Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

However, it’s not advisable to prematurely close your fixed deposit. A credit card against FD is a better option when you immediately need funds. Click the banner below to know about Paisabazaar’s credit card against FD. Now when it comes to knowing how to close an FD, it is important to know that there are two modes to exercise FD closure. The first one is closing FD on maturity while the other one aids those who wish to close FD before maturity.

Let’s first talk about how to close FD on maturity.

Let’s first talk about how to close FD on maturity.

Manage all FDs in one place

Manage all FDs in one place

No Bank A/C Required

No Bank A/C Required

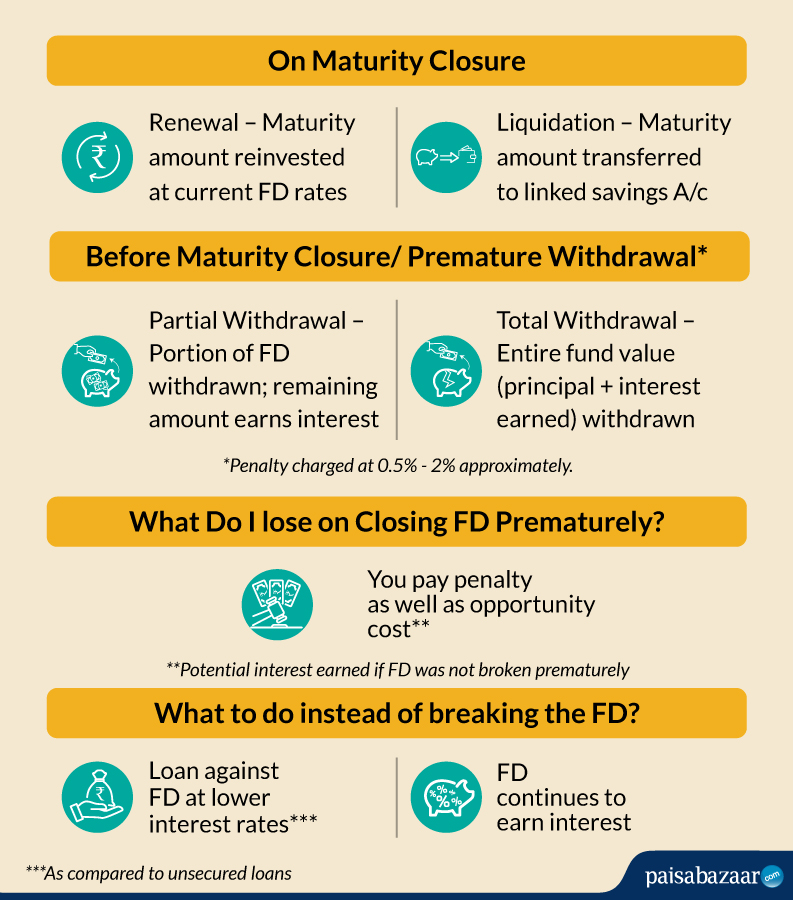

Although the process of FD closure may vary from bank to bank, the surrender of a fixed deposit certificate is a pre-requisite in all banks and other providers as well. Before submitting this certificate, make sure that it is duly signed by all the depositors if it was jointly held. Along with the deposit certificate, your provider may also ask for the submission of an account closing form, just like an account opening form, giving necessary details which should include savings account details, FD details, etc. Banks usually use either of the following two options to deal with fixed deposits when they mature: Auto-Renewal: Automatic renewal of fixed deposit is a common exercise among providers. This entails rebooking of existing FD for the same tenure but at the prevailing fixed deposit rates. This option is exercised if the depositor has not provided an instruction otherwise. If there were nominees involved, the same shall be appointed in the renewed FD as well. Auto-Liquidation: In this option, the FD is liquidated on the date of maturity. By liquidation, we mean the transfer of the entire fund value in the linked savings account mentioned by the depositor at the time of booking the FD. Investors must check these with their respective providers as it may differ. The second mode of closing an FD is premature closure, i.e. closing FD before maturity. Let’s understand how to close FD before maturity, i.e. how to withdraw and FD prematurely.

Fixed deposits, unlike their name, are liquid as they can be closed anytime. There can be times where you may find yourself in a sudden need of money but do not wish to loan it out. At such times, your FD can be your financer. Banks and other financial institutions provide the facility to withdraw or close fixed deposit before maturity. There is a nominal penalty charged on premature withdrawal of FD and money is transferred to the account of the depositor in no time. Also, premature withdrawal can be done fully or in parts (i.e. premature closure or partial withdrawal). In case of partial withdrawal, investors can withdraw a part of the entire FD value. For example, you have an FD of Rs. 1 lakh and you go for 40% partial withdrawal. 40% of Rs. 1 lakh, i.e. Rs. 40,000 will be withdrawn from the FD and credited to your savings A/c. the remaining 60% or Rs. 60,000 shall remain invested and continue to earn interest. Please note that this percentage is that of the deposit amount or principal. In case of cumulative, interest will be added to the original deposit amount and on withdrawal, the amount shall be a percentage of the updated principal (original deposit + accrued interest). For non-cumulative deposits, interest is already credited to your savings account so the principal will be the original deposit amount. In case of premature closure of FD (full withdrawal), there are two (2) options laid down for the investor, viz.:

Now let’s talk about the online and offline mode involved in the closure of FD, prematurely or on time.

If you are not familiar with internet banking or do not feel comfortable using it, pick the traditional method of offline closure. Collect the important documents (e.g. an ID proof, deposit certificate, photograph(s), etc.) and visit either the nearby branch or the branch in which your FD was booked initially. A bank’s representative shall help you with the procedure. You will be required to fill an account closing form as you did at the time of opening. Once this form, along with the required documents, is submitted, the request shall be processed. On successful closing FD, funds will be transferred to your savings account.

Every bank has its own set of steps to be followed to successfully close an FD. But to close a fixed deposit online, it is imperative that you are registered for internet banking. For this, you will need registered login details (a combination of username/mobile number and password) to access the bank’s net-banking option. We are providing steps on how to close FD in the top 5 banks in India

Following are the steps to close an SBI fixed deposit online: Step 1: Using your registered User ID and password, log in to SBI net banking Step 2: Select the e-Fixed Deposit option from the bar menu at the top and click on Proceed. Step 3: Click on ‘Close A/c Prematurely’ which is the last tab in the bar menu. Step 4: Select the FD which you want to close and click on Proceed. Step 5: Details of the selected FD will be displayed on the screen which you need to verify. Step 6: Give remarks for the closing of FD in the ‘Remarks’ field and click on ‘Confirm’. Step 7: Enter the High-Security Password which you will receive on your registered mobile number. (This will be labelled as OTP for your FD) On successful submission of OTP or high-security password, a message will be displayed on the screen confirming the successful closure of the selected FD.

To close a fixed deposit made with HDFC Bank, the following set of steps should be followed: Step 1: Go to the official website of HDFC Bank and login to HDFC net banking using the registered login credentials. Step 2: Click on ‘Transact’ from the side menu and then select ‘Liquidate Fixed Deposit’. Step 3: Select the FD you need to close/liquidate using the drop-down box of ‘Select An Account’. Step 4: Select Savings/Current Account in which transfer is to be completed. Step 5: Click on ‘I Accept Terms & Conditions’ and go ahead with ‘Continue’. Step 6: Check the details of the FD to be closed which will display the interest earned at what HDFC FD Rate as well as the total amount to be credited. Also, check for the penalty that is levied. Step 7: Click on Confirm to complete the closing of FD. A message will be displayed on the screen saying ‘FD Liquidation – Complete’. Check the account in which the FD amount has been credited. You will also get a confirmation SMS about the same.

The following mentioned steps shall help you to close FD in ICICI Bank: Step 1: Log in to your ICICI Bank net banking account. Step 2: Open ‘Deposits’ in ‘My Accounts’ from the bar menu at the top of the webpage. Step 3: At the side menu box, select ‘Service Requests’. Step 4: Click on Close or Renew Fixed/Recurring Deposit. Step 5: Fill the online form that will next appear on the screen.

Step 6: Once all the filed are filled, click on ‘Submit’. Step 7: Verify the details on the Request Confirmation page (check maturity amount and ICICI Bank FD rate at which interest is calculated) and enter One Time Password or OTP sent to your registered mobile number. Now ‘Submit’ again. Confirmation message shall be displayed on the screen. Check your savings account number whether the amount is credited. Please note that for partial closure, investors need to use phone banking or visit the nearby branch of ICICI Bank.

To close your fixed deposit in Punjab National Bank (PNB) online, the following steps shall be useful: Step 1: Go to the official website of PNB. Step 2: Log in to PNB net banking using your login credentials. Step 3: Open Manage Accounts tab. Step 4: Select ‘Premature FD Closure’ under the section of ‘Open/Close Accounts’. Step 5: On the page thus redirected, select the FD A/c to be closed as well as destination A/c number (in which FD amount is to be transferred). Step 6: Click on ‘Continue’. Step 7: Details of the FD to be closed will be displayed on the screen. Verify the same properly. Step 8: Click on ‘Yes’ to confirm closure of your fixed deposit. Step 9: Enter the transaction password in the space provided and hit the ‘Submit’ button. A message box will be displayed on the screen on successful closure.

Follow the steps stated further to online close fixed deposit in Axis Bank:

Step 1: Open the Axis Bank mobile app. Step 2: Click on FD/Rd option. Step 3: Select the FD number of the one that you want to close. Step 4: Click on Close Fixed Deposit. Step 5: Enter the MPIN sent to your registered mobile number and click on Submit. On successful submission, the selected FD will be closed immediately.

Step 1: Log in to Axis Bank net banking using your registered login credentials. Step 2: Click on ‘Accounts’ and select ‘Deposits’. Step 3: Under the ‘More Services’ option, select the ‘Break FD’ option. Step 4: From the drop-down list, select the account to be credited. Step 5: Enter your Axis Bank NetSecure Code to proceed. Step 6: Click on the ‘Submit’ button to complete the process. On successful submission, a message will appear on the screen confirming the successful closure. Now that we’ve covered all the ways in which you can close and FD, i.e. before maturity (premature withdrawal) or on maturity, let us throw some light on important aspects circling closing of a fixed deposit account.

The following are some of the important facts regarding closure of a fixed deposit account:

On breaking your FD, i.e. on premature withdrawal of FD, you lose on the potential interest that you would have earned if continued the deposit for its fair tenure

Now that you know how to close a fixed deposit account, especially prematurely, let’s talk about its alternative too. Instead of breaking your FD, there is another option of taking a loan against a fixed deposit. This option enables you to self-finance your needs keeping your FD as collateral. Since it is a secured loan, you don’t need to pay interest at high rates as in the case of unsecured loans. If the FD amount is almost equal to the cash requirement you have at present, opting to close the FD, i.e. to prematurely withdraw may be your best bet. But if the case is reversed, in which the amount required is fairly less compared to the FD, you should consider taking a loan against FD. Let’s understand this with the following examples: Scenario 1: You have an FD of Rs. 1 lakh for 1 year. On the 3rd month, you face a cash crunch and need Rs. 90,000 urgently. In such a case, it is better to withdraw the FD prematurely. This is because if you take a loan against FD, the interest that you will be paying will be considerably lot which will not get compensated by the interest that you will earn on your FD. (Interest rate is charged at a rate above the contracted FD rate which is usually 0.5% -1% higher.) Scenario 2: You have an FD of Rs. 10 lakh for 4 years. On 3rd month you require Rs. 1.5 lakh and you consider breaking your FD so as to finance your requirement. Here, instead of closing your fixed deposit prematurely, it is recommended to take a loan of Rs. 1.5 lakh against the said FD. You will be paying interest only on Rs. 1.5 lakh. Meanwhile, your FD will keep on earning interest on the entire amount of Rs. 10 lakh.

Are you closing your FD prematurely because you’re running out of funds? Here is a better option – Paisabazaar Step Up Credit Card. Paisabazaar, in partnership with SBM Bank (India) Ltd. is offering customers a secured credit card against fixed deposit. All you need is an FD in SBM Bank (India) Ltd. and you will be offered the Step Up Card. Along with adding to your immediate purchasing power, this credit card will help you in building your credit score from scratch. And if you’re suffering from a poor credit score, it will help in boosting your credit score.

To conclude, when opting to close an FD before or on maturity, always keep certain points in mind like penalty to be paid, option to reinvest (in case of liquidation on maturity) and option to take loan against FD (instead of premature withdrawal), etc. Also remember that on early closure of FD, interest rates might be revised.