Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

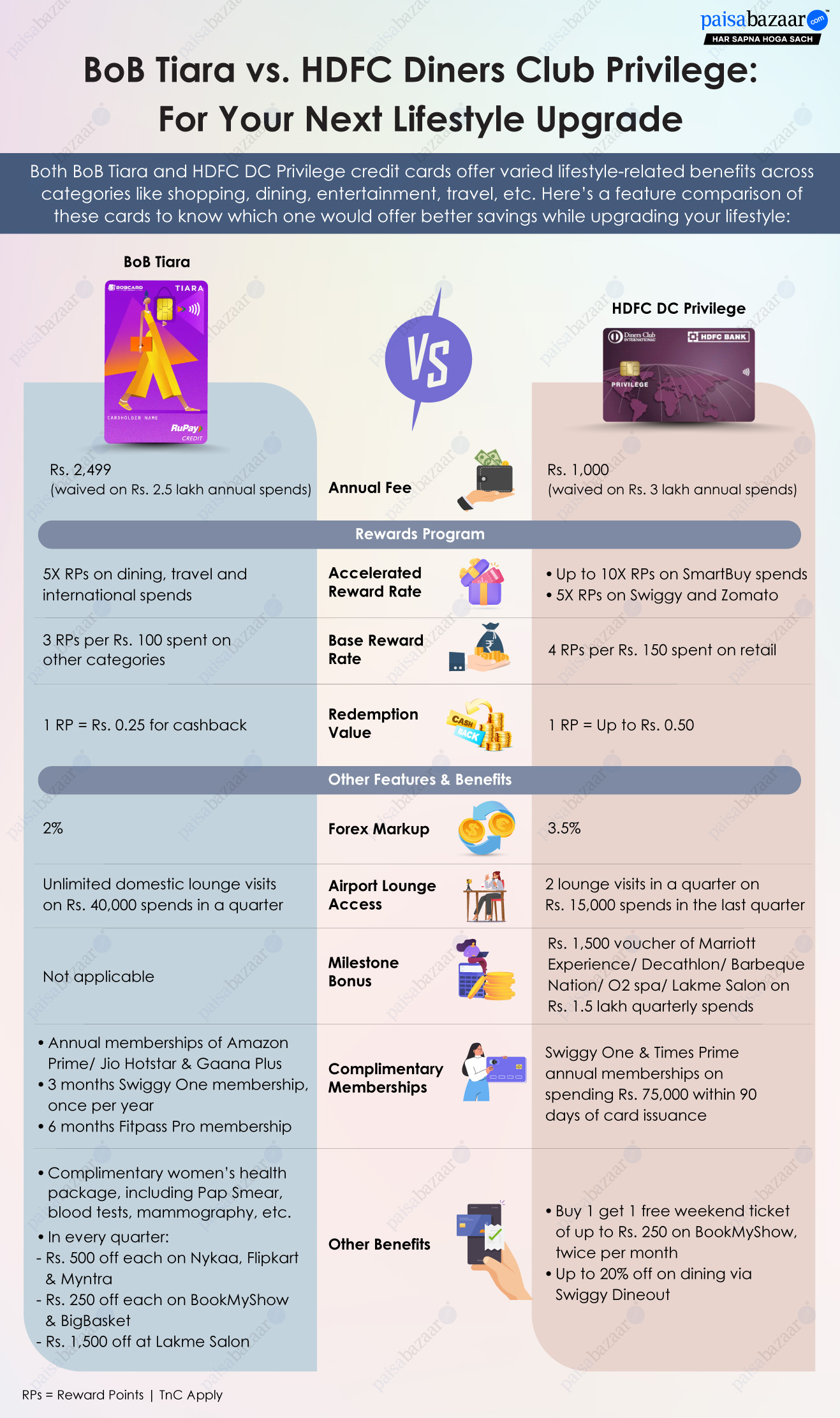

Moving beyond essentials, lifestyle-related expenses such as dining, entertainment, travel, etc. use up a considerable amount from our budget. Targeting the need to get a good value-back on such spends, several credit card providers offer cards which allow the user to maximise their savings on these spending categories. BoB Tiara and HDFC Diners Club Privilege are two such examples which not only come with a higher reward rate on such spends, but also offer complimentary memberships and discounts for some of the leading brands and platforms.

