Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

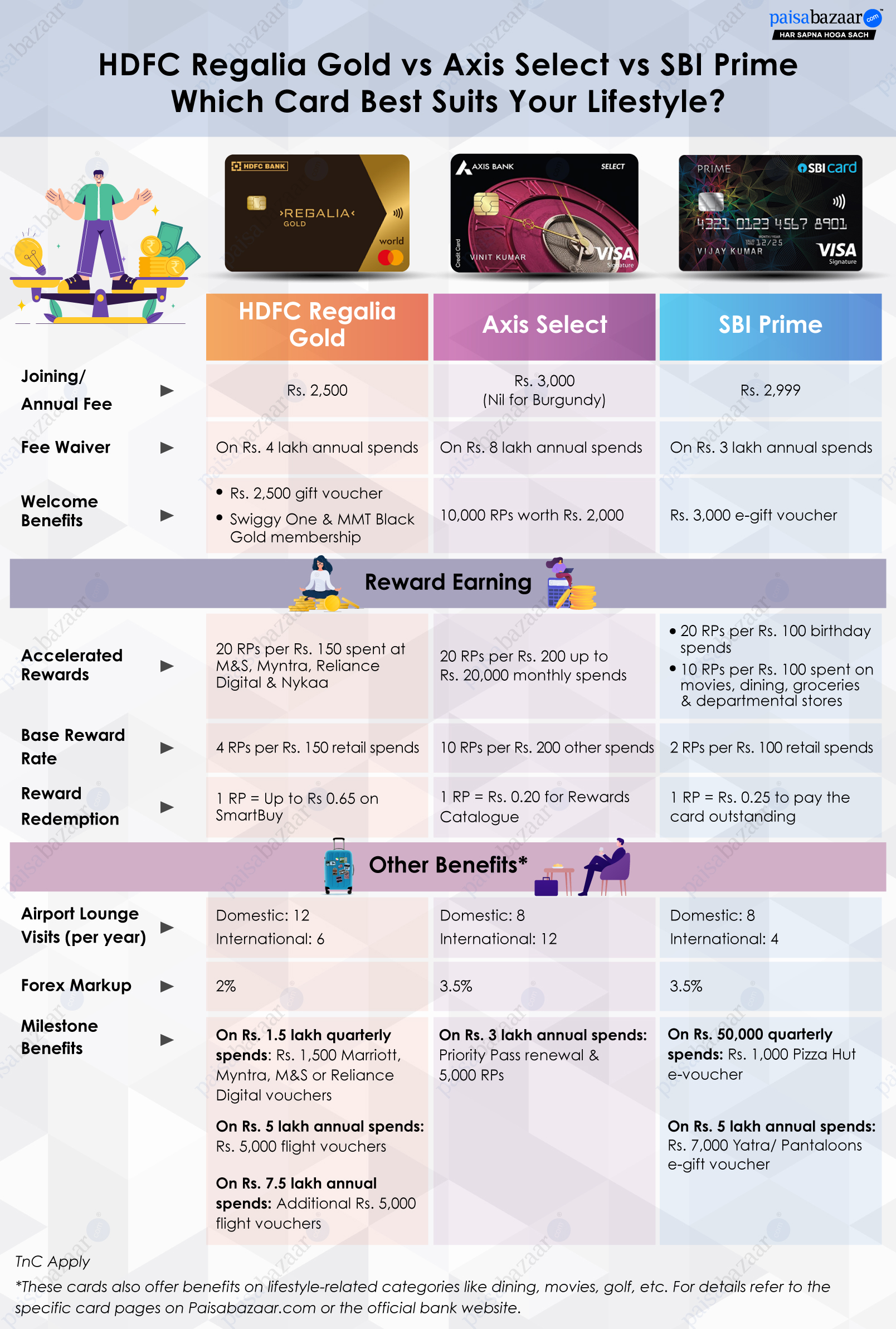

HDFC Regalia Gold, Axis Select and SBI Prime credit cards are some of the popular cards available in the market at moderate annual charges. They not only come with a good rewards program, but also offer different lifestyle benefits targeted towards travel, shopping, dining, golf and many more. Despite all being rewards focused all-rounder cards, they cater to distinct customer preferences.

