Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Planning to buy a high-end gadget, furniture, jewellery, or even fund an international trip? Your credit card can offer you convenience, rewards and repayment flexibility on making these big-ticket purchases, if used the right way. Whether you are a first-time credit card user or a seasoned spender, understanding the right purchase timing, repayment strategies, and associated benefits can help you make smarter financial decisions related to credit cards. If not managed wisely, the same credit card that brings the freedom and purchasing power for high-value expenses can trap you in a debt spiral.

So, here is how you can strategically make big-ticket purchases using your credit card, while avoiding debt traps and maximising the interest-free period and benefits.

Using a credit card for big-ticket purchases can prove to be quite advantageous for the following reasons:

High Value-back

Making big spends using your credit card can help you earn more cashback and reward points. Certain cards offer incremental rewards on spending beyond a certain threshold, along with milestone bonuses which become easier to unlock if you make high value transactions using them.

Also Read: Best Cashback Credit Cards in India | Best Rewards Credit Cards in India

Interest-free Period

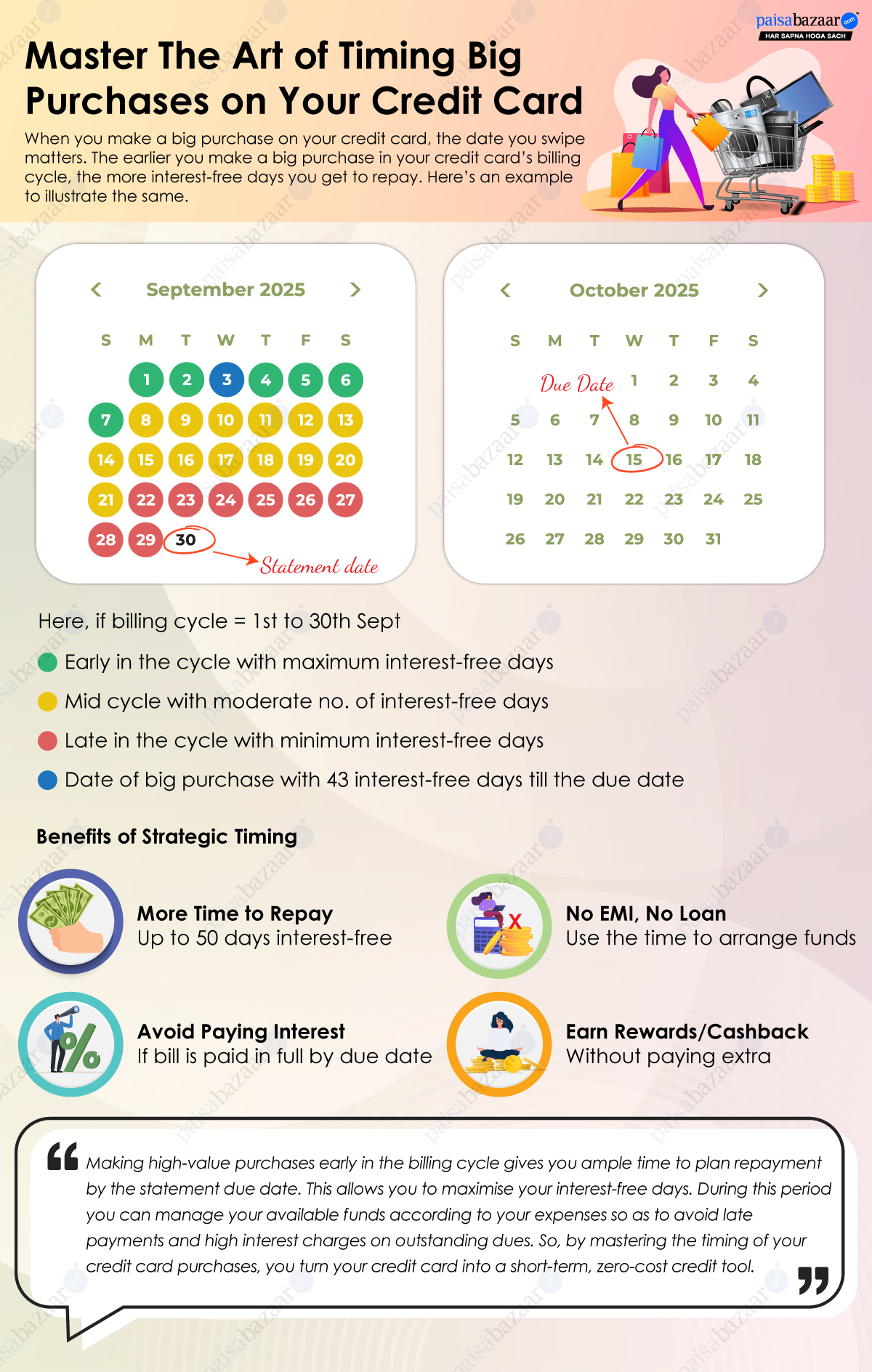

Most credit cards offer an interest-free credit period of 40 to 50 days, depending on their billing cycle. For instance, if a card has a billing cycle from 1st to 30th of every month and the payment due date is 15th of the next month, you can get an interest-free period of 45 days on a big-ticket purchase made on the first date of the cycle. This period gives you enough time to manage your budget and arrange for the funds to repay the credit utilised for that purchase. Moreover, if you pay the full outstanding amount by the due date, you won’t be charged with any interest either.

EMI Conversion Facility

EMI conversion feature of credit cards can be quite useful in case you have to make a purchase that goes beyond your monthly budget and you need additional time to repay your dues. You can either opt for merchant EMI at the time of purchase or post-purchase EMI to convert your large purchase into smaller installments to ease the monthly repayment burden. Many banks also offer zero or low-interest EMIs with varying tenures which you can choose from to minimise any extra cost.

Purchase Protection

Select credit cards come with the purchase protection insurance cover which provides an added layer of security. Generally applicable for a limited time, such a cover can protect you against product damage or theft.

In order to get the maximum number of interest-free days, you should make your big-ticket purchases towards the beginning of your statement cycle. Given below is an illustration of how timing your purchases as per your billing cycle can help you ease the repayment stress:

Making a big-ticket purchase using your credit card is quite easy since the assigned credit limit gives you extended spending capacity. But repaying it in full by the payment due date is crucial to avoid accruing interest charges, late payment fee and debt accumulation. Missing your credit card repayments also has a negative impact on your credit score. So, here are some quick tips to ensure you pay your credit card dues for the regular as well as big-ticket purchases without accruing any additional charges:

