Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

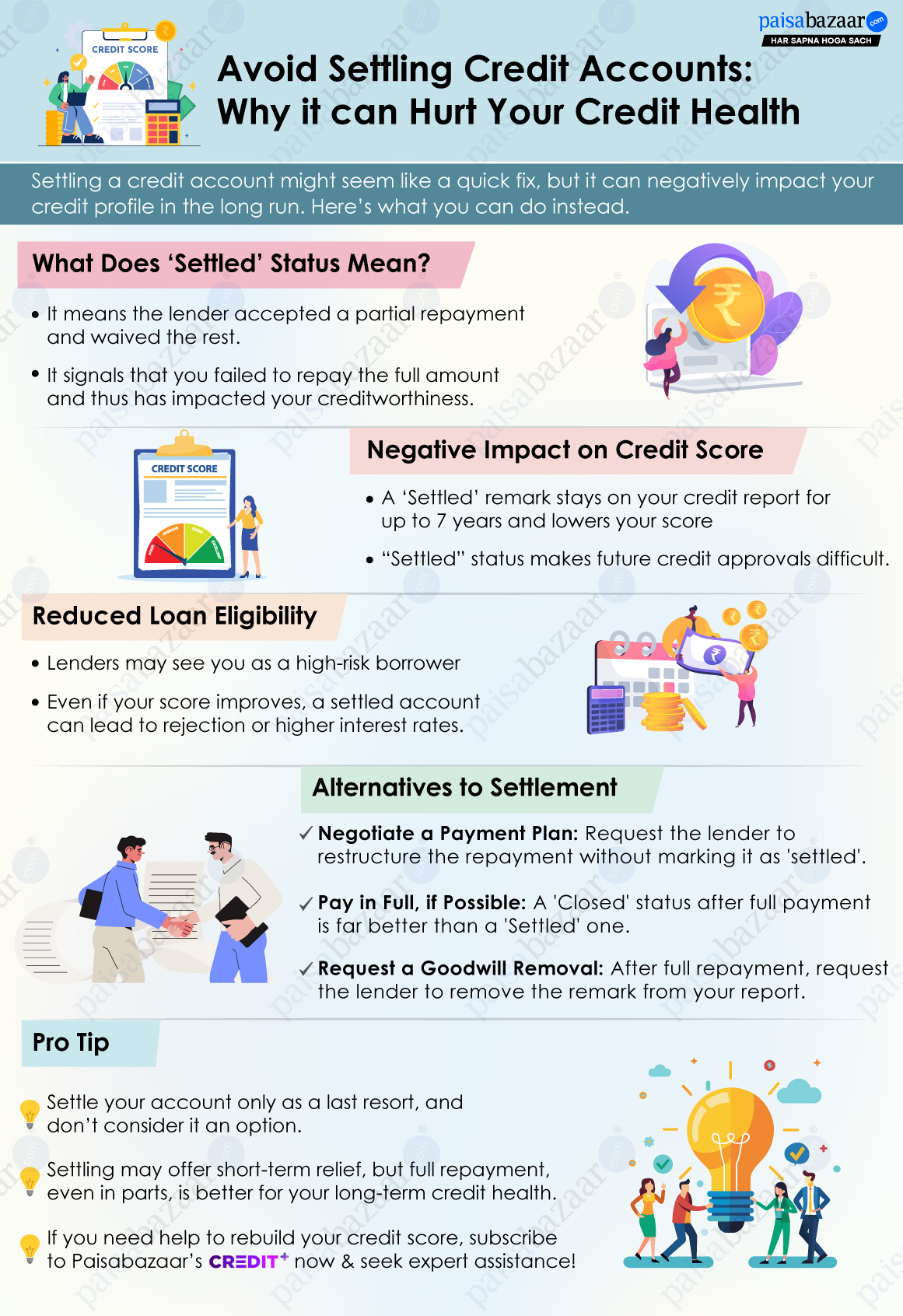

When you take a loan or a credit card, you have to pay off all dues on time. Any default or missed payment can significantly damage your credit score, whereas timely repayments help maintain your high credit score. When you are unable to pay off your dues for more than 90 days, the bank marks the account as NPA. It will severely damage your credit score and make it almost impossible for you to avail credit.

However, the bank may offer you an option to pay off a lower amount and settle the account. It may sound like a relief in a dire financial condition, but it will have serious implications on your credit health in future. Let us understand why settling a credit account should be your last resort and why you should look for alternatives.

A default credit account is considered as settled when the borrower pays off a part of the loan outstanding after negotiating with the lender. Here, a smaller amount is recovered by the lender instead of the total outstanding against an NPA account where no amount was going to be recovered. The borrower, in financial distress, gets to end the loan at a lower value and the lender recovers some of its losses.

It may sound like a win-win situation for both, but there’s a catch for the borrower here. The account status in the credit report is flagged as “Settled”, which indicates partial repayment instead of being marked as “Closed” (which implies you paid off the dues completely).

While settling a credit account would resolve your immediate financial crisis, it would also mean that your creditworthiness in future would decline severely.

Settlement impacts your credit score negatively. As you weren’t able to repay your dues, it is viewed as a breach of your repayment obligation. Credit bureaus consider it a sign of financial distress and thus, they no more trust your repayment capability.

This impacts your creditworthiness and hurt your chances of securing loans or credit cards in the future. Thus, you should settle your account only as a last resort and try to pay off your loan and close the account instead, even if it may take longer.

Read in Detail: Effects of Loan Settlement on your Credit Score

A settled account will remain in your credit report for as long as 7 years from the date of reporting. This is the most damaging aspect of credit settlement.

A missed payment in DPD (Days Past Due) remains in your credit report for 36 months and after that it is replaced by the newer timely repayments. But, in case of a settled account, it shall remain for long.

When a lender assesses your credit application, they look at the DPD data and past account statuses. Your DPD may recover in three years but your settled account status will haunt you longer. Even if you rebuild your credit score over time, a settled account in your report can lead to:

A high-risk borrower is one whom lenders don’t trust completely for recovery of their investments. This is because they find an indisciplined credit behaviour, sometimes caused due to a default or settled credit account. Lenders considering you a high-risk borrower has potential to impact your:

Lenders often look for two account statuses in your credit report – settled or closed. Let us understand the difference between the two terms:

| Term | Meaning | Impact on Credit Report |

| Closure | All dues paid in full | Positive or neutral impact |

| Settlement | Partial repayment after negotiating with the lender | Negative impact; stays for 7 years |

You should always aim for closure instead of settlement to preserve your credit health.

If you’re facing genuine difficulty repaying your debt, consider these steps before going for a settlement:

Also Read: Credit+: Paisabazaar’s Credit Improvement Services to Help Build Credit Score

While settling a credit account might provide a short-term relief, it comes at the cost of damaged credit health in the long-term. It reduces your score, creates a negative mark on your credit report, and affects your ability to borrow in the future.

If your financial burden has reduced and you want to improve your credit score, you can contact your lender for updating the status of your loan account as closed from settled by paying whatever additional amount is required. If the lender agrees and updates the account status, you can see a rise in your credit score and an improved credit report.