Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Table of Contents :

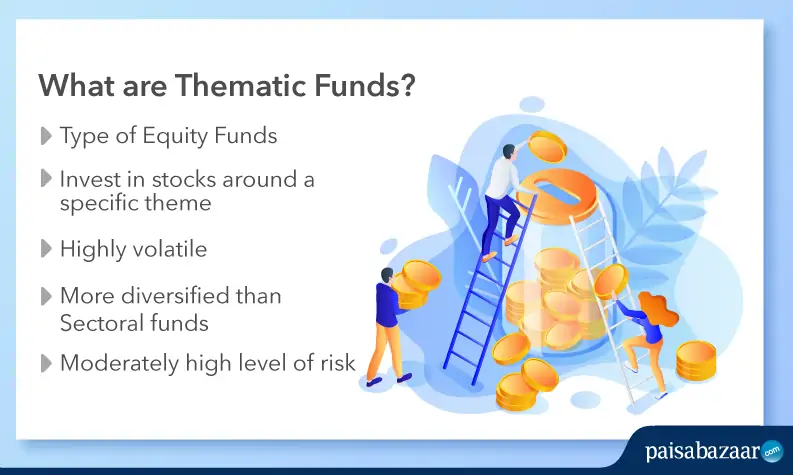

Thematic funds are mutual funds that invest in stocks of multiple sectors, which are woven around a determined theme. These funds may invest in sectors following themes like rural consumption, rural India, international exposure, export-oriented, etc.

Also Read: What are Thematic Funds

| Fund Name | AUM (In Crore) | 3-Year Returns (In %) | 5-Year returns (In %) |

| ABSL MNC Fund | 3,457 | 1.71 | 4.00 |

| SBI Magnum Global Fund | 3,508 | 3.19 | 4.46 |

| SBI Magnum Equity ESG Fund | 2,324 | -0.66 | 3.55 |

| UTI Dividend Yield | 1,987 | -1.01 | 3.43 |

| ICICI Prudential India Opportunities Fund | 2,319 | – | – |

*Data as on 27 May 2020; Source: Value Research

**The above list has been created on the basis of the Net Asset value of these funds

| 1-Year Returns

(in %) |

3-Year Returns

(in %) |

5-Year Returns

(in %) |

|

| ABSL MNC Dir Fund | -11.13 | 1.71 | 4.00 |

| NIFTY MNC TRI | -22.30 | -2.41 | 2.86 |

(Data as on 27 May 2020; Source: Value Research)

| 1-Year Returns

(in %) |

3-Year Returns

(in %) |

5-Year Returns

(in %) |

|

| SBI Magnum Global Dir Fund | -4.18 | 3.19 | 4.46 |

| NIFTY MNC TRI | -22.30 | -2.41 | 2.86 |

(Data as on 27 May 2020; Source: Value Research)

| 1-Year Returns

(in %) |

3-Year Returns

(in %) |

5-Year Returns

(in %) |

|

| SBI Magnum Equity ESG Dir Fund | -20.66 | -0.66 | 3.55 |

| NIFTY MNC TRI | -22.30 | -2.41 | 2.86 |

(Data as on 27 May 2020; Source: Value Research)

| 1-Year Returns

(in %) |

3-Year Returns

(in %) |

5-Year Returns

(in %) |

|

| UTI Dividend Yield Fund | -14.70 | -1.01 | 3.43 |

| NIFTY MNC TRI | -22.30 | -2.41 | 2.86 |

(Data as on 27 May 2020; Source: Value Research)

| 1-Year Returns

(in %) |

3-Year Returns

(in %) |

5-Year Returns

(in %) |

|

| ICICI Prudential India Opportunities Fund | -23.93 | – | – |

| NIFTY 500 TRI | -22.30 | – | – |

(Data as on 27 May 2020; Source: Value Research)

You can invest in Thematic funds through either of the following ways-

Ques. What is the difference between Sectoral and Thematic funds?

Ans. Sectoral funds invest in stocks of only one given sector, whereas Thematic funds invest in stocks of multiple sectors that follow a specific, determined theme.

Ques. Are Thematic funds safe to invest?

Ans. Yes, Thematic funds are safe to invest in. However, these funds involve a moderately high level of risk and require a deep understanding of the theme that the fund invests in. Hence, one should be an aggressive investor and analyst in terms of studying the market fluctuations.

Ques. How much share of a portfolio should be invested in Thematic funds?

Ans. Thematic funds should not constitute any more than 5-10% of an investor’s portfolio.

Ques. Are Thematic funds good?

Ans. Thematic funds are good if you are looking for medium to long term investments, as you might have to withdraw your investment if the particular theme does not perform well. Additionally, you must be well-versed with the market trends around the theme and make informed decisions while investing in a Thematic fund.

Ques. Which are the best Thematic funds to invest in 2021?

Ans. Given their Net Asset Value, you can invest in the following Thematic funds this year-