Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

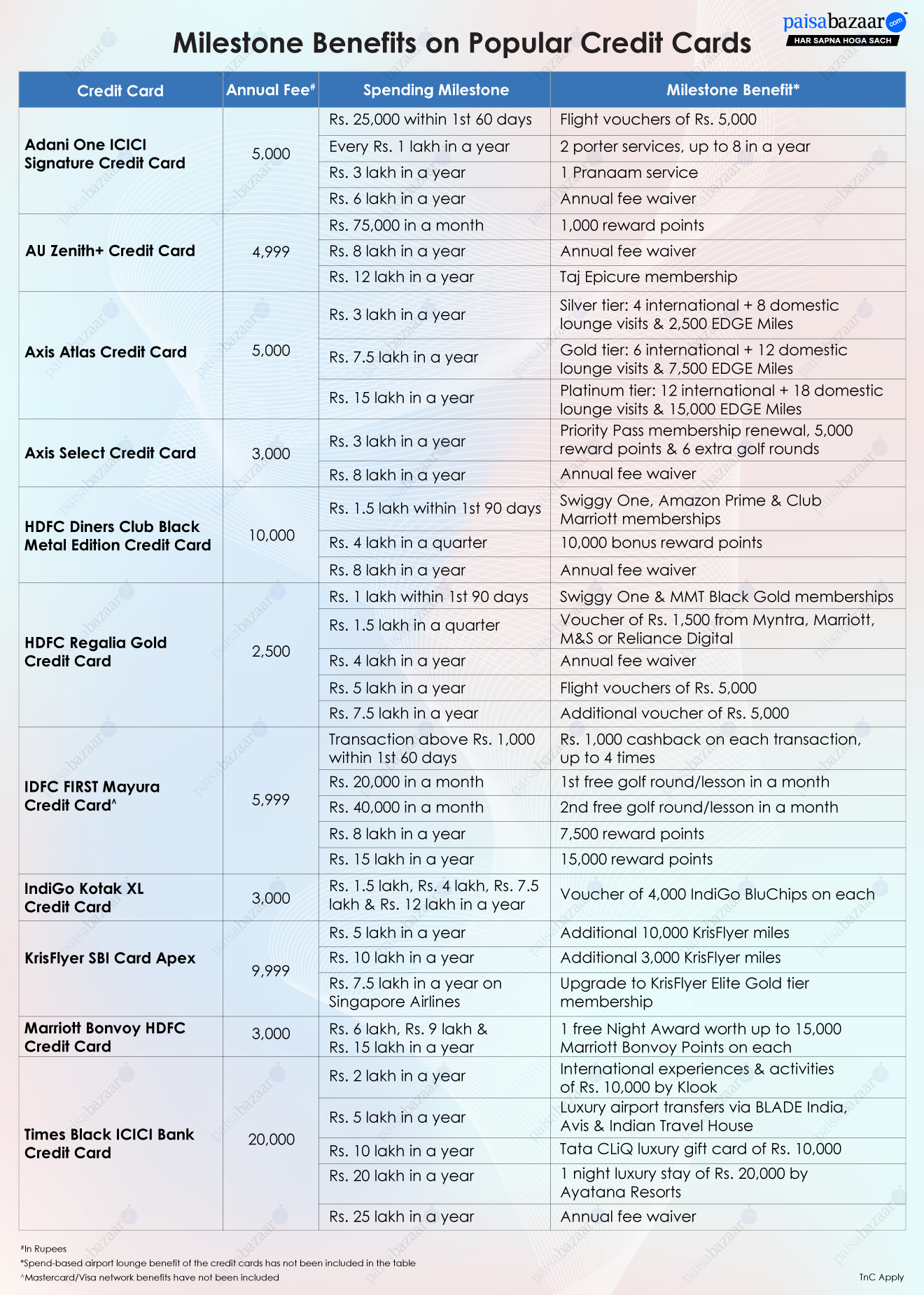

Most credit cardholders focus on the rewards and cashback programs of their cards where you earn back a percentage of every spend you make. However, there is another category of card benefits with significant savings that is often overlooked. These benefits are the credit card milestone bonuses which are offered on reaching certain spending milestones during a card anniversary year. Given below is a detailed account of how these milestone benefits are offered and how you can optimise your credit card usage to ensure you maximise your benefits.

