Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

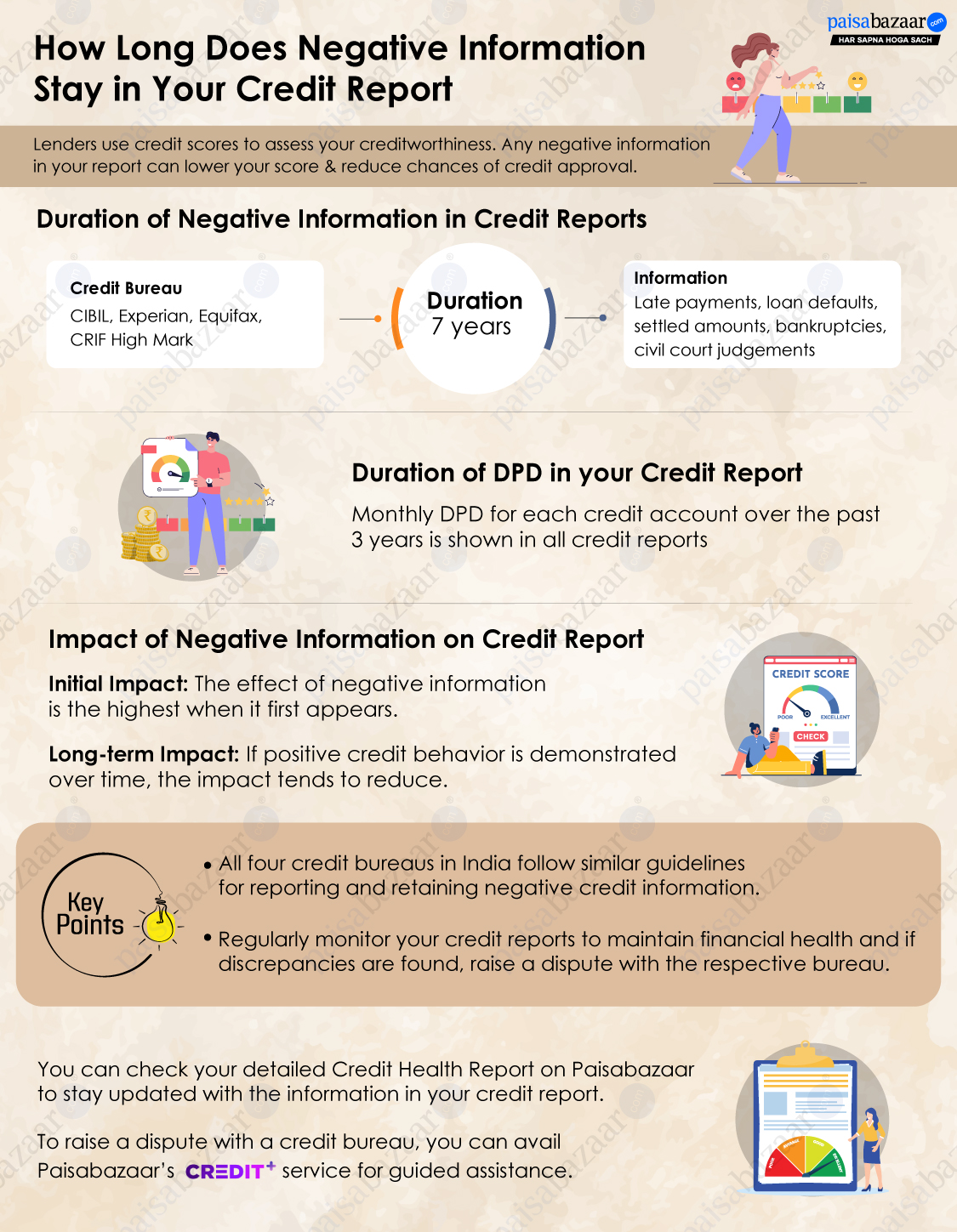

Lenders and credit card providers check your credit report before approving or rejecting your credit application. A good credit score and a clean credit report can make it easy for you to get your application approved, whereas a low credit score occurring because of numerous negative items in the credit report can make it difficult to get your application approved.

Simply put, defaults and negative information in your credit report reduce your creditworthiness significantly. Thus, it becomes imperative to get the negative information removed from the credit report, if possible or wait for a certain duration for it to vanish from your report eventually. Once your credit score is good enough, you can plan to avail new credit again.

How Long does a Default Account Status Remain in Your Credit Report?Your credit report contains information regarding the status of all credit accounts. Lenders pay a lot of attention to this section of your credit report. It contains details such as account opening/closing date, account type, lender name, account number, sanctioned loan amount/credit limit, etc. It also contains a credit account’s latest status, such as active, closed, settled, NPA, wilful defaulter, etc. All information related to your credit accounts remains in your credit report for seven years, whether positive or negative. A “closed” status signifies that you have paid all dues in full, and the account is closed. It has a positive impact on your credit report. Any other account status, be it settled, NPA or wilful defaulter, has a serious impact on your credit report and will have a damaging impact on your credit score. |

How Long does a Default Payment Remain in Your Credit Report?When you look into the Payment History section of the credit report, you will find all credit accounts with DPD (Days Past Due) data. This information stays in your credit report for thirty-six months or three years. Any default or missed payment is mentioned here for every month. Missing the payment deadline regularly can impact your credit score and lower your creditworthiness. Lenders may not trust you for new loans or credit cards, especially for high-ticket loans or higher credit limits at the time of credit approval. Even if your application is approved, you may end up with stricter loan terms, lower limits, higher interest and shorter tenure. It is worth mentioning that CIBIL does not maintain a defaulter’s list, and no such list is maintained or shared by any other credit bureau with lenders. However, as discussed above, any default will feature in your credit report for up to 7 years. |

Also Read: How to Check the CIBIL Defaulters List

Your creditworthiness is impacted by every default or missed payment in your credit report. Regularly missing out on repayments, a settled account, or an NPA damages your credit score to an extent where there is almost no scope for any credit approval in future.

As long as such defaults remain in your report, your score shall remain low. There isn’t much that you can do to improve your score. Under such circumstances, you should patiently repay your remaining credit dues on time, pay off any default/NPA if possible and not apply for new credit.

Missed payment instances shall vanish from your report in about three years, and the default account status may be removed from your account after seven years. Once such details get removed, your recent good credit behaviour shall start showing results, and you may witness improvement in your credit score eventually.

To improve your credit score, you should follow some of these points very diligently:

A settled account in your credit report may also dent your credit score drastically. You can contact your lender and request to update the account status as closed after paying off the remaining dues.

If the lender agrees and accepts your payment, it converts the settled status to closed and provides you with an NOC (No Objection Certificate). You can submit this NOC to the credit bureau, and the bureau shall update it in its database. You shall start witnessing a significant improvement in your credit score from the next cycle.

Suggested Read: Why Should You Not Settle a Credit Account

It may not be possible for defaulters at times to improve their credit scores on their own. In case you find it difficult to understand why your credit score is falling, you can subscribe to Paisabazaar’s Credit+ service and seek expert assistance to understand the reasons behind your falling credit score and how to start rebuilding it. Our experts analyse your detailed credit health report and offer the best possible suggestions to minimise the impact of defaults in your credit report in the long run. If you follow their recommendations, you can start improving your credit score sooner.