Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

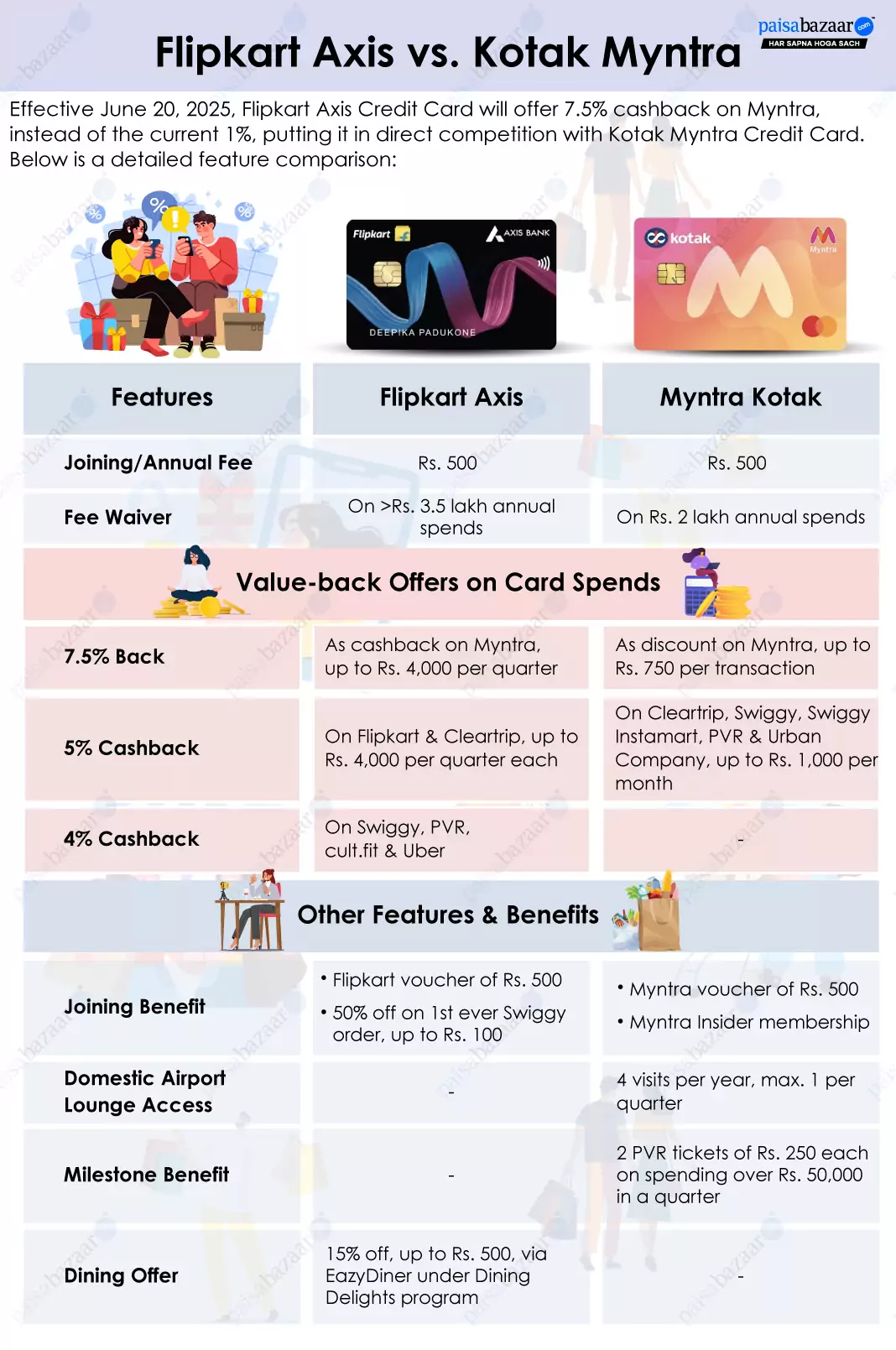

For a long time, Flipkart Axis Bank Credit Card remained a solid option for Flipkart and Myntra loyalists offering 5% cashback on both platforms. However, through subsequent feature updates and devaluations, Myntra benefit reduced to the base rate (1%). Meanwhile, Myntra’s own co-branded card – Myntra Kotak – took the centre stage with 7.5% discount on all Myntra spends – one of the highest rates among co-branded cards.

However, Axis Bank has now announced a feature update on its Flipkart Axis Card, effective 20th June 2025 – wherein the card will offer 7.5% cashback on Myntra, positioning the card in direct competition with Myntra Kotak Card offering similar value-back on Myntra, albeit with different capping restrictions.

Here is a comparison of these two cards in the light of their overlapping preferred partner merchants to help you determine which card aligns better with your needs.

Annual Fee:

Both the credit cards charge the same joining and annual fees of Rs. 500 but their fee waiver conditions vary. Myntra Kotak allows the users to avail fee waiver on spending just Rs. 2 lakh in a year, while this spending threshold is higher for Flipkart Axis cardholders at more than Rs. 3.5 lakh annual spends.