Unlike the regular reward points or cashback that you earn on every eligible card transaction, milestone benefits are one-time bonuses offered on reaching a specific spending threshold within a defined period. This time period can range from a month, a calendar quarter or even an anniversary year. The milestone bonuses can either be additional rewards, co-branded vouchers, spending category specific benefits, fee waivers or complimentary lifestyle-related services.

For instance, HDFC Regalia Gold offers a reward rate of up to 20 reward points per Rs. 150 spent . However, in addition to this rewards program, you can get a shopping voucher of Rs. 1,500 on spending at least Rs. 1.5 lakh in a quarter. You can also avail the annual fee waiver and flight vouchers on reaching other annual spending milestones.

Milestone benefits come in various forms depending on the credit card variant and cater to diverse spending habits and preferences. Here are some of the most common types:

Many credit cards often offer additional bonus reward points as milestone benefits. These reward points can further be redeemed against cashback as statement credit, product catalogue, or gift vouchers from popular brands and platforms. These reward points can also be converted into airmiles or loyalty points for flight and hotel stay bookings as per the travel partners. For instance, AU Zenith+ credit card offers 1,000 reward points on reaching Rs. 75,000 monthly spends.

Nowadays, many credit cards have started offering airport lounge access only if the card user reaches a certain spending milestone. While some may come with additional complimentary lounge visits as a milestone bonus. For instance, IDFC FIRST Power+ offers domestic lounge access only if you spend a min. of Rs. 20,000 in a month while Axis Select offers additional 6 international lounge visits by spending Rs. 3 lakh or more in a year.

Some credit cards also offer complimentary memberships to the loyalty programs of popular platforms, hotels or airlines. These memberships help to save on lifestyle-related category spends, including dining, entertainment, travel, health and fitness, etc. Some cards may also offer membership tier upgrades as milestone bonus, like KrisFlyer SBI Card Apex offers an upgrade to KrisFlyer Elite Gold tier membership on spending Rs. 7.5 lakh in a year on Singapore Airlines.

Most credit cards waive off the annual fee charged on reaching a certain annual spending threshold. This benefits effectively makes the card lifetime-free if the user is able to avail it every year. Some also offer joining fee waivers on spending a certain amount within a set time frame during the initial card membership period. For instance, AU Vetta credit card offers joining fee waiver on spending Rs. 40,000 within 90 days from the card issuance date.

Several travel perks are also offered as milestone bonuses. Hotel stay related benefits can include free night stays, room upgrades, complimentary meals and other such services at some of the top hotel chains. On the other hand, some credit cards offer benefits to make air travel cheaper as well as more comfortable through flight ticket vouchers and other add-on services like seat upgrades, priority boarding, choice of seat or a free meal.

Gift cards and vouchers from popular shopping brands and leading platforms is another common milestone bonus. This can help the cardholders who either shop frequently from the partner brands or use the associated platform for different services. For instance, Times Black ICICI Bank credit card offers a Tata CLiQ voucher worth Rs. 10,000 on reaching Rs. 10 lakh annual spends.

Complimentary access to golf rounds and lessons can also be associated with minimum spending requirements for some credit cards. For instance, IDFC FIRST Mayura credit card offers up to 2 golf rounds/lessons every month, where 1st free access is provided on Rs. 20,000 monthly spends while the 2nd one is given on reaching Rs. 40,000 monthly spends.

In order to optimise your savings through credit card milestone benefits, the following points must be kept in mind while planning your card spends:

Credit card milestone bonuses can be quite helpful in maximising your savings. By strategically planning your spends, regularly tracking your progress, and understanding the terms and conditions of the card benefits, you can turn everyday spends into significant savings by availing milestone bonuses.