Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

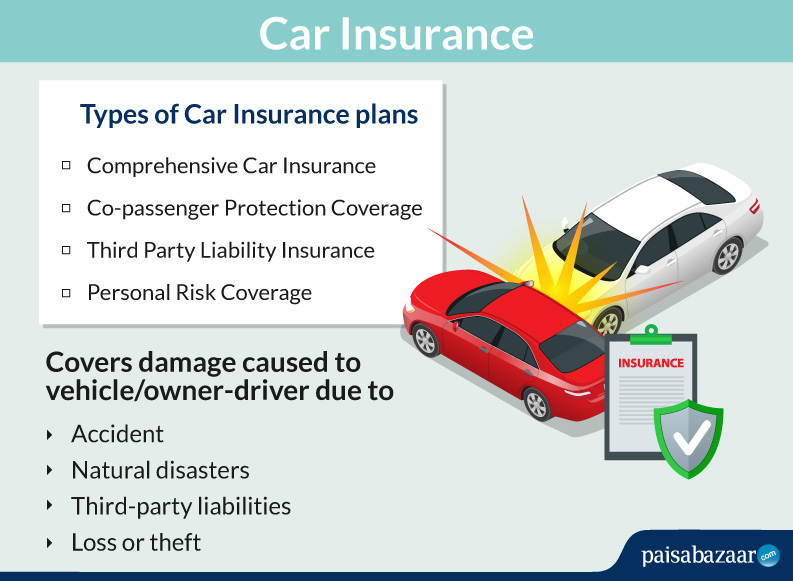

Insurance provides protection against risks that may damage any of your possession, be it property, house or vehicle. Car insurance is a type of motor insurance policy which helps the policyholder manage financial losses associated with various risks, such as car accident, theft or loss of the car.

Car insurance, which comes under vehicle insurance policy, is mandatory in India under the Motor Vehicles Act, 1988. It provides financial support to the car owner to manage situations like repair costs due to accident, theft or loss of the car. This insurance plan includes a compulsory third party coverage to manage any injury or damage to another person, vehicle or property caused by the insured car.

A car insurance can be divided into 4 broad categories. They are:

Comprehensive Policy: It is an all-inclusive plan which provides end-to-end coverage for all the risks related to the car, first party, co-passengers and third party. It also provides coverage against all natural disasters or human-made catastrophes, including earthquakes, landslides, floods, strikes and riots.

Co-passenger Protection Coverage: Some insurance providers offer personal accident coverage for co-passengers, though this can be availed by paying an additional premium. In case of the death of the passenger or the one who is driving, you can get 100% compensation for it. If there is any type of permanent disability from any injury, a 100% compensation can be claimed.

Third Party Liability Insurance: Law in India mandates the purchase of this policy for everyone. It provides coverage against liabilities arising from any harm caused to third-party and property by the insured car.

Personal Risk Coverage: A policy usually provides coverage only for the owner of the car. However, instead of the driver, any other person in possession of a valid license can also be covered by purchasing personal injury coverage rider.

The coverage provided by car insurance usually varies from provider to provider. However, some situations and cases are covered by almost all of them. Let us look at some of the points:

It makes sense to understand how a car insurance functions. This will help in planning better for the coverage that you need as per your requirement.

It is compulsory for all types of car, old or new, to get a car insurance, along with a third-party insurance coverage. To be eligible to get this insurance, a person should be 18 years and above, a citizen of India, should possess a driving license and should possess the RC of the car.

In case of any eventuality, you need to make a claim with the insurance company to get the compensation for the financial loss. It makes sense to understand the steps to go ahead with the claim process.

In case of accident or damage done to you, car or to the third party, intimation to the insurance company is important. Along with that, following are the essential documents which need to be submitted for timely claim:

Car insurance companies have two options to settle the claim; one is through cashless where the claim is settled directly by the insurance company, if the insured gets the vehicle repaired at the network garage. The other is reimbursement claim, where the insured pays the bill and the insurance company later reimburses the amount.

Apart from the standard coverage provided by the provider, you can also opt for additional benefits, called add-ons, by paying an extra amount. These advantages vary for every provider. Some of the add-ons are:

A car insurance provides mental peace and relaxation after buying a car; however, the insurance does not cover all types of cases. Some situations not covered, also called exclusions, are:

One can renew his or her policy through online mode after the required inspection either by you or by a surveyor; following are the steps:

Almost every other insurance company provides motor insurance in India. Some of insurance companies providing car insurance in India are:

Low premium costs are usually the sole deciding factor while choosing a car insurance product and this could also mean not having an adequate protection cover. You should consider other important points as well before buying a policy.

After buying a car, the next big thing is getting a car insurance. You should not delay in getting one because of its advantages. Let us look at some of them:

Usually, the insurance policy provides only 50% of the IDV for the parts which can easily wear and tear (rubber and plastic parts). However, the insurer can opt for nil-depreciation, under which he/she can ask for complete claim over these parts.

Insured declared value (IDV): The premium paid against the insurance is in direct proportion to the car’s IDV. Hence, the IDV decreases over time – which ultimately decreases the premium.

Place or city of registration: The city in which the vehicle has been registered affects the premium amount. Therefore, rural drivers pay less compared to their urban counterparts – due to the increased chance of the car getting stolen or vandalized in urban areas.

Age of person: Apart from the age of the car, the person’s age is also a factor. It is estimated people start to drive responsibly as they age compared to younger people. Hence, premium decreases with increase in age.

Purpose: The vehicle or car can be used for various purposes such as commercial, personal/domestic, etc. The premium depends on this as well.

The insurance policy remains more or less unaffected in such a case. The policyholder needs to update the address by logging into the website of the insurance provider. Apart from that, the premium one pay might change as per the zone.The insurance policy remains more or less unaffected in such a case. The policyholder needs to update the address by logging into the website of the insurance provider. Apart from that, the premium one pay might change as per the zone.

In case you met with an accident which results in permanent or temporary disability, personal accident cover will compensate the insured.

You should always carry your valid driver’s license, insurance copy, your car’s Pollution Under Control certificate along with your car’s Registration Certificate.

It is a service provider that helps the insured with cashless claim facility on hospitalisation in one of the network hospitals of the insurance company.

The online sale of four wheeler insurance has more than doubled since September 1, 2019, when the new motor vehicles law was implemented, according to an insurance web aggregator. The report also said that 90% of the plans sold in 3 days from Sept 1 was for people whose policies had lapsed. The new motor vehicle law imposes heavy penalties on car drivers for violating traffic rules.

According to an estimate, of the 19 crore registered vehicles, 30% of car owners fail to renew their car insurance policy after initial years. Now, car owners will have to pay heavy penalties for not wearing seat belts, drink and drive, speeding, driving without insurance and others.

In an effort to reduce the number of road deaths and to tame rash drivers, the Insurance Regulatory and Development Authority (IRDA) has formed a panel to work on linking of traffic violations with insurance premiums.

The nine-member panel has been given 2 months to submit their report on the “implementation framework and the methodology” of the plan. At present, car insurance premiums are linked to the type of vehicle and the engine capacity. But, soon the premiums paid on car insurance may be linked to how you drive and the number of accidents you were involved in.

To reduce the number of road deaths, the government has also increased the amount of compensation paid by insurance companies to Rs. 5 lakh in case of serious injuries and to Rs. 10 lakh in case of deaths.

From September 1, 2019, while buying a car insurance policy, car owners would get an option to choose from 3 types of car insurance. They would also get the flexibility to go for different insurance providers for getting these covers. Till now, 2 options were available and these had to be taken from the same insurance company.

The Own Damage (OD) policy had to be taken along with the Third Party (TP) component from the same insurer. Now, insurers will offer 3 types of insurance policies – Standalone OD Policy, Standalone TP Policy and a Comprehensive Policy, comprising both TP and OD cover. Policyholder also has the liberty to choose different providers for different policy covers.

The new rule comes after a circular issued by the IRDA on June 21, 2019, saying separate policies can be taken for both old and new cars. As per the Motor Vehicles Act, 1988, it is mandatory to have a Third Party insurance for any vehicle. The new ruling comes after a Supreme Court order in 2018 made it mandatory that the TP insurance for new cars and two wheeler should be provided for 3 years and 5 years respectively.