Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

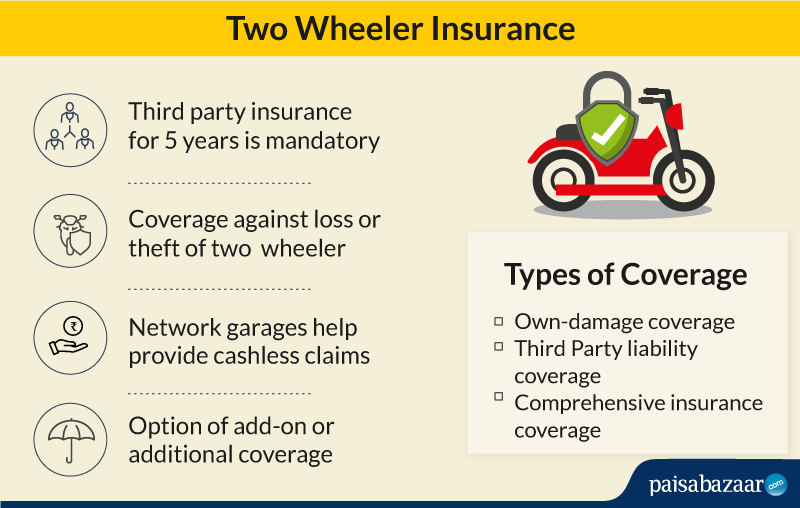

For many people in India, a two wheeler is an important mode of transport. But in order to use it on the road, it is mandatory to get a two wheeler insurance policy, especially a third party coverage, under Motor Vehicles Act, 1988.

Table of Contents:

An accident or a theft of a two wheeler can lead to financial stress because of the need for repairs, hospitalisation, treatment or a new vehicle. Thus, a two wheeler insurance policy provides financial coverage to the policyholder in times of needs like accidents, theft or repair.

There are basically 2 types of two wheeler insurance coverage available in the Indian market. These are:

Third-Party Insurance: This type of insurance is also termed as liability insurance and is compulsory for every two wheeler owner. It covers the policyholder against legal liabilities arising out of bodily injury/death or property damage done to a third party (accidental) involving the insured vehicle.

Comprehensive Insurance: This type of insurance is also termed as package policy. It covers third-party liability as well as damage caused to the insured vehicle, and death/disability of the owner/driver due to an accident.

A two wheeler insurance plan shall come to your financial aid in some of the following cases:

All vehicle insurance plans come with add-on covers in addition to the standard benefits offered. Following are the additional benefits offered on extra payment that you must buy along with your two wheeler insurance:

Personal Accident Cover: By buying this cover, you get insured against death or permanent disability due to the accident. Thus, on the death of the insured in an accident, the insurance company provides monthly income to the family.

Zero Depreciation Cover: This is the most important add-on cover that you must buy while finalising your bike insurance. With this add-on cover, your vehicle gets the original value, without deducting depreciation, in case it is lost or damaged.

In order to get the two-wheeler insurance, a person must be:

A person who is eligible to ride a two wheeler in India can apply for a two wheeler insurance policy, provided the individual has a valid driving license. One can apply for Bike Insurance in India either online or offline and below are the ways to do it:

In case of any untoward incident like accident or theft, immediately inform the insurance provider

In case of a theft of the two wheeler or an accident leading to injury to the owner-rider, damage to the vehicle or third party liability, inform the insurance company as soon as possible. Also, submit the following essential documents:

An insurance company can take somewhere around 10-30 days for claim settlement. Motor Insurance provider companies have two options to settle the claim.

One is cashless option where the company pays for the repairs done at one of the network garages while the other is reimbursement where the claim is settled if the insured repairs his vehicle in the garage which does not come under the network of the insurance company.

Below are some factors that can lead to rejection of a two-wheeler insurance claim. These are also called exclusions.

Some of the insurance companies providing two wheeler insurance in India are as follows:

A two wheeler insurance policy needs to be renewed every 1 year, 3 years or 5 years, as the case may be. The renewal of two wheeler insurance takes only a few simple steps, viz.:

Important points for renewal

With the emergence of new insurance providers every year in the market, the facilities and benefits of two-wheeler insurance are evolving with time. Following are some of the benefits of buying bike insurance:

Following are few errors that you must avoid when buying two-wheeler insurance:

If you do not opt for nil depreciation cover, you will be charged some amount as depreciation at the time of receiving your claims. This feature is an add-on cover and experts’ advice always to consider buying this add-on cover to get the original value of your two-wheeler at any point in time.

There are many factors which plays an important role in calculating the two-wheeler insurance policy premium you need to pay.

It is the amount which policyholder agrees to pay while the company pays the rest.

Some insurance companies provide this as in built feature while some offer this as an add-ons which policyholder can buy. Following coverage is provided under this”:

With the new motor vehicles law coming into effect from September 1, the online sale of two wheeler insurance policies has more than doubled, as per details from an insurance web aggregator. It also came to light that 90% of the policies sold in next 3 days from Sept 1 was for people whose policies had lapsed.

As per an estimate, of the 19 crore registered vehicles, 70% of two wheeler owners do not renew their policies after few years. Under the new law, fine for driving without insurance has increased from Rs. 1,000 to Rs. 2,000 for the first-time offenders and to Rs. 4,000 for second-time offenders. If two wheeler owners are caught riding without helmets, they have to pay a fine of Rs. 1,000 and their license gets suspended for 3 months.

Two wheeler owners can now choose from 3 types of two wheeler insurance policy from September 1, 2019. They can also get these policies from separate insurance providers. Till now, 2 options were available and these had to be taken from the same insurer.

The Own Damage (OD) policy had to be taken along with the Third Party (TP) component from the same insurer. Now, insurance companies will offer 3 types of insurance policies – Standalone OD Policy, Standalone TP Policy and a Comprehensive Policy, comprising both TP and OD cover. Policyholders also get the liberty to choose different providers for different policy covers.

The new rule is a result of a circular issued by the IRDA on June 21, 2019, saying separate policies can be taken for both old and new cars. According to the Motor Vehicles Act, 1988, it is mandatory to get a Third Party insurance for any vehicle. The new ruling comes after a Supreme Court order in 2018 made it mandatory that the TP insurance for new cars and two wheeler should be provided for 3 years and 5 years respectively.