Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Profession Tax is a state government direct tax imposed on the income earned by a wide range of people pursuing various professions. In the following sections, we will discuss key features of Profession Tax in Tamil Nadu as well as the importance of this direct tax for the government.

The reason for levying any sort of tax by the government is to generate revenue in order to build robust infrastructure, pay government workers like police personnel, firefighters; ensure defence of the country, etc. Besides that, the government uses these funds for public welfare programs including child development and women’s welfare schemes. There are many different types of taxes that are imposed on the citizens e.g. income tax, capital gains tax, corporate tax, customs duty, etc. A common direct tax imposed by the state government is the professional tax.

Professional Tax is dependent on the gross income of professionals and salaried people. It is deducted from the salaries of all employees each month. When it involves a company, directors of the company, partnerships, individual partners, self-employed and businesses, it is deducted from the gross turnover of the company recorded in the previous year. In certain cases, the disbursement of tax is preset and is to be paid irrespective of what the turnover is. The slab for professional tax varies in each state across India.

If you are thinking about starting a company of your own, there are some key rules and regulations you need to follow pertaining to professional tax. These key rules are as follows:

The following is a short list of individuals who are exempted from the profession tax in Tamil Nadu:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Tamil Nadu is one of the relatively small number of states in India that actually levies profession tax on its citizens. Anyone who gets a salary or any sort of income would come under the profession tax structure. For complete understanding of who all come under the profession tax and how it is levied, you can visit the official government website http://www.tn.gov.in/dtp/professional-tax.htm. This tax is compulsory, but you can claim the income tax deduction on the amount paid as profession tax. Constitution of India Article 276 states that the total amount payable as profession tax should not exceed Rs. 2500. The registration process for professional tax in Tamil Nadu can be completed online.

The slab of the profession tax has been revised for Tamil Nadu in the year 2018. Now, it involves a new provision of tax on employment and calling as well as professions and trades. Profession Tax for the following categories will be calculated on a half-yearly basis:

As per the Tamil Nadu Municipal Laws Second Amendment Act 59 of 1998, section 138 C, “Any individual occupied in any trade, profession, employment and calling in the city limits of the Corporation of Greater Chennai, will have to pay the half-yearly Professional Tax. It will be calculated based on the gross income that is declared half-yearly as follows:

| Average Monthly Income (Half-yearly/Rs.) | Revised Profession Tax (Half-yearly/Rs.) |

Old Profession Tax (Half-yearly/Rs.) |

|

| Up to 21,000 | NIL | NIL | |

| 21,001 to 30,000 | 135/- | 100/- | |

| 30,001 to 45,000 | 315/- | 235/- | |

| 45,001 to 60,000 | 690/- | 510/- | |

| 60,001 to 75,000 | 1025/- | 760/- | |

| 75,001 and above | 1250/- | 1095/- | |

The following is the list of documentation required for the registration process under profession tax rules of Tamil Nadu:

These requirements are subject to periodic change as per directions provided by the Tamil Nadu state government.

Property tax should be paid within 15 days from the commencement of half-year i.e. the month of September and March.

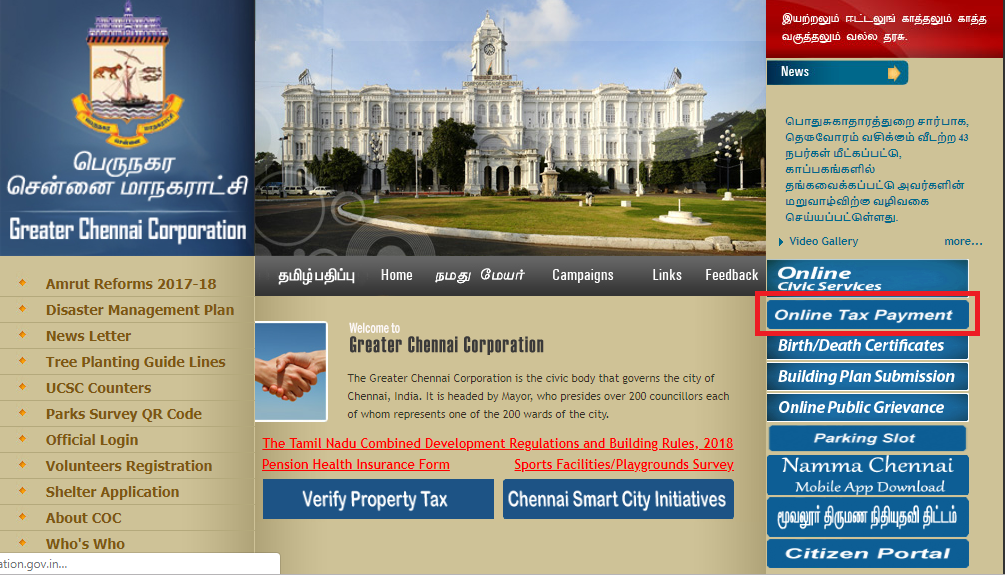

Step 1 – Log on to the Greater Chennai Corporation website and click on ‘Online Payment’ option shown in the left-hand bar.

