as for the new application of PAN Card. However, there may be certain circumstances under which…