Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

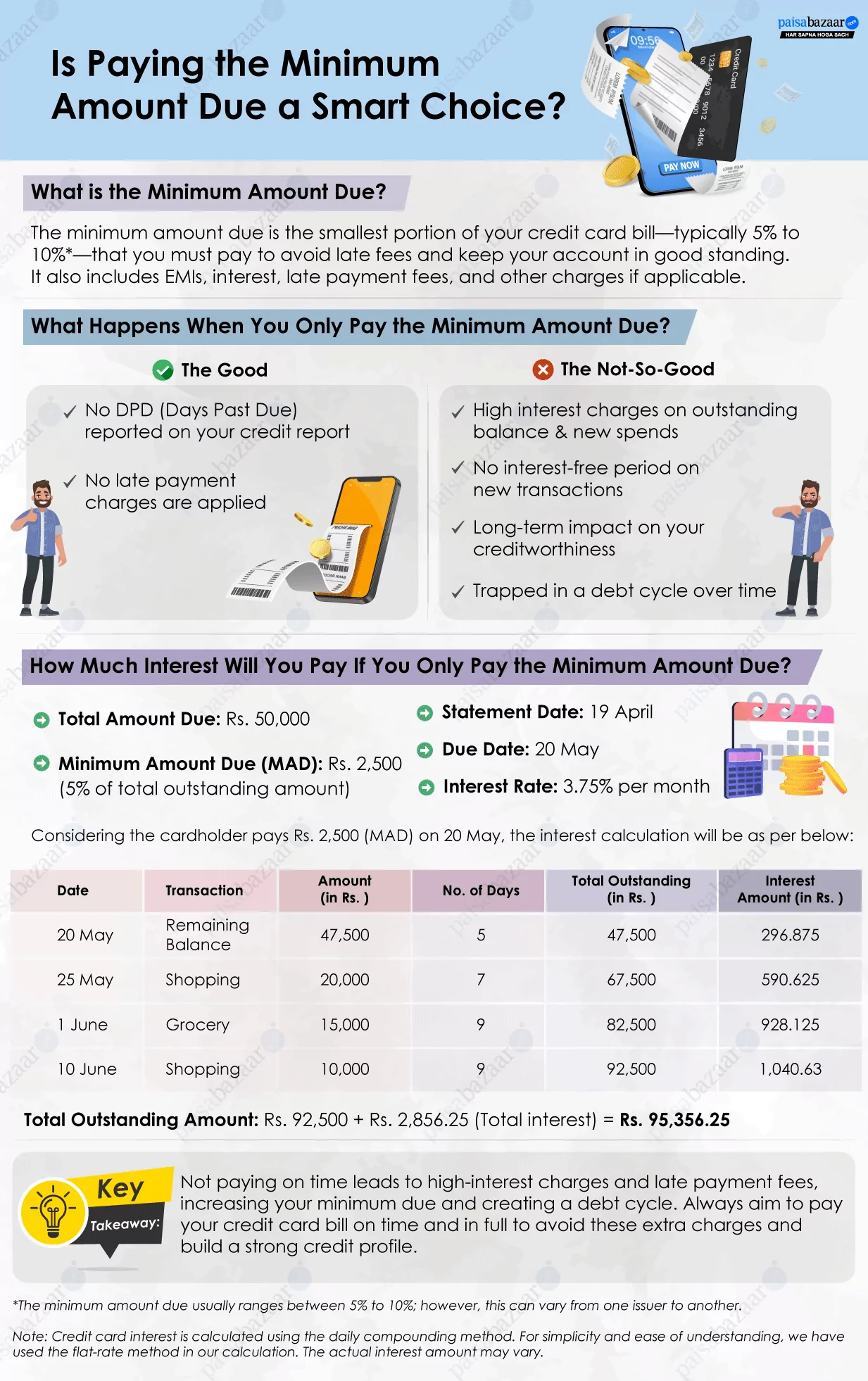

Paying only the minimum amount due is a common practice that many credit cardholders follow when making bill payments. While consumers often believe that paying just the minimum is a good way to build credit and maintain a healthy credit score, this can have negative consequences if it becomes a regular habit.

Here’s everything you need to know about the minimum amount due on a credit card—and whether it’s truly a smart financial practice.

What Is the Minimum Amount Due on a Credit Card?

What Is the Minimum Amount Due on a Credit Card?The minimum amount due is the smallest portion of your total outstanding credit card bill that must be paid by the due date to keep your account in good standing and avoid late payment charges. Usually, the minimum due ranges from 5% to 10% of the total outstanding amount, though this percentage may vary from one issuer to another.

One important thing to note is that the minimum amount due includes EMIs, interest, fees, and other charges. So, if you have an ongoing EMI, it will also be added to the monthly minimum amount due.

While calculating the minimum amount due, the following components are considered:

Example 1:

Minimum Amount Due: 5% of Rs. 30,000 = Rs. 1,500

Example 2:

Minimum Amount Due: Rs. 1,500 (5% of Rs. 30,000) + Rs. 5,000 (EMI) = Rs. 6,500

Example 3:

Minimum Amount Due: Rs. 1,500 (5% of Rs. 30,000) + Rs. 5,000 (EMI) + Rs. 500 (Annual Fee) = Rs. 7,000

Paying only the minimum amount due is sufficient to keep your credit card account active and avoid late payment fees. However, it is not a good long-term practice. When you pay only the minimum due, the remaining outstanding balance gets carried forward (revolved) to the next billing cycle. The outstanding balance, along with any new purchases, starts attracting high interest charges from the date of the transaction.

By paying your credit card bill in full, you can get an interest-free period of up to 45–55 days (depending on the issuer). However, if you pay only the minimum amount due, you lose this interest-free period. Interest will be charged on both the outstanding balance and new purchases from day one until all dues are cleared.

Therefore, it is advisable to always pay your credit card bill in full to avoid high interest charges and save yourself from falling into a debt trap.

Missing bill payments or making partial payments towards your credit card dues is the most common reason why people fall into debt. If you don’t make any payment against your credit card bills, it can lead to late payment charges. Not only do missed payments attract high-interest charges leading to subsequent debt, but they can also damage your credit score, as missed payments are recorded in your credit report’s ‘Days Past Due (DPD)’ section. Hence, if you are not able to pay your card bill in full, you should pay at least the minimum amount due or the maximum amount you can repay to maintain a healthy credit profile.

Does Paying Minimum Amount Due Affect Your Credit Score?

While paying the minimum due avoids a negative mark on your credit report, it increases your credit utilization ratio and outstanding balance, both of which can affect your credit score over time. A higher CUR and revolving large balances for a longer period are seen as risky behaviour by lenders, which makes it difficult for you to get approved for better credit cards in the future.

| Pros | Cons |

|

|

Paying only the minimum amount due may offer short-term relief, but it can lead to long-term financial stress. It’s always better to pay your credit card bill in full and on time to maintain a good credit profile and avoid high-interest charges. However, if you are not able to pay your credit card bill in full every month, at least paying the minimum helps you avoid late fees and late payment reporting.