Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Profession tax is a direct tax levied on all kinds of professions, trades and employment in proportion to the income of the individual. Since the profession tax falls under the ambit of the state governments as per the article 276 of the constitution, it varies from state to state. There are many states in India which do not even levy the profession tax. However, article 276 also caps the upper limit of the profession tax to Rs. 2500. Click here to find whether your resident state levies profession tax or not?

Profession tax paid by an individual is eligible for income tax deduction as per the Income Tax Act, 1961. Self-employed individuals can annually or monthly pay the profession tax on their own. But the employer deducts the tax from the salary of salaried employees. However, in order to pay the profession tax (if applicable), you need to register first and then only you can deposit it to the concerned authority.

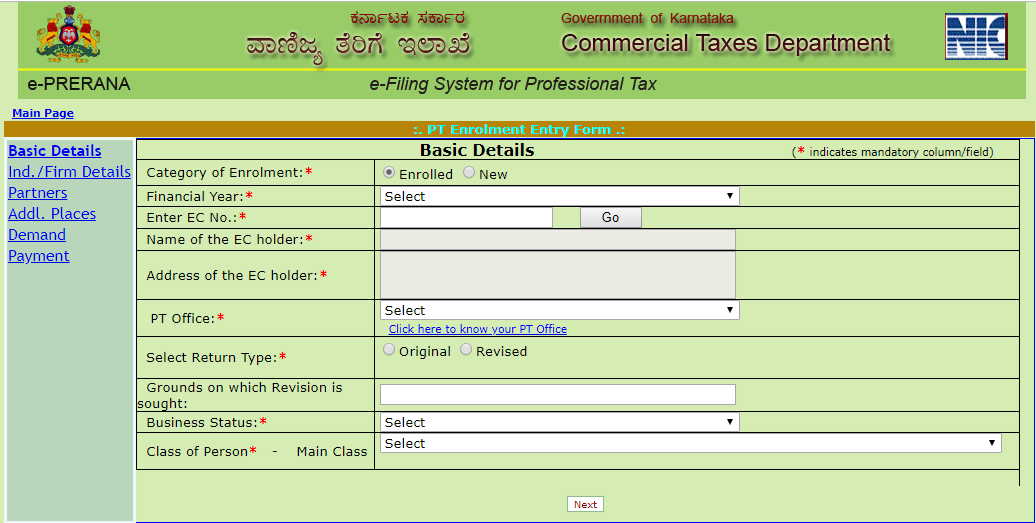

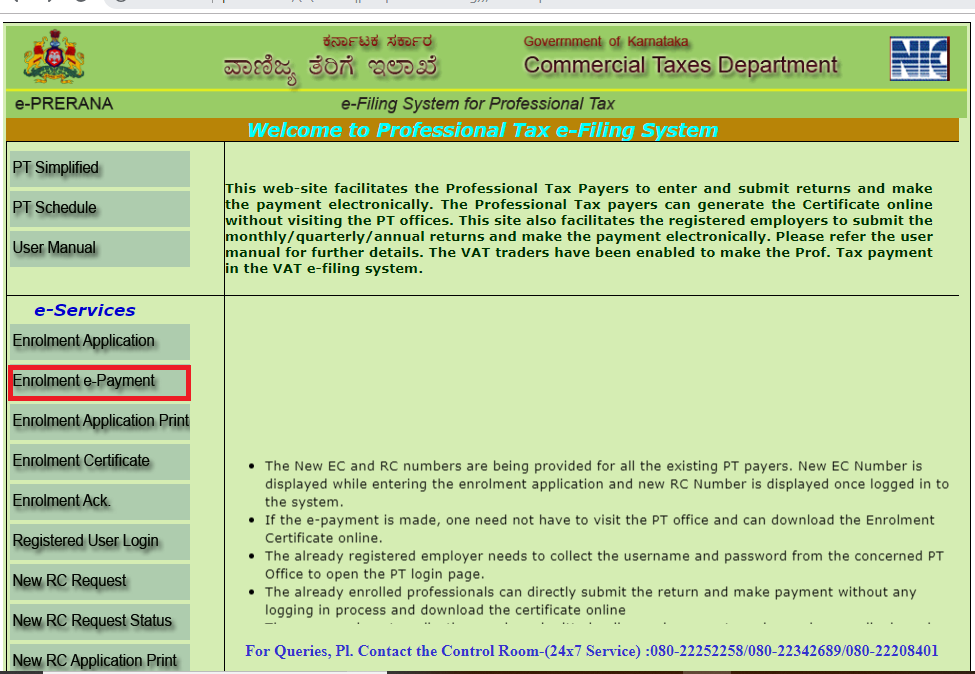

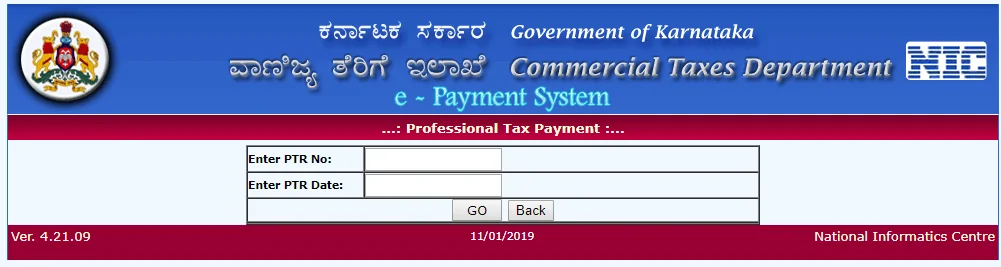