Joining Benefits:

| Flipkart Axis Credit Card | Myntra Kotak Credit Card |

|

|

Flipkart Axis and Myntra Kotak cards offer joining bonuses of similar values of up to Rs. 600 and Rs. 500 respectively. But the activation bonus of Myntra Kotak is limited to just Myntra app, whereas Flipkart Axis comes with offers on both Flipkart and Swiggy. An important point to note is that the Swiggy discount is only available on making the first ever order, so if you are already a Swiggy customer, then you can only avail the Flipkart voucher of Rs. 500 as your joining benefit on the Axis Bank credit card.

These cards are tailor-made for frequent online shoppers and even offer accelerated value-back on some common preferred merchants* which include Myntra, Cleartrip, Swiggy and PVR. The core value-back is mostly offered in the form of cashback by both these cards. The details are as follows:

Myntra Offer: Both of these credit cards offer 7.5% savings on Myntra spends. Flipkart Axis offers it as cashback of up to Rs. 4,000 per quarter, while Myntra Kotak offers it as discount of up to Rs. 750 per transaction.

Accelerated Cashback Rate on Other Platforms:

| Cashback | Flipkart Axis | Myntra Kotak |

| 5% | On Flipkart & Cleartrip, up to Rs. 4,000 per quarter each | On Cleartrip, Swiggy, Swiggy Instamart, PVR & Urban Company, up to Rs. 1,000 per month |

| 4% | On Swiggy, PVR, Uber & cult.fit | – |

Base Cashback Rate: The Kotak credit card variant takes the lead when it comes to the base savings rate on non-accelerated spending categories with 1.25% cashback. Moreover, since Kotak Myntra credit card is a RuPay card, you can also earn this value-back on UPI transactions. On the other hand, Flipkart Axis offers 1% cashback on other card spends.

Exclusions: There are certain common excluded categories from the cashback benefit of both the cards like rent, fuel, EMIs, wallet loading and cash advances. However, categories like jewellery, insurance and utilities which usually include big-ticket spends are only excluded from cashback benefits of Flipkart Axis credit card. So, if you wish to save on these categories, then Myntra Kotak would be a better option for you.

*As per the latest preferred merchants list. This list is subject to change from time to time.

In addition to the cashback structure, these cards also provide benefits on spending categories like travel, entertainment and dining in the form of lounge access, milestone benefit and discount.

| Flipkart Axis Bank Credit Card | Myntra Kotak Credit Card |

|

|

Both the cards also offer 1% fuel surcharge waiver, but with different capping conditions. Flipkart Axis offers it on fuel spends worth Rs. 400 to Rs. 4,000, capped at Rs. 400 per month, while Myntra Kotak offers it on fuel spends of Rs. 500 to Rs. 3,000, capped at Rs. 3,500 per year.

Based on these card benefits, those who wish to get complimentary domestic lounge access and additional savings on movie tickets can opt for Myntra Kotak. In contrast, those who frequently dine out and wish to save on that cost can choose Flipkart Axis credit card instead.

Given below is a table containing quarterly spends on major platforms and other categories with the respective cashback and discount savings that you can accrue using Flipkart Axis and Myntra Kotak credit cards:

| Spending Categories | Quarterly Spends | Flipkart Axis Savings | Myntra Kotak Savings |

| Myntra | Rs. 10,000 | Rs. 750 | Rs. 750 |

| Flipkart | Rs. 7,000 | Rs. 350 | Rs. 87.5 |

| Cleartrip | Rs. 15,000 | Rs. 750 | Rs. 750 |

| Swiggy | Rs. 2,500 | Rs. 100 | Rs. 125 |

| Swiggy Instamart | Rs. 6,000 | Rs. 60 | Rs. 300 |

| PVR | Rs. 1,800 | Rs. 72 | Rs. 565^ |

| Uber | Rs. 6,000 | Rs. 240 | Rs. 75 |

| Urban Company | Rs. 1,500 | Rs. 15 | Rs. 75 |

| cult.fit | Rs. 1,000 | Rs. 40 | Rs. 12.5 |

| Dining | Rs. 4,500 | Rs. 713.25# | Rs. 56.25 |

| Utility Bill Payments | Rs. 15,000 | – | Rs. 187.5 |

| Other Eligible Spends | Rs. 15,000 | Rs. 150 | Rs. 187.5 |

| Total Quarterly Spends | Rs. 85,300 | Rs. 3,240.25 (3.79% savings) |

Rs. 3,444.25 (4.03% savings) |

^Combining Rs. 500 off on PVR tickets as part of milestone bonus and 5% cashback (here Rs. 65) on the remaining spend amount

#Combining 15% off (here Rs. 675) on dining via EazyDiner and 1% cashback (here Rs. 38.25) on the remaining amount

The overall savings on both these cards are quite close, with Myntra Kotak credit card taking a slight lead with Rs. 204 more savings in a quarter which is just 0.24% more than that of Flipkart Axis credit card. So, in order to compare, you must analyse category or platform specific savings on each card and pick a card that offers better value-back on the categories you frequently spend on. Moreover, the capping on cashback earnings and discounts though may seem like a limitation, but since the upper limits are quite high, they would not have much impact, if at all, on your savings capacity if you are an average spender.

Both the cards cater to a similar customer base which prefers to make their purchases online and often spends on popular platforms spanning across categories like food delivery, apparel shopping, movies, travel, groceries, household products, etc. Listed below are some common features, along with key differences in the cards’ benefits, based on which you can make a choice between these two card options.

Similar Features:

Key Differences:

Choose Flipkart Axis Bank Credit Card If:

Choose Myntra Kotak Credit Card If: