Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

The Finance Ministry has finally accepted the recommendations suggested in the 56th GST Council’s meeting on 3rd September 2025, that comprised of the Finance Minister, Union Minister of State for Finance and 31 Finance Ministers (28 from states and 3 from union territories with legislative assemblies). The rationalisation in GST rates have been announced to…

A certain amount of interest income is exempt from income tax for all taxpayers. The bank adds up the interest amount from all your accounts across its branches to check if it crosses the exemption limit. When this exemption limit is crossed, the financial institution deducts tax against your PAN and deposits it with the…

Are you new at your job and have seen your salary slip for the first time? Don’t get overwhelmed with a lot of terms and numbers in it. Read this article to understand what is covered in your salary slip and why it is important for you to know about it in detail. What is…

In light of the extraordinary situation resulting from the COVID-19 lockdown measures, the Finance Department has released an ordinance on 31st March 2020 providing relaxation in various aspects of the Direct and Indirect Tax regimes. One of these announcements extends tax saving investments for FY 2019-20 till 30th June 2020. This can greatly benefit many…

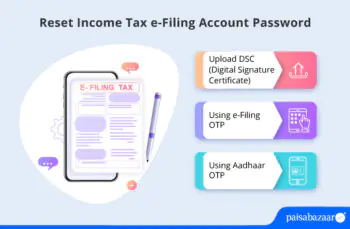

In case you have to e-file your taxes on the official Income Tax e-Filing portal or access the various services available on the e-filing website, you have to register and log into the portal using your user id (PAN/Aadhaar/Other user ID) and password. Unfortunately, this is not possible in case you have forgotten your e-filing…

The Income Tax Act, 1961 (IT Act, 1961) provides various tax benefits to reduce the tax burden in case expenses are incurred towards medical expenses for self/family or if the tax assessee or his/her dependant is disabled. These tax deduction benefits are specified in Section 80DD, Section 80DDB and Section 80U of the IT Act,…

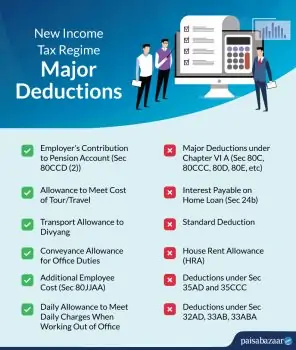

A new and optional income tax regime was announced in Union Budget 2020. Under this new regime, the income tax slab rates have been significantly reduced. However, the concessional slab rates come at the cost of traditional income tax deductions that can be claimed under the old (existing) tax regime. As things stand right now,…

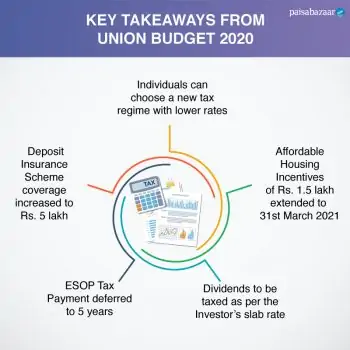

The Union Budget 2020 presented by Finance Minister Nirmala Sitharaman has proposed a number of changes that directly impact the individual tax payer. These changes which will come into effect from 1st April 2020 are as follows: New Tax Rates Introduced in Union Budget 2020 Union Budget 2020 introduced a new Income Tax Regime, which…

Income Tax Return (ITR) forms provide can be downloaded online from the e-filing website of the Income Tax Department. Alternately, if you are using ITR 1 (Sahaj), you have the option of filling out the form and filing the return online without having to download the form. In case you have to fill out your…

After you have filed and verified your ITR, the next step is to wait for the intimation that the ITR has been processed. ITR processing involves checking the TDS claimed by you with Form 26AS, tax and interest calculation and other arithmetic calculations. Generally, ITR is processed within 30-45 days from the date of ITR…