The article provides a step by step guide for Karnataka to register and pay the profession tax online.

Table of Contents :

Individuals earning Rs.10,000 or more per month are liable to pay the professional tax in Karnataka under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976.

If you are a salaried individual having a salary more than Rs.10,000 but less than Rs. 15000, you need to pay Rs.150 per month as a profession tax. In case your salary is more than Rs. 15,000 then you are required to pay Rs.200 per month.

If you are a legal or medical practitioner or a professional consultant then the professional tax depends on the tenure of your service. Please click here to find your professional tax in such a case.

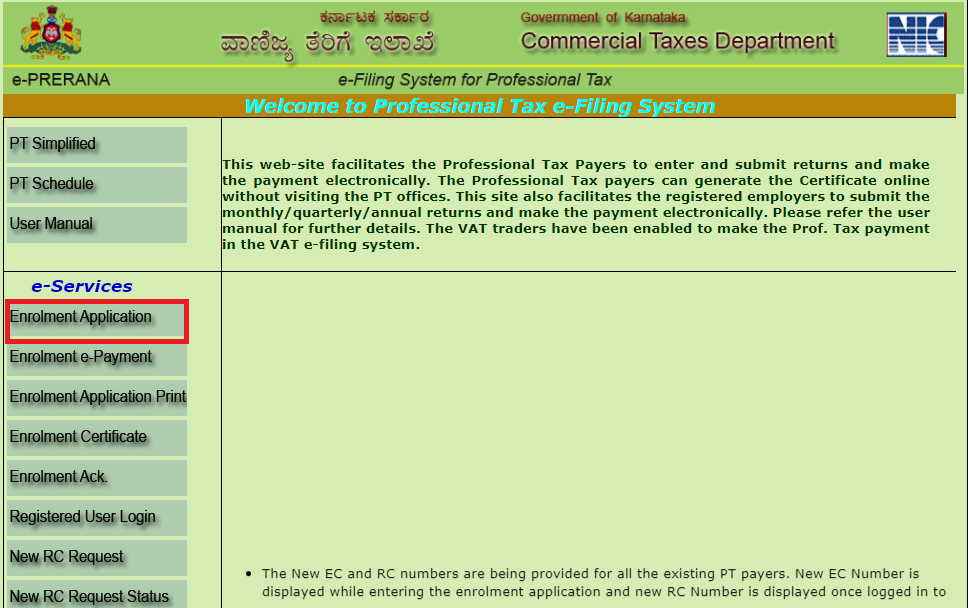

The Karnataka government has developed a website dedicated to the professional tax named as e-Prerana. You can enrol yourself here for the professional tax payment and also pay it online. You can also go to the website for any kind of further information related to the profession tax in Karnataka.

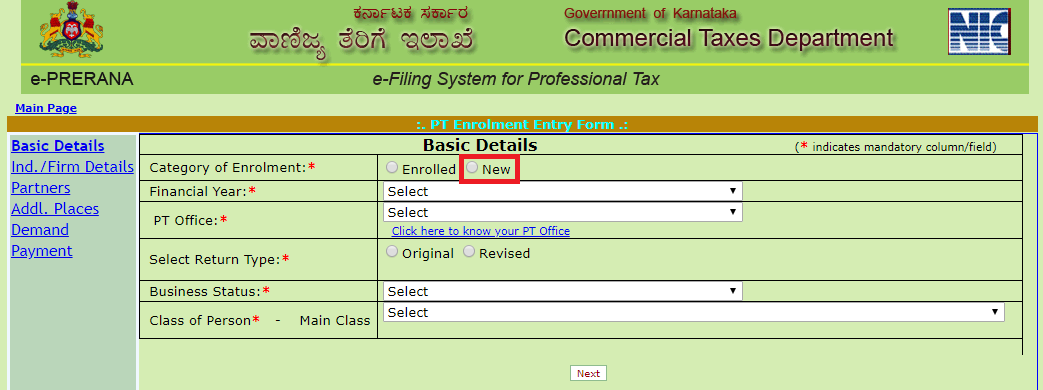

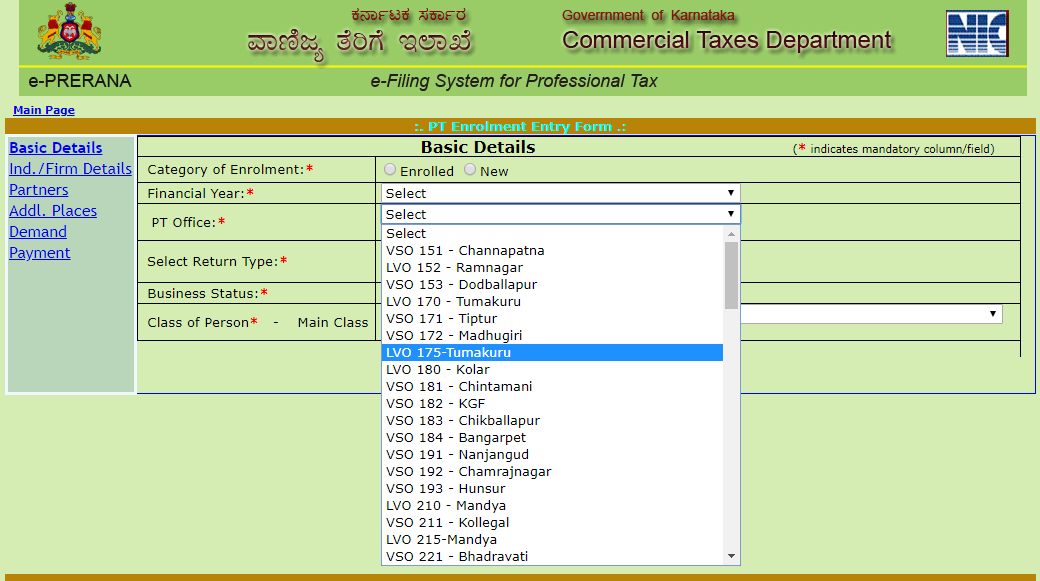

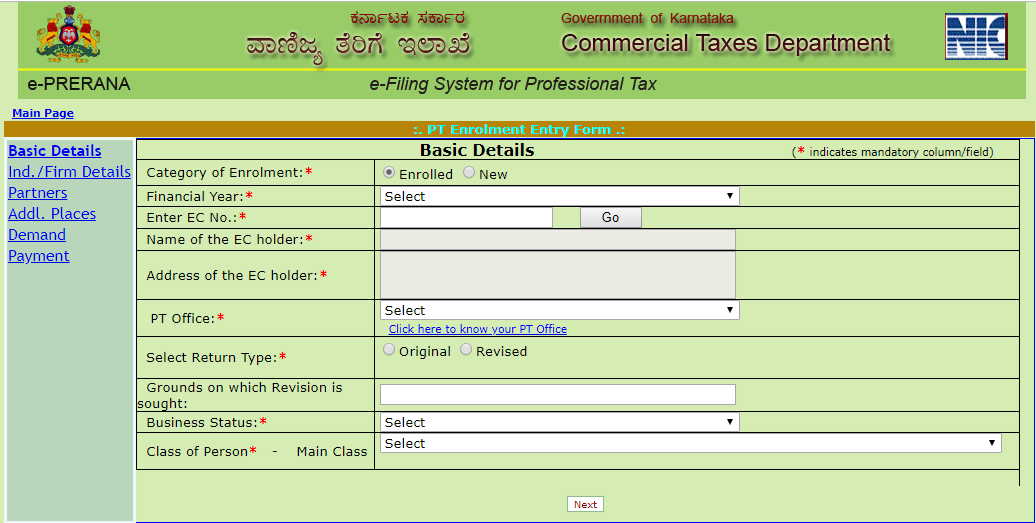

Every employer who is liable to pay the Profession Tax of his employees is mandated to obtain a certificate of registration first. Here is how an employer can get the registration certificate online.

After uploading the documents submit the application and the computer would generate a registration certificate with a unique number. The username and password would be sent to the registered mobile number.

Note :