Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

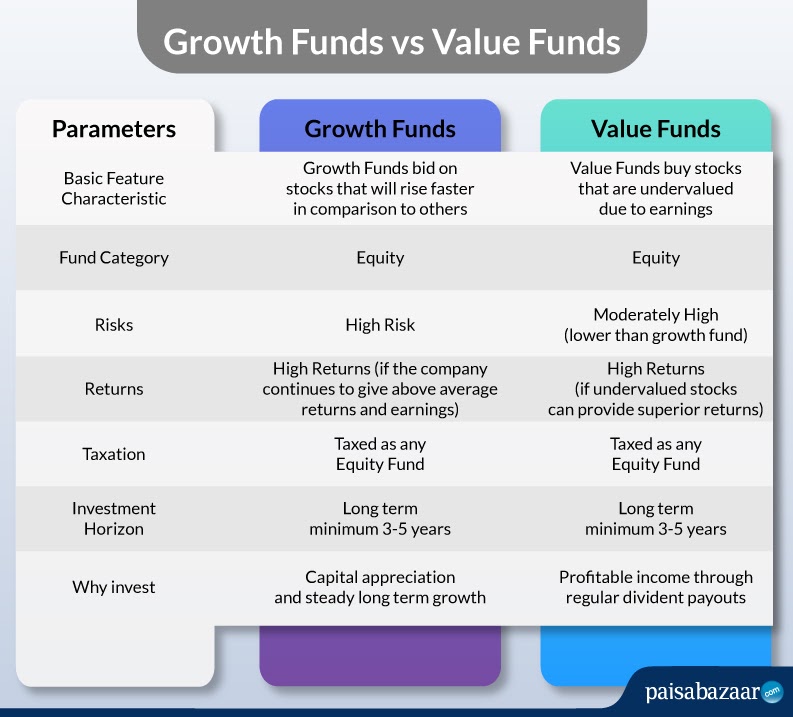

Both Growth Funds and Value Funds are Equity Funds that bid on stocks trading at lower prices in the current situation but the difference between them is majorly in the investment objective and strategy. Growth Funds invest in the shares of companies that are selling at low prices but will grow in the overall stock market at a faster rate than others. Value Funds invest in equities that are presently valued less in the market but its stock prices do not determine its worth.

Growth Funds invest in growth stocks i.e. the shares of companies that have demonstrated better than average gains and may offer strong earnings growth in the future. Emerging companies have the potential to deliver high levels of profit. Growth Stocks could possibly be in large cap, mid cap and small cap companies, and fund corpus invested in such stocks retains its status of Growth Fund until it has achieved its full potential. The growth companies can expand over time because they have product/s which are expected to sell better in the future hence performing better than its competitors in the whole market.

Value Funds invest in stocks that are underpriced in the current scenario due to market forces but have higher dividend yield. Fund Managers or Value investors look out for stocks that are yet to be recognized by the investors or might have fallen out of favor but do have good fundamentals. It seeks established companies that are trading lower than their worth but are backed by strong potential. It invests in businesses trading at a share price that is considered a bargain at present.

Also Read: 5 Best Value Funds to invest in 2020

Value Fund investors believe that stocks of good companies going unnoticed in the market and currently selling at discounted price will earn high returns once these bounce back in the market. It is then its true value realization will happen. Growth Funds have a different approach. It takes on stocks with strong relative momentum where the earning growth rates are high. Growth Investors are willing to buy stocks with high P/E ratio (Price-to-Expectation Ratio) where the investors expect higher earnings. Stocks with high P/E might be overvalued at times but investors are ready to pay high price-to-earnings multiples so that they can sell it off at a higher price when the company grows.

Value Funds are theoretically considered to be less risky than Growth Funds because it usually invests in stocks of large and well established companies that offer regular dividends and even if it fails to come up to the target price, it shall provide some capital gains. Although Value Funds carry some risk of price fluctuation in the market but of lesser magnitude than Growth Funds where the latter is exposed to high market risk. Both may fare better than the other in different economic circumstances as Value Funds generally perform better in times of recession.

Growth Funds have given good returns when interest rates are falling and company earnings are rising. Growth Funds are expensive and carry potential of high capital gains & returns but also high risks. Value Funds are less expensive and less risky.

Both aim for high returns with different styles of investing and perform differently in different economic cycles. Growth funds usually provide higher returns than Value Funds as the latter is more stagnant until a dividend payout is made by the company or stocks see capital growth. In

Growth Funds Money is reinvested and is highly dependable on capital gains as it pays little or no dividend and returns are realized through capital appreciation of the investment. Returns of Value Funds depends on value hike of the stocks

Both are essentially Equity Funds and hence are taxed alike. If an investor has made a capital gain of ₹50,000 on investment in an equity fund, Short Term Capital Gains Tax of 15% would be levied if s/he withdraws the amount within one year of investment. The payable tax would be ₹7,500. Also, if an investor has made a capital gain of ₹1.5 lakh on investment in an equity fund, and withdraws the amount after 1 year of investment, Long Term Capital Gains Tax of 10% would be levied on ₹50,000. ₹1Lakh is exempted from taxation. The payable tax would be ₹50,00.

Choosing a Mutual Fund depends on the financial goal, risk appetite and investment horizon of the investor. There are few things an investor should consider:

It is suggested that an investor must invest in a blend of both Growth and Value Funds as both complement each other and to have a diverse portfolio. Some Fund Managers pursue GARP (Growth At Reasonable Price) strategy to invest in blended funds that focus on growth companies with traditional value indicators. Additionally, one can also look at Index Funds as an alternative.

Index Funds, also called Index-tied or Index-tracked Funds are those that imitate the portfolio of an index. They are constructed to match the portfolio of a financial market index such as Sensex or Nifty and invest in these broader market indexes. It is comparable to Growth and Value Funds as Index Funds usually contain a blend of both funds.

Combining attributes of both, Index Funds seeks to have better results. It has average to below average market risks due to diversification and has an edge over both Growth and Value Funds in the long term. It is also not an actively managed fund and hence costs are low as well. It believes passive investing (indexing) is best for large cap stocks.