Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

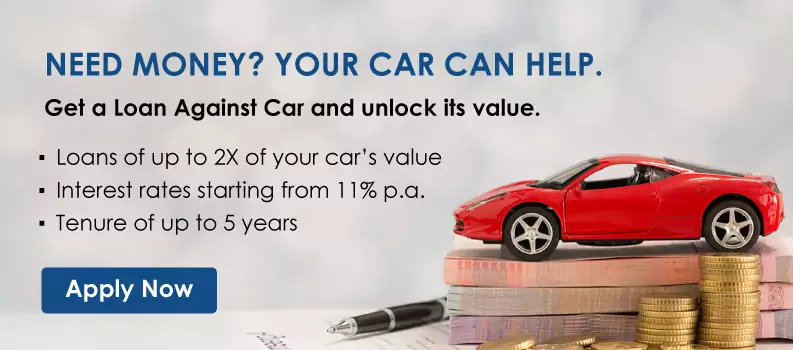

Loan Against Car is a secured loan where your vehicle, i.e., your car is used as collateral to access quick funds without selling it. Lenders can finance up to 200% of the car’s value, depending factors such as the features of the car, applicant’s credit profile, etc. Proceeds of the loan can be used for any purpose, except for speculative activities. With no end use restriction, quick processing and minimal documentation, Loan Against Car can be a hassle-free credit solution for funding urgent financial needs --- all while you continue to use your car.

| Loan Against Car on Paisabazaar – Highlights | |

| Interest Rate | Starting from 11% p.a. |

| LTV Ratio | Up to 200% of the car value |

| Tenure | Up to 5 years |

| Processing Fees | Up to 2% of the loan amount |

The key features and benefits offered on Loan Against Car are listed as below:

The interest rates on Loan Against Car may vary from one lender to another. The final interest rates offered would depend on various factors including the applicant’s credit profile, lender’s internal risk policies and features of the pledged car such as its age, make, condition, etc. The interest rates on Loan Against Car offered by Paisabazaar partners are:

| Lenders | Interest Rates (p.a.) |

| HDFC Bank | 14% – 16% |

| IDFC FIRST Bank | 14% – 16% |

| AU Small Finance Bank | 14% – 21% |

Rates as of 13th June 2025

A Loan Against Car EMI Calculator helps you estimate the monthly instalments you’ll need to pay when you take a loan against your existing car. By entering basic details like loan amount, interest rate and tenure, you will be able to get a clear idea of your EMI and plan your finances better. It’s a quick and handy tool to ensure the loan fits your budget before you apply. Individuals can use various combinations of interest rates, loan amounts and tenures to ascertain the optimum tenure and EMI after considering their loan repayment capacity.

The eligibility criteria for availing Loan Against Car varies across lenders. However, a common set of eligibility criteria is given below:

| Eligible Profiles | Individuals (Salaried and self-employed professionals/non-professionals) Non-individuals (Pvt. Ltd., Public Ltd., Partnership Firm, Proprietorship Firm, Co-operative societies, Trust and HUF) |

| Min. Age | 18-21 years when applying for the loan |

| Max. Age | 80 years at the end of the loan tenure |

| Employment Type | Salaried and Self-employed |

| Min. Salary | Rs 20,000 |

| Total Work Exp. | At least 1 year; some lenders also require work experience with the current employer |

| Annual Income | At least Rs. 2 lakh |

| Business Continuity | Business must be in existence at least for the past 2 years |

| Credit History | Available to new-to-credit customers & those with established credit history |

| Collateral | Most lenders accept all personal vehicles (cars) as collateral except those which are discontinued |

It varies from lender to lender. While some offer loans only against passenger vehicles, others may also accept commercial vehicles. However, here are some general eligibility norms:

Car owners who need funds urgently – Whether it’s for a medical emergency, unexpected expense or planned purchase, you can unlock the value of your car without having to sell it.

Those seeking an alternative to personal loans – Since this is a secured loan, it often comes with lower interest rates compared to unsecured options.

Step 1: Enter your mobile number in the application form

Step 2: Enter OTP to verify your mobile number

Step 3: Provide your personal details

Step 4: Provide your car details

Step 5: Compare offers and apply for the best-suited loan

| Proof of Identity | PAN card, Aadhaar card, Passport, Voter ID, Driving license |

| Proof of Address | Aadhaar card, Driving license, Passport, Utility bills |

| Proof of Income for Salaried | Form 16, Salary slips, Bank account statements, etc. |

| Proof of Income for Self-employed | Last three months’ bank statements, Income Tax Returns (ITR) or audited Balance Sheet and Profit & Loss Statements |

| Vehicle Documents | Copy of the Vehicle Registration Certificate and Insurance |

| Other Documents | o Net banking or Debit card details to set up e-Mandate o Proof of signature o Photographs |

Loan Against Car processing fees may vary widely based on lenders and credit profiles of loan applicants. To give a fair idea of the key fees and charges, read the table below:

| Particulars | Charges |

| Processing Fee | Up to 2% of loan amount |

| Prepayment Charges | Up to 6% of principal outstanding |

| Foreclosure Charges | Up to 5% of principal outstanding |

| Penal Interest | Up to 2% per month on the overdue instalment |

| RTO Transfer Charges | At actuals |

| Car Valuation/Asset Verification Charges | Rs. 750 per case |

| Stamp Duty (non-refundable) | At actuals |

It is a secured loan option wherein a consumer pledges his car as collateral to raise funds against it.

With a Loan Against Car, indiviudals can borrow funds against their vehicle. It’s a convenient way to access a larger loan amount at a comparatively lower interest rates, making it one of the great alternatives to personal loan.

You can avail Loan Against Car for tenure of up to 5 years or 60 months, further depending on other factors such as the age of the car.

Anyone who owns a car and meets the minimum eligibility criteria and furnish the required documents can avail loan against car.

Adding a guarantor is not required as your pledged car acts as a security.

Yes, Loan Against Car borrowers can keep the pledged car in their position and continue using it. However, the lender will have a lien on the car’s title, which implies that your lender has the legal claim over it till complete repayment of the loan. In case of loan default, the lender may repossess the car to recover the outstanding amount.