Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

An error in your credit report can seriously damage your credit score. It can eventually impact your creditworthiness and affect your loan and credit card approval in future. A timely intervention can help rectify these errors and maintain a high credit score. Let us understand errors that can be present in a credit report, how to detect and get them removed to be eligible for most loan and credit card offers in future.

Common Errors in a Credit ReportYour credit report can contain the following errors –

|

You should not panic if you see errors in your credit report. It can occur due to multiple reasons. The best option is to stay vigilant and check your credit report regularly.

Four credit bureaus operate in India – CIBIL, Experian, Equifax and CRIF High Mark. As per an RBI directive, a borrower is eligible for a free detailed credit report from the credit bureau every year. You can request the report and check its details for errors. These errors can occur anytime, and thus, it is recommended that you check your credit report every month. However, credit bureaus charge you a subscription fee if you want regular reports.

You can check your credit report at Paisabazaar and receive monthly updates for free. It can help you stay updated with any changes in your report and rectify errors as they occur. Also, you get credit reports from multiple bureaus at Paisabazaar. It helps to find from whose end the error has originated.

When you find the same error in credit reports from all credit bureaus, it shows that a specific lender has provided incorrect data to all bureaus, and thus, the correction request needs to be made to the lender first.

When the error is detected in the credit report of a specific bureau and other bureaus have correct reports, it shows that the mistake is from the bureau’s end, and the lender is not at fault. Thus, you should raise the issue with the bureau and get it corrected.

Also Read: How to Detect Fraud in Your Credit Report

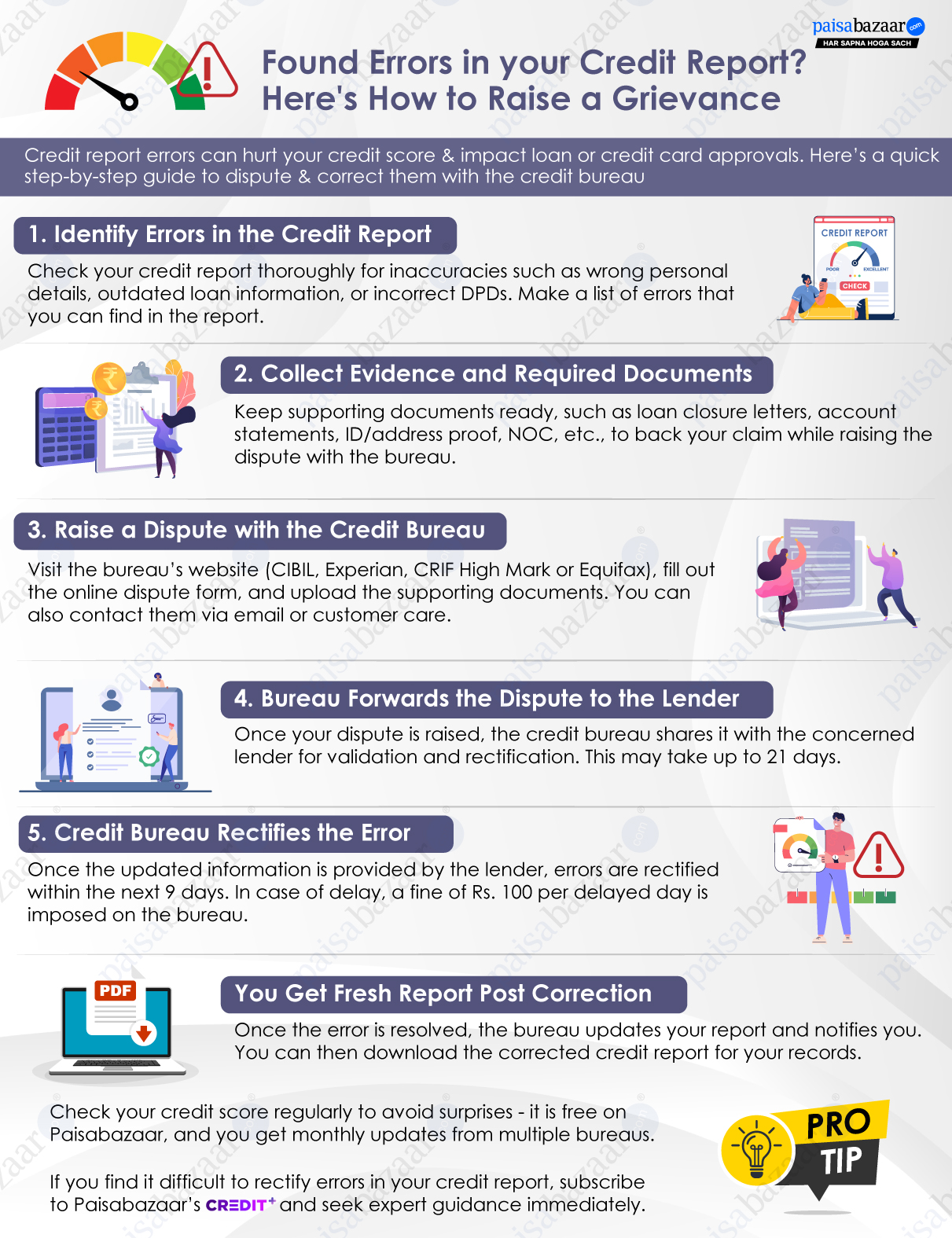

How to Raise a Grievance for Correcting Errors in the Credit Report

How to Raise a Grievance for Correcting Errors in the Credit ReportThere are two options to raise a grievance. You can either send a mail to the concerned lender or the credit bureau, properly mentioning the complaint and providing related documents for scrutiny of your request or raise a complaint directly at the credit bureau’s portal.

Here is a step-by-step process to raise a grievance through the credit bureau’s website:

Step 1: Visit the credit bureau’s website and login to your account

Some credit bureaus also provide a direct link for grievance redressal.

Step 2: Mention errors in the latest credit report and specify the correct value/data

Step 3: Attach relevant documents with the form in the attachment section

Step 4: Review all details and submit the form

The grievance is raised, and the bureau requests a response from the concerned lender. Once the lender submits its response, the credit bureau updates the entries and generates a fresh credit report containing the latest credit score.

Suggested Read: CIBIL Dispute Resolution – How to Raise a CIBIL Dispute

Seek Expert Guidance through Paisabazaar’s Credit+ ProgramBorrowers who find it difficult to understand errors in their credit report can now get their errors identified and rectified with expert assistance. They can now subscribe to Paisabazaar’s Credit+ Advisory Service and seek the assistance of a credit expert. The credit expert analyses the detailed credit report and identifies all errors in your credit report. He then helps you raise grievances with the concerned entities and rectify them before these errors damage your credit score further. The expert guides you during the complete procedure and provides timely updates. In addition, you also get to learn about various factors that impact credit score and how to improve and maintain a high credit score to be eligible for loans and credit cards in future. |

Read in Detail: Credit+: Paisabazaar’s Credit Improvement & Rectification Services