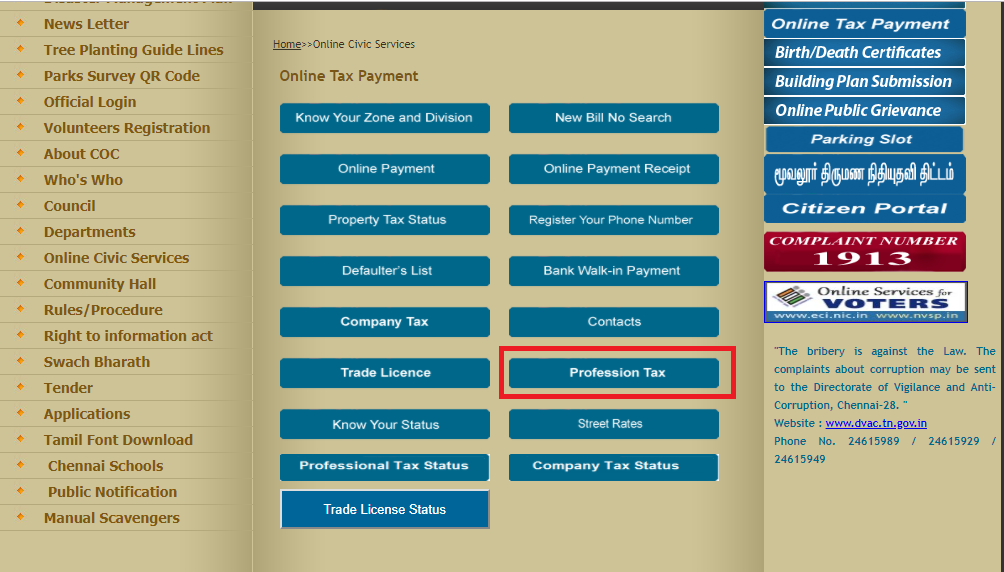

Step 2 – Now, select and click on ‘Profession Tax’ tab shown among the various options.

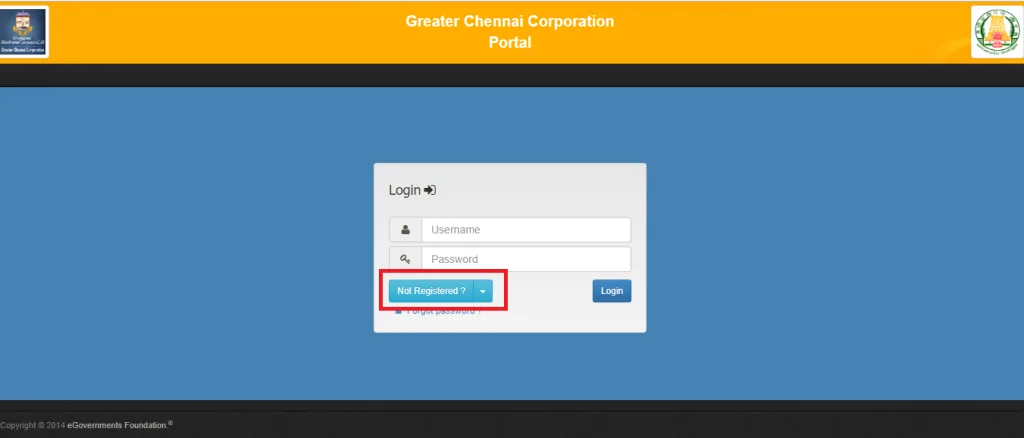

Step 3 – Log on to the new page using your user name and password. If you are not a registered user, please register yourself first by clicking on ‘Not Registered’ option.

Step 4 – Now you can know the profession tax due amount using your profession tax number mentioned on the profession tax payment receipt of earlier years. Online payment of profession tax in Tamil Nadu can be completed using your credit card, debit card or net banking of major banks in India.