Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Any salaried person or individual who generates an income either by doing business, by having a job, being part of an association is liable to pay the profession tax often also known as professional tax. The government of the state where the individual resides collects this particular tax and therefore, it varies from state to state. There are some states such as Chhattisgarh, Delhi, Himachal Pradesh, Haryana, etc., do not even levy the profession tax.

Anyone who belongs to the Hindu undivided family, an individual person, is the owner of any business/company/association etc. is eligible to pay it. However, as per the constitution, the maximum tax that can be collected under the profession tax scheme is Rs. 2500 per individual per financial year.

It is imperative for governments around the world to build revenue in order to maintain the federal structure of the country. Taxes, in general, play an important role in achieving that. The citizens of a country have to pay many kinds of taxes some are direct taxes while others are indirect tax. Some examples are customs duty, corporation tax, capital gains tax, income tax etc.

Profession tax is one of the key direct taxes where a significant amount of revenue is generated by a state. Most of the population in a country is covered by this tax. Depending on what the gross income of any individual and the salaried person is, the profession tax is calculated. Every month an amount is deducted from all employees’ salaries for this.

As for businesses, self-employed, individual partners, partnerships, directors of a company, the tax is deducted from the previous year’s gross turnover. Sometimes, the professional tax amount is a fixed amount which is paid regardless of the company’s turnover. There are certain states in India that levy professional tax and some states do not.

Anyone who is thinking of venturing into a business of their own needs to follow certain regulations and rules related to profession tax. The following are the main ones with respect to deduction of profession tax:

Those earning income in West Bengal have to pay profession tax. All individuals with a salary or a steady source of income would have to pay profession tax. For more details on the professional tax, you may visit the Official website of the Directorate of Commercial Taxes West Bengal Government. However, You can claim the profession tax payment under income tax deduction.

Article 276 of the Constitution of India states professional tax amount cannot exceed Rs. 2500. In the state of Bengal, the enrolled people are supposed to pay their taxes on or prior to July 31 every financial year. For employers, this tax is paid on a monthly basis.

The following are the professional tax slabs and applicable monthly tax amount in West Bengal.

| Gross Income Per Month (Rs.) | Profession Tax Per Month |

| 40,001 and above | Rs. 200 |

| 25,001 to 40,000 | Rs. 150 |

| 15,001 to 25,000 | Rs. 130 |

| 10,001 to 15,000 | Rs. 110 |

| Up to 10,000 | Nil |

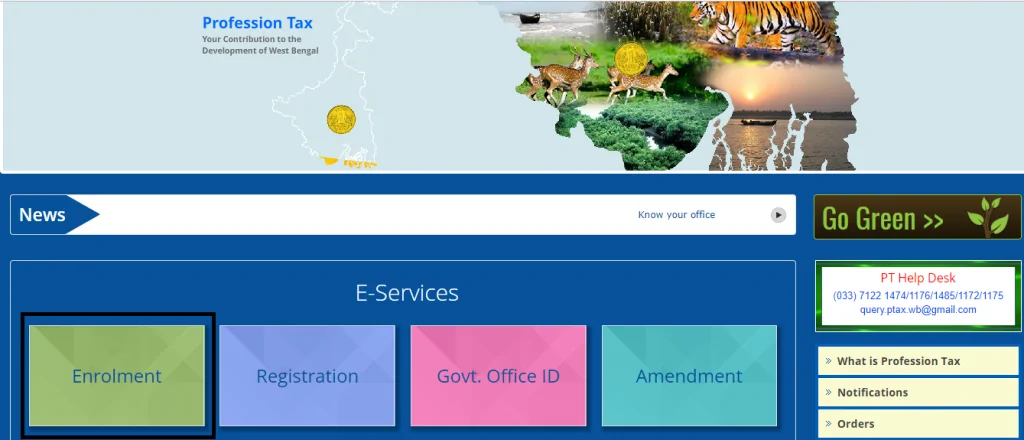

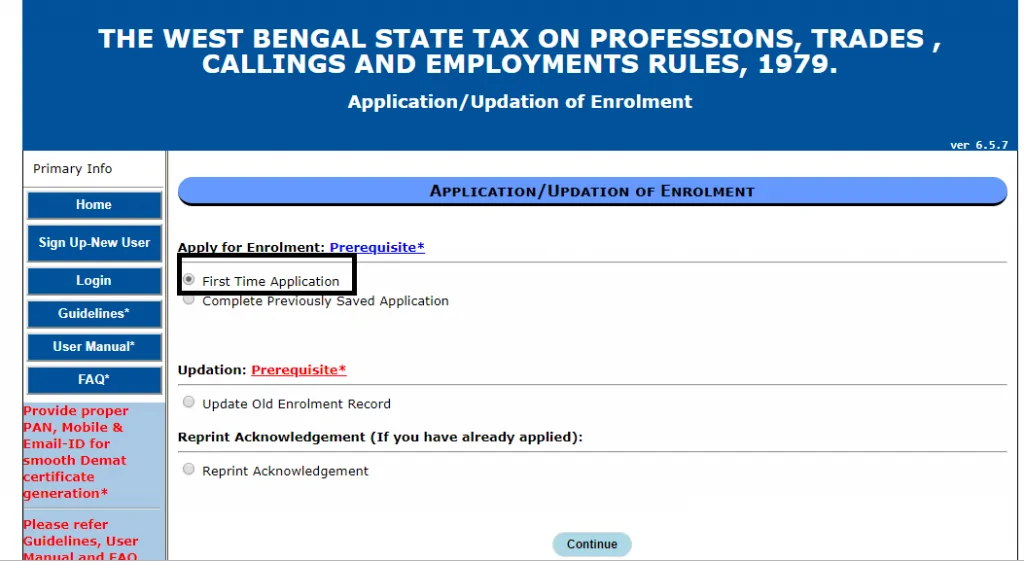

For new enrolment: Go to the Official WB Government Official Profession Tax Website.

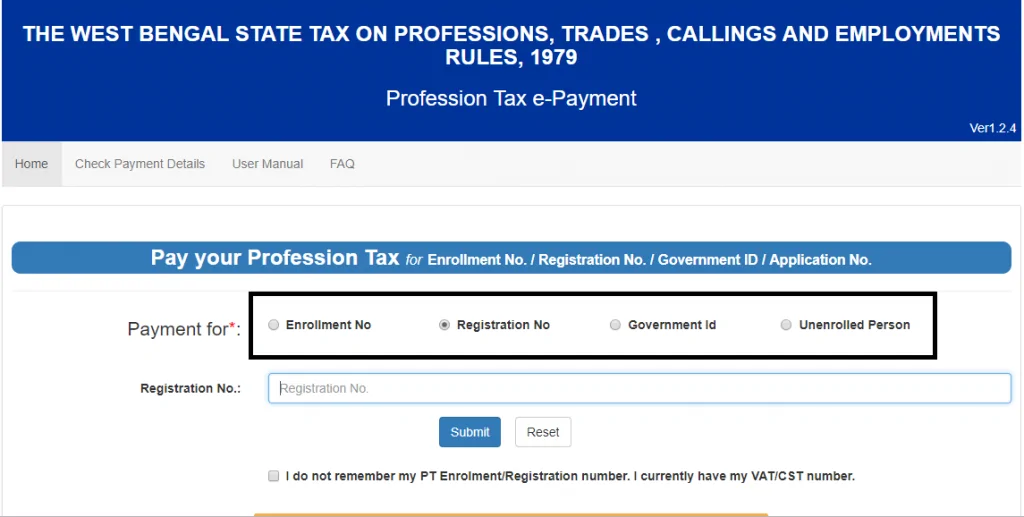

In case of an already enrolled individual, go to the official government website.

All you may have to do is enter your (EC) Enrolment Certificate (9-digit) number and proceed.

For firms and other categories, similar easy steps need to be followed.

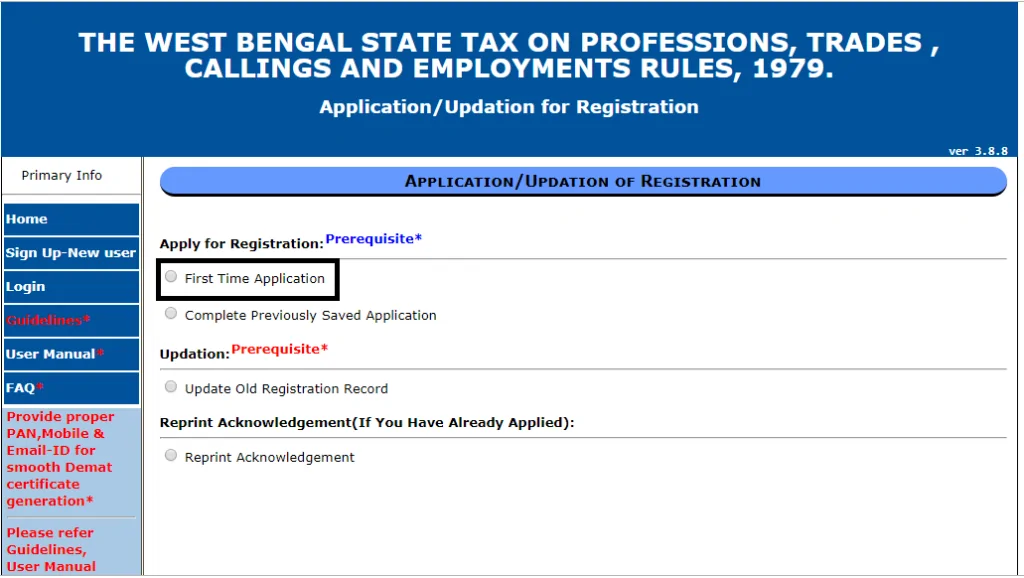

When registering for employment certificate, the employer should first go to the official WB Government website for Profession Tax:

In case of an employer registering under profession tax, papers necessary for registration are:

Certain individuals and businesses are exempted from paying profession tax. The following is a short list of individuals and businesses who are exempt from paying professional tax in West Bengal:

The due date for payment of profession tax is the 21st of every month. For people whose tax liability is less than Rs. 3000, they are required to pay it quarterly. The interest rate per annum is 12% for late payment. In the case of tax liability up to 30,000 the penalty is Rs. 200. If it exceeds Rs. 30,000 then Rs. 100 is charged per each month in case of delayed payment.