Pay the Full Outstanding Amount

Whenever possible, aim to pay off the entire outstanding amount by the due date, especially after making a big-ticket purchase. Avoid opting to pay only the minimum amount due, as this will be accompanied with high interest charges on the remaining balance, which can generally range between 30% and 45% per annum. Additionally, once you carry forward a balance, interest-free periods on future purchases are no longer applicable due to which new credit card transactions start accruing interest from day one. So, pay in full to avoid debt accumulation and to maintain a healthy credit profile.

Use Auto-pay or Set Reminders

Enabling auto-pay for your credit card repayments ensures that your dues are paid on time, avoiding late payment charges and penalties. If you prefer to make manual payments, you must set up multiple reminders either on your phone, calendar apps, or email alerts. Timely repayments also protect your credit score, which can drop by a single missed or late payment.

Consider EMI Conversion

If you are struggling to repay the full amount together, most banks allow you to convert big-ticket purchases into EMIs. This facility breaks the cost into smaller, more manageable payments spread over a repayment tenure of choice. You can initiate credit card EMI conversion through net banking, mobile app, or by calling credit card customer support. You should also check whether a no-cost EMI option is available or compare interest rates and other charges before opting for an EMI conversion.

Exclusive Card Offers from India’s top banks are just a click away Error: Please enter a valid number

Here are some do’s and don’ts that you must keep in mind while making big purchases using your credit card:

Do’s

Don’ts

Given below are some of the popular shopping credit cards which you can consider to make future big-ticket purchases. If you are planning to apply for a credit card that maximizes savings on electronics, fashion, or large spends, these options can be a good starting point:

YES BANK Paisabazaar PaisaSave Credit Card Joining fee: ₹0 Annual/Renewal Fee: ₹499 6% cashback on travel and dining spends Unlimited 1% cashback on all other spends, including UPI Product Details Flipkart Axis Bank Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 7.5% cashback on Myntra 5% cashback on transactions at Flipkart and Cleartrip Product Details Cashback SBI Card Joining fee: ₹999 Annual/Renewal Fee: ₹999 5% cashback on all online spends 1% cashback across all offline spends Product Details HDFC Millennia Credit Card Joining fee: ₹1000 Annual/Renewal Fee: ₹1000 5% cashback on Amazon, BookMyShow, Flipkart, Myntra, Zomato & more 1% cashback on spends at other categories Product Details HDFC Regalia Gold Credit Card Joining fee: ₹2500 Annual/Renewal Fee: ₹2500 5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital 4 reward points per Rs. 150 across all retail spends Product Details

Know More

Know More

Know More

Know More

Know More