Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

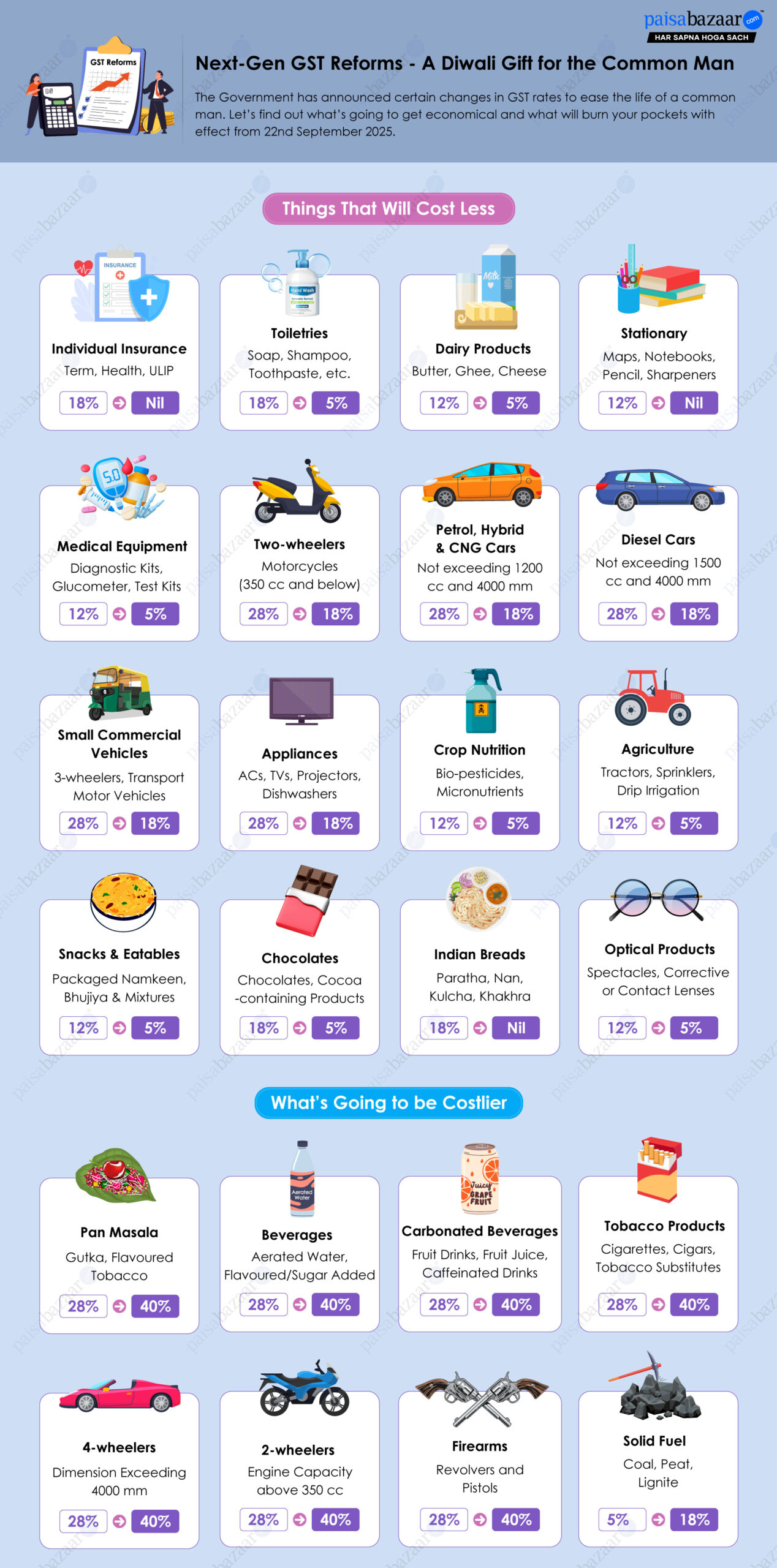

The Finance Ministry has finally accepted the recommendations suggested in the 56th GST Council’s meeting on 3rd September 2025, that comprised of the Finance Minister, Union Minister of State for Finance and 31 Finance Ministers (28 from states and 3 from union territories with legislative assemblies).

The rationalisation in GST rates have been announced to ease lives of common man with focus on labour-intensive industries, agriculture, health and other key drivers of the economy. Let’s find out what’s going to get economical and what will burn your pockets with effect from 22nd September 2025.

Key Takeaways

|

Let us have a look at some of the commodities that will get economical.

| Product | Current GST | New GST |

| Term, Life Insurance, ULIP | 18% | Nil |

| Health Insurance, Family Floater, Senior Citizen | 18% | Nil |

The government has exempted all individual insurances including term, health, ULIPs, etc. from GST providing relief to all insurance holders.

However, it is yet to be ascertained if the exemption would be applicable to add-on GMC policies or not.

| Product | Current GST | New GST |

| Maps, Charts, Globes | 12% | Nil |

| Exercise Books, Notebooks | 12% | Nil |

| Pencils, Sharpeners, Crayons, Pastels | 12% | Nil |

| Erasers | 5% | Nil |