Here is a detailed comparative analysis of the features and benefits offered by each card to help you decide which one best aligns with your lifestyle needs.

HDFC Regalia Gold Credit Card Joining fee: ₹2500 Annual/Renewal Fee: ₹2500 5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital 4 reward points per Rs. 150 across all retail spends Product Details Axis Bank SELECT Credit Card Joining fee: ₹3000 Annual/Renewal Fee: ₹3000 Up to 20 EDGE Reward Points per Rs. 200 spent 10,000 EDGE Reward Points worth Rs. 2,000 as welcome benefit Product Details SBI Card PRIME Joining fee: ₹2999 Annual/Renewal Fee: ₹2999 5X reward points on dining, groceries, departmental stores, and movies 8 international Priority Pass & 4 domestic airport lounge visits per year Product Details

Know More

Know More

Know More

All three credit cards HDFC Regalia Gold, Axis Select and SBI Prime come at similar annual fees of Rs. 2,500, Rs. 3,000 and Rs. 2,999 respectively. The welcome benefits offered by each on joining fee payment are as follows:

| HDFC Regalia Gold | Axis Select | SBI Prime |

| – Rs. 2,500 gift voucher – Swiggy One & MMT Black Gold membership on Rs. 1 lakh spends within 90 days |

10,000 EDGE Reward Points on 1st card spend within 30 days | Rs. 3,000 e-gift voucher from Pantaloons, Yatra, Bata/ Hush Puppies, Aditya Birla Fashion or Shoppers Stop |

Here, SBI Card Prime and HDFC Regalia Gold both match the fee charged with the bonus vouchers. But Axis Select takes a back seat with a joining benefit worth Rs. 2,000 which is Rs. 1,000 less than the annual fee it charges. This HDFC credit card also comes with a chance to further increase your value-back through the dining and travel memberships, but those can only be availed if you plan your card spends to satisfy the spend-based conditions within the time limit.

All three credit cards focus on different category spends for their accelerated categories, so the best card option would be dependent on your spending habits. The details are given below:

| Rewards | HDFC Regalia Gold | Axis Select | SBI Prime |

| Accelerated Rate | 8.67%: 20 RPs per Rs. 150 on M&S, Myntra, Reliance Digital & Nykaa spends | 2%: 20 RPs per Rs. 200 on up to Rs. 20,000 monthly spends | 5%: 20 RPs per Rs. 100 on birthday 2.5%: 10 RPs per Rs. 100 on dining, groceries, departmental stores & movie spends |

| Base Rate | 1.73%: 4 RPs per Rs. 150 retail spends including insurance, utilities and education | 1%: 10 RPs per Rs. 200 | 0.5%: 2 RPs per Rs. 100 |

Reward Redemption Options & Value Comparison:

Axis Select: 1 RP = Rs. 0.20 for Axis EDGE Rewards Catalogue and point-to-mile conversion

SBI Prime: 1 RP = Rs. 0.25 to pay card outstanding

HDFC Regalia Gold:

In terms of the rewards program with the value-back rate and reward redemption options, HDFC Regalia Gold credit card appears to be the best option among the three cards. But the high savings rate is possible only if the users opt for the redemption options with higher value-back, i.e. the curated brand catalogue or travel bookings. Another highlight is that this card also offers the base reward rate on categories like insurance, utilities and education, which are often excluded.

While Regalia Gold’s rewards program favours partner brands and select redemption options, Axis Select offers more uniform value-back structure across spends. However, the redemption value is quite low which brings down the overall savings. On the other hand, SBI Prime, despite offering a low redemption value, still comes with decent savings on everyday essentials- slightly better than those offered by Axis credit card. The base rate for the SBI Card is, however, the lowest among the three.

The complimentary airport lounge access offered by the credit cards both within and outside India are as follows:

| Airport Lounge | HDFC Regalia Gold | Axis Select | SBI Prime |

| Domestic | 12 visits per year | 8 visits per year, max. 2 per quarter on Rs. 50,000 spends in last 3 months | 8 visits per year, max. 2 per quarter |

| International | 6 visits per year via Priority Pass | 12 visits per year via Priority Pass | 4 visits per year via Priority pass, max. 2 per quarter |

All three credit cards offer Priority Pass international lounge access. However, SBI credit card provides the least number of complimentary domestic and international lounge visits. For domestic lounges, HDFC Regalia Gold is a better choice with 12 annual visits, while Axis Select offers 8 which are further subject to a spend-based condition. For international lounges, Axis Select takes the lead, but its Priority Pass is complimentary only for the first year. To renew it, you will have to spend a min. of Rs. 3 lakh annually. These conditions on Axis Select may seem like a hassle, but since the spending requirements are low, they won’t be very difficult to achieve even for an average card spender.

Forex Mark-up Charges: While Axis and SBI credit cards both charge a 3.5% forex mark-up fee, HDFC Regalia Gold brings some respite on these charges on international transactions with a slightly lower fee of 2%.

| HDFC Regalia Gold | Axis Select | SBI Prime |

| On Rs. 1.5 lakh quarterly spends: Rs. 1,500 Marriott, Myntra, M&S or Reliance Digital vouchers On Rs. 5 lakh annual spends: Rs. 5,000 flight vouchers On Rs. 7.5 lakh annual spends: Additional Rs. 5,000 flight vouchers |

On Rs. 3 lakh annual spends: Priority Pass renewal, 5,000 RPs and additional 6 golf rounds | On Rs. 50,000 quarterly spends: Rs. 1,000 Pizza Hut e-voucher On Rs. 5 lakh annual spends: Rs. 7,000 Yatra/ Pantaloons e-gift voucher |

| Max. Annual Value-back via Milestone Benefits | ||

| Rs. 16,000 | Rs. 1,000 + Priority Pass + 6 Golf Rounds | Rs. 11,000 |

The features offered by Regalia Gold benefit high-spenders the most due to higher spending milestones while focusing on shopping and travel categories. Axis Select offers multiple benefits on reaching one single spending milestone. This milestone is towards the lower side and is required to retain the existing Priority Pass and get benefits like additional rewards and golf rounds. Milestone benefits by SBI Prime on the other hand could benefit both low as well as mid-range spenders and offer a better value than Axis Select, but are quite brand-specific.

Given below are other card benefits related to the lifestyle needs of the customers:

HDFC Regalia Gold Credit Card

Axis Select Credit Card

SBI Card Prime

| Mastercard | Visa | American Express |

| – 4 rounds of green fees access; up to 50% off on golf games+1 free lesson per month at select courses in India – Up to 15% off on best available room rates & on F&B at LaLit Hotels |

– Up to 10% savings on Hertz car rental & up to 35% on Avis Car Rentals – Exclusive offers across 900 luxury hotels worldwide |

– Up to 20% off at 700+ restaurants – Free Tablet Plus membership for upgraded hotel stays worldwide |

Axis Select credit card stands out by offering extensive lifestyle benefits across popular platforms, in addition to premium travel experiences and golf access. In contrast, HDFC card primarily focuses only on dining benefits. For SBI Prime credit card, the benefits are dependent on the associated network, though hotel stay benefits at the respective partner hotels are provided across all card variants.

Since all three credit cards are all-rounder cards which offer a diverse range of benefits, it’s essential to first consider the core value-back system, which is the rewards program, to determine which card would allow you to save the most on your everyday card spends and whether you can maximise your value-back through the available redemption options. Thereafter, you can analyse other card benefits and check which card offers the ones which you can utilise the best based on your lifestyle.

Given below are some card-wise indicators to help you choose the best card:

HDFC Regalia Gold is suitable for:

Axis Select is suitable for:

SBI Prime is suitable for: