Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

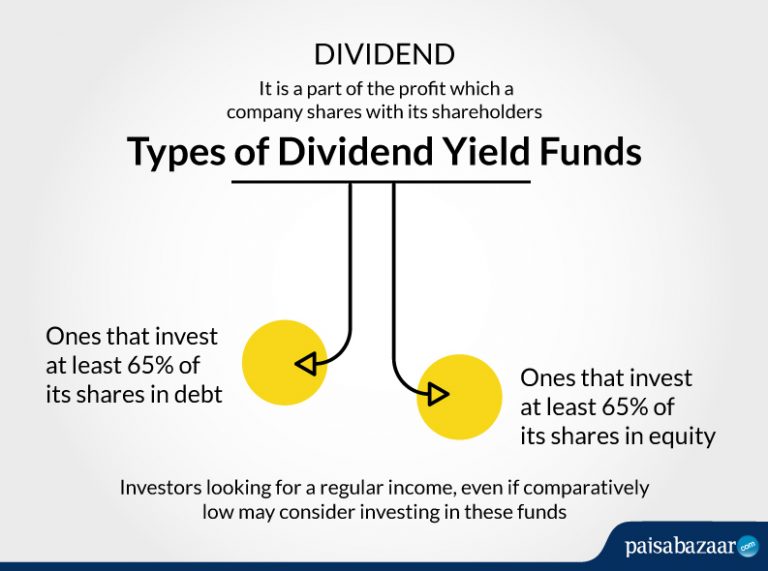

Dividend refers to that part of the profit which a company shares with its shareholders. A dividend yield fund is a mutual fund that invests in shares/stocks of only those companies that pay high dividends.

Dividend Yield funds are of two types; ones that predominantly invest in equity shares (at least 65%) of the company offering high dividends, and second, that majorly invest in debt shares (at least 65%) of the company.

To learn more about what Dividend Yield funds are, Click here

Get Your Free Credit Report with Monthly Updates Check Now

Depending upon their past 5-year returns, given below is a list of top Dividend Yield Funds that you may consider while investing-

| Fund Name | AUM (Cr) | 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) |

| Principal Dividend Yield Fund | 155 | -10.92 | 0.77 | 5.89 |

| UTI Dividend Yield Fund | 1,987 | -12.75 | -1.53 | 3.33 |

| Templeton India Equity Income Fund | 699 | -18.84 | -4.21 | 1.68 |

| ICICI Prudential Dividend Yield Fund | 134 | -26.33 | -9.09 | 0.53 |

| Aditya Birla Sun Life Dividend Yield Fund | 600 | -13.83 | -8.01 | -0.48 |

Data as on 18 May 2020; Source: Value Research

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Principal Dividend Yield Fund | -10.92 | 0.77 | 5.89 | 9.56 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹65,000 for a period of 5 years at a CAGR of 5.89% (as on 18 may 2020), your corpus at the end of your investment (which would be today) would have been ₹86,534.26

A Good Credit Score shows that you manage Your Finances Well Check Score

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Templeton India Equity Income Fund | -18.84 | -4.21 | 1.68 | 7.43 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹75,000 for a period of 5 years at a CAGR of 1.68% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹81,515.27

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| UTI Dividend Yield Fund | -12.75 | -1.53 | 3.33 | 7.49 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

A Good Credit Score shows that you manage Your Finances Well Check Score

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| ICICI Prudential Dividend Yield Fund | -26.33 | -9.09 | 0.53 | – |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | – |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹95,000 for a period of 5 years at a CAGR of 0.53% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹97,544.33

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Aditya Birla Sun Life Dividend Yield Fund | -13.83 | -8.01 | -0.48 | 6.15 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹85,000 for a period of 7 years at a CAGR of 6.15% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹1,29,079.99

Your Credit Score Is Now Absolutely Free Check Report

You can invest in Dividend Yield funds through either of the following ways-

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Ques. What is the difference between Dividend Yield and Dividend Option funds?

Ans. Dividend yield funds invest in companies which declare high dividends and are regular in terms of dividend declaration. On the other hand, the dividend option of a mutual fund simply gives an investor the choice of receiving returns in the form of a regular and steady flow of income, termed as dividends. Mutual funds which provide dividend option generate returns by means of capital appreciation only.

Ques. What is the Dividend Distribution Tax (DDT)?

Ans. Companies distribute their profits among their stakeholders in the form of dividend declarations. Such dividends are treated as part of the income of stakeholders. The tax levied on such income is called Dividend Distribution Tax (DDT). However, unlike other forms of income, where income tax is charged at the receiver of the income, DDT is charged on the dividend declaring company itself. This way, dividend income is tax-exempt at the hands of the recipient shareholder. However, the dividend income in excess to Rs. 10 lakh in a year is chargeable at 10% income tax for individuals, HUF, partnership firms or private trust.

Ques. What is the current Dividend Distribution Tax (DDT) rate?

Ans. The tax treatment of dividend yielding mutual funds is different for equity and debt funds. While dividend yielding mutual funds (equity) are taxed at 10% (11.64%, including Surcharge and Cess), dividend mutual funds (debt) at 25% (29.12%, including Surcharge and Cess).