Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

To ensure better security and smoother transactions, NPCI has mandated modifications to the existing UPI rules, which will come into effect from August 1st 2025. These changes shall affect both users and service providers. If you use UPI frequently, you should know these changes related to balance checks, payment status enquiry, autopay modifications, etc. Let…

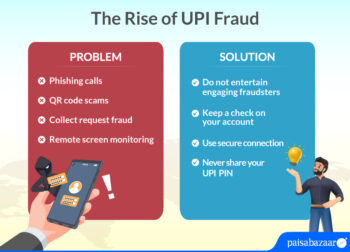

UPI (Unified Payments Interface) has transformed the digital landscape. This is now one of the most popular modes of payment. As digital payments increase, there is a higher risk of falling prey to scammers and fraudsters. We must take necessary precautions to keep our UPI payments safe and secure. UPI fraud refers to the fraudulent…

Contactless transactions have provided a better security feature while making transactions at PoS terminals. With lower risks of card skimming or fraud, Axis Bank has extended this feature from debit cards and credit cards to other wearables. However, these devices are yet to gain popularity among the masses, let us find out if these are…

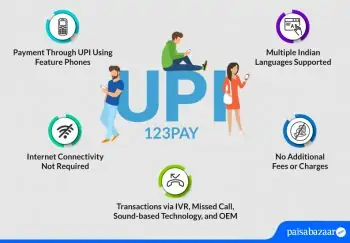

Unified Payment Interface is a single platform for accessing different bank accounts for making or requesting payments. It is an immediate money transfer service that lets users do transactions round the clock 24×7 and 365 days. This service was earlier limited to smartphones that needed internet connection. RBI in association with NPCI has launched the…