Given below is a comparison of the fees, features and benefits of these credit cards to help you know which one of these would be the best choice to have substantial savings on your lifestyle needs.

BoB Tiara comes at a joining and annual fee of Rs. 2,499 while its HDFC counterpart charges a fee of Rs. 1,000 every year. Both cards come with certain fee waiver conditions which are as follows –

| Waiver/Reversal | BoB Tiara (Fee: Rs. 2,499) | HDFC DC Privilege (Fee: Rs. 1,000) |

| Joining Fee | On spending Rs. 25,000 within 60 days of card issuance | – |

| Annual Fee | On spending Rs. 2.5 lakh in a year | On spending Rs. 3 lakh in a year |

Both BoB Credit Card and HDFC Credit Card offer higher value-back on select lifestyle-related categories. The detailed reward benefits are discussed below –

| BoB Tiara | HDFC Diners Club Privilege |

| 5X: 15 RPs per Rs. 100 spent on dining, travel and international spends (capped at 5,000 RPs per month, beyond which base rate is applicable) | Up to 10X: Up to 40 RPs per Rs. 150 spent on flight and hotel bookings on SmartBuy 5X: 20 RPs per Rs. 150 spent on Swiggy and Zomato (4X out of 5X RPs are capped at 2,500 RPs per month, while remaining 1X RPs is uncapped) |

BoB Tiara: 3 RPs per Rs. 100 spent on other categories, including UPI (RPs on UPI are capped at 2,000 RPs per month)

HDFC Diners Club Privilege: 4 RPs per Rs. 150 spent on other retail purchases

BoB Tiara: 1 Reward Point = Rs. 0.25 for cashback

HDFC Diners Club Privilege:

Though both cards offer unlimited base rewards, the disparity in their reward rate is quite noticeable due to the difference in their reward redemption values. Tiara focuses on dining, travel and international spends with accelerated value-back of 3.75%, while DC Privilege offers an accelerated value-back of 6.66% on Swiggy and Zomato. Diners Club Privilege further extends its higher rewards rate to SmartBuy travel spends with up to 13.33% savings. Similar differences can be seen in the base reward rate where the former offers 0.75% back and the latter 1.33%. However, this advantage of higher value-back can only be maintained if the cardholders redeem the rewards against travel bookings and dining payments on SmartBuy. When it comes to redemption as cashback, this field becomes a bit more levelled.

Both the cards offer memberships to popular platforms related to diverse lifestyle categories like dining, entertainment, online shopping and fitness.

BoB Tiara Credit Card:

HDFC Diners Club Privilege Credit Card: Annual memberships to Swiggy One and Times Prime on spending Rs. 75,000 within 90 days of card issuance

BoB Tiara takes a lead when it comes to complimentary memberships by covering OTT entertainment, music, fitness and dining categories across popular platforms. Meanwhile, HDFC Diners Club Privilege only offers such memberships in the form of spend-based joining benefits.

Both credit cards live up to their lifestyle-focused image and offer discounts on popular platforms.

Bank of Baroda Tiara Credit Card:

HDFC Diners Club Privilege Credit Card:

Here, BoB Tiara comes with benefits centered towards a wider array of categories, including women’s health, online shopping, beauty and wellness, groceries and entertainment. On the other hand, HDFC Diners Club Privilege mostly focuses on dining and entertainment categories.

While both credit cards focus on rewarding varied lifestyle spends, both have slightly different approaches. Read the snapshot below, before applying for a credit card from these two options.

Opt for BoB Tiara Credit Card If:

Opt for HDFC Diners Club Privilege Credit Card If: