Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

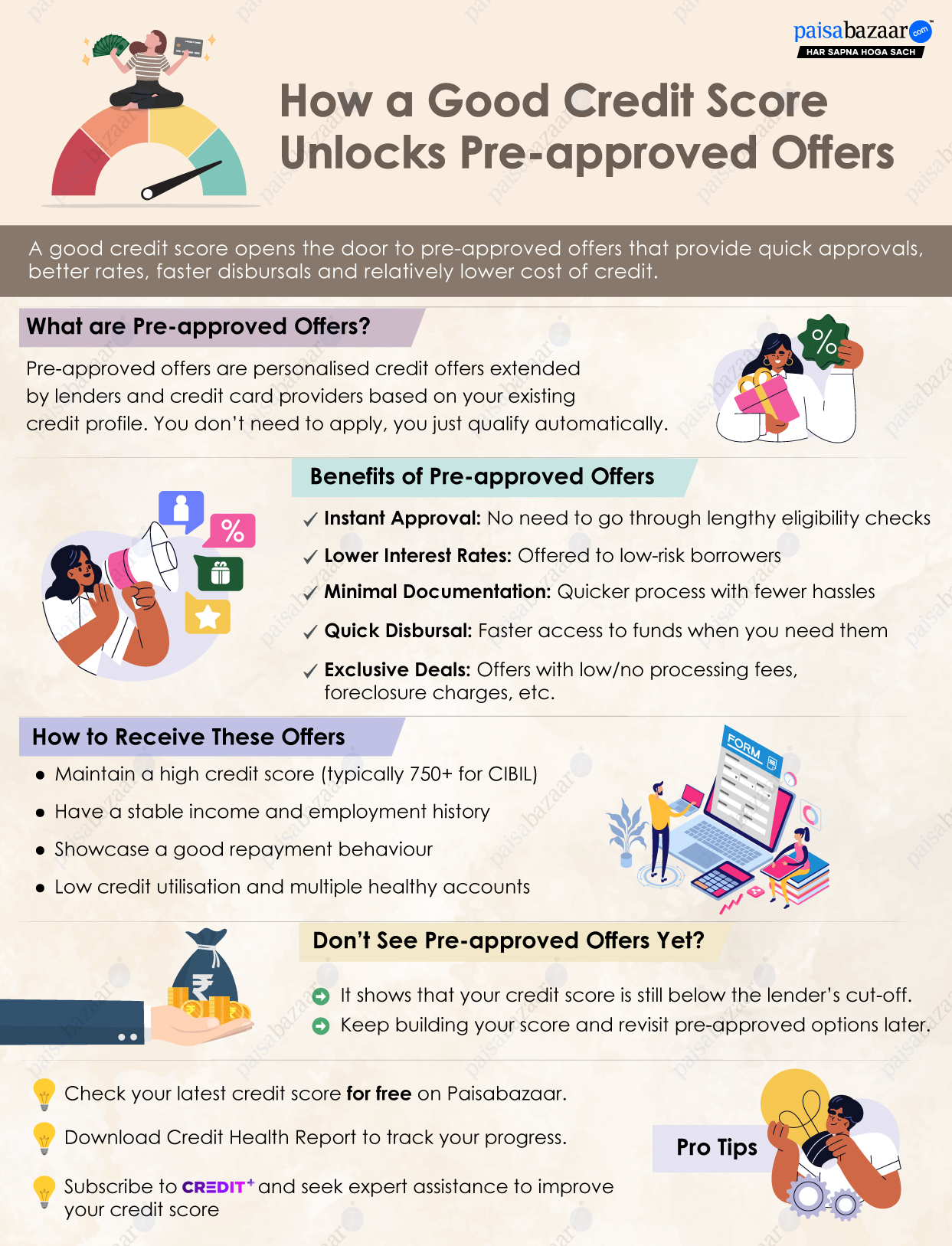

Pre-approved offers for personal loans and credit cards come with easier processes, zero or minimal documentation and quick disbursals – usually on the same day. Pre-approved offers are usually given by Banks to their select consumers or by lenders to consumers with a strong credit score.

Your credit score (scored out of 900) reflects your creditworthiness, based on how responsibly you’ve managed loans and credit cards in the past. The closer the score to 900, the better it is. A high score means you pose low risk for the lender, and thus, they are more likely to approve your loan or credit card applications.

A good credit score (typically, a CIBIL score of 750 and above) can provide you access to loans or cards with minimal documentation and quicker disbursals.

Read in Detail: What is a Credit Score

What Are Pre-approved Offers?Pre-approved offers are extended to you by banks or NBFCs based on your existing credit score, income, and overall credit profile. If you already meet a lender’s criteria on credit score, income etc. you may get pre-approved offers from them. You can see these offers on your bank’s netbanking or mobile banking dashboard. However, your profile will only show pre-approved offers from that bank. On Paisabazaar, you will see offers from multiple lenders and credit card providers, basis your credit profile. This can be very beneficial as you get to compare offers in one place and choose the one that suits your requirements the best. |

Pre-approved offers can make life easier when you need credit quickly and without much hassle. Some of the benefits of these offers are mentioned below:

Applicants with high credit scores pose less risk of default for a lender when compared to those with low credit scores, where the borrower has already shown an indisciplined credit behaviour.

Lenders reward this “less risk” of their investment (loan to a borrower) by extending such offers only to those with a strong credit score, often borrowers with a CIBIL score of 750 or more. This is because the borrower is likely to repay on time, considering the past credit behaviour.

If your score is low, you are unlikely to be eligible for any pre-approved offers and may have to go through the regular application process and documentation, and would also have lesser choice to apply form. You may also have to adhere to stricter loan terms and pay higher interest cost.

Also Read: How is a High Credit Score Beneficial for You

Do Pre-approved Offers Affect Credit Score?Just viewing or receiving a pre-approved offer doesn’t impact your credit score. As you did not request an offer, no hard enquiry is initiated. However, as soon as you accept the offer and apply for the loan or card, the lender initiates a hard enquiry. This might reduce your score slightly, and that too only temporarily. If you follow disciplined credit behaviour, your score would rise again. |

As you may not be eligible for pre-approved offers when your credit score is low, you should first and foremost try to improve your credit score.

If you’re working on improving your score, it may take some time depending on the severity of your credit profile. Once your score crosses the minimum eligibility threshold, you may start receiving pre-approved offers from lenders again.

Suggested Read: 7 Tips to Boost Your CIBIL Score and Get Loan Approval

Pre-approved offers depend mainly on your credit score. That’s why, it’s important to:

A consistent credit behaviour will enable you to stay eligible for the best credit offers whenever needed.

To stay updated with your credit score, do check it on Paisabazaar. In case you have a good credit score, you should see pre-approved offers on your dashboard. In case you have a low score and you want to improve it with the help of expert assistance, do subscribe to Paisabazaar’s Credit+ program and start rebuilding your credit score starting today.