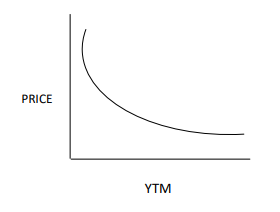

Bond convexity is a measure of the curvature in the relationship between the bond prices and bond yields. In other words, the degree of sensitivity of a bond to interest rate fluctuations – not just in a straight line, but along a curve. The term is a second-order derivative of the price equation and is relevant in the context of bond risk management strategy.

Bond Convexity

Bond convexity is a crucial concept that helps investors to understand how bond prices respond to changing interest rates environments than the duration estimates. By understanding convexity, investors can compare bonds more effectively and understand risk management, especially in volatile market conditions.

Explore Bonds by Category

High Yield

ICRA BBB

You Invest

₹9,949

Returns (YTM)

13.25%

You Get

₹11,493

Today

15 months

Invest in Tencent Backed, Digitally-Driven NBFC Managing an AUM of 1,700+ Cr

You Invest

₹9,949

Returns (YTM)

13.25%

You Get

₹11,493

Today

15 months

Invest in Tencent Backed, Digitally-Driven NBFC Managing an AUM of 1,700+ Cr

ICRA BBB

ACUITE BBB+

You Invest

₹9,800

Returns (YTM)

13.25%

You Get

₹12,680

Today

34 months

Listed NBFC, 670+ Cr AUM with 100% Secured Lending

You Invest

₹9,800

Returns (YTM)

13.25%

You Get

₹12,680

Today

34 months

Listed NBFC, 670+ Cr AUM with 100% Secured Lending

ACUITE BBB+

CARE BBB+

You Invest

₹1,01,274

Returns (YTM)

12.75%

You Get

₹1,17,652

Today

28 months

Listed NBFC backed by Kedaara Capital with 47% Capital Adequacy Ratio

You Invest

₹1,01,274

Returns (YTM)

12.75%

You Get

₹1,17,652

Today

28 months

Listed NBFC backed by Kedaara Capital with 47% Capital Adequacy Ratio

CARE BBB+

What is Bond Convexity

How to Buy Bonds through Paisabazaar?

Get up to 13.25% from bonds in 5 simple steps

Step 1: Login to your Paisabazaar account

Step 2: Select the Bonds

Step 3: Complete the KYC process

Step 4: Enter bank details

Step 5: Link your demat account

Understanding Why Bond Convexity Matters

To understand the concept of bond convexity, we need to understand the ‘duration’, which is considered the first order derivative of the bond price equation. Duration measures how sensitive your bond is to changes in interest rates. It assumes a linear relationship between bond yield changes and changes in price. But, this relationship isn't actually linear when interest rates change by large shifts—it's curved. Convexity corrects this error and provides a more accurate prediction.

Example

To understand convexity and duration better, let me compare it to driving a car. The speed of the car is referred to as the duration. While the driver is speeding up or slowing down (i.e., the rate of change), the car is called convexity. In relation to the bond market, the higher the convexity, the more drastic the change would be in the price given a move in interest rates.

Formula for Calculating Bond Convexity

Convexity = (1 / P) * Σ [(Ct * (t² + t)) / (1 + y)^(t+2)]

Where:

‘P’ is the current price of the bond

‘Ct’ is the cash flow at time ‘t’

‘y’ is the yield to maturity

‘t’ is the time period in years

Let’s take an example

ABC Ltd. has issued bonds having a face value of Rs 1,000 with a coupon rate @ 10% p.a. The maturity period of the bond is 3 years. The yield to maturity is 10% and the prevailing current bond price is Rs 1,000.

Let’s calculate convexity:-

First, we need to identify cash flows, i.e., ‘Ct’

| Year | Cash Flow |

|---|---|

| 1 | 100 |

| 2 | 100 |

| 3 | 1,100 (1,000 +100) |

Now, applying the bond convexity formula:-

For the year 1

Cash Flow (Ct): 100

Time period (t): 1

Yield to maturity (y) = 10% = 0.10

Convexity: [(100 * (1² + 1)) / (1 + 0.10)^(1+2)] = 150.26

For the year 2

Cash Flow (Ct): 100

Time period (t): 2

Yield to maturity (y) = 10% = 0.10

Convexity: [(100 * (2² + 2)) / (1 + 0.10)^(2+2)] = 409.77

For the year 3

Cash Flow (Ct): 1100

Time period (t): 3

Yield to maturity (y) = 10% = 0.10

Convexity: [(1100 * (3² + 3)) / (1 + 0.10)^(3+2)] = 8197.45

Summing the values of convexity

150.26+ 409.77+8197.45 = 8757.48

Dividing by bond’s price = 8757.48/1000 = 8.757 or 8.76

The value 8.76 means the bond has positive convexity.

People also search for

Difference between Convexity & Duration

| Differentiation Factor | Convexity | Duration |

|---|---|---|

| Relationship | Measures the curvature of the price-yield relationship | Assumes linear relationship - straight line |

| Measures | Change in price sensitivity | Price sensitivity |

| Calculus Order | Second derivative of price-yield function | First derivative of price-yield function |

| Accuracy Level | Accurate for large interest rate movements | Accurate for small interest rate changes |

| Impact When Interest Rates Fall | Predicts higher price appreciation than the duration predicts | Predicts price increase using a straight-line estimate |

| Impact When Interest Rates Rise | Shows a smaller price decline than the duration predicts | Predicts price decline using a linear estimate |

Positive Convexity & Negative Convexity

Positive convexity refers to a bond's price rising faster when bond yields fall and falls slower when yields rise. This benefits investors with more upside than downside, which is seen in most regular corporate bonds, government bonds, or plain vanilla bonds. Negative convexity is seen in callable bonds, as such bonds have a ceiling on their price. When interest rates fall, bonds are usually called, i.e., limiting upside for investors. And, when interest rates rise, the bond won’t be called, i.e., full downside for investors. This creates a negative convexity, which hurts investors by limiting upside and worsening losses.

Bonds Having Higher Convexity

Zero-coupon bonds, non-callable corporate bonds and long-term government bonds have higher convexity. Zero coupon bonds have higher convexity because their entire cash flow is received at the maturity period. This makes the present value of the bond extremely sensitive to interest rate changes in the market, which results in a pronounced curve in the price-yield relationship. The price swings are high for bonds with longer maturity periods.

Is Higher Bond Convexity Good?

Higher positive convexity is considered good for investors because it offers greater upside potential and downside protection. Upside potential here refers to the faster increase in the bond's price when interest rates fall and downside protection means the bond's price falls less when interest rates rise. However, such bonds often come with lower yields and higher prices. Therefore, investors should balance high bond convexity benefits with their investment objectives and the return potential. Ignoring convexity in the portfolio can lead to underestimating the bond risk during an environment of sharp rate movements.

How to Buy Bonds through Paisabazaar?

Get up to 13.25% from bonds in 5 simple steps

Step 1: Login to your Paisabazaar account

Step 2: Select the Bonds

Step 3: Complete the KYC process

Step 4: Enter bank details

Step 5: Link your demat account

FAQs

Bonds Articles

View All ArticlesCheck Top Bond Offers with Assured Returns of up to 13.25%

Paisabazaar is a loan aggregator and is authorized to provide services on behalf of its partners

*Applicable for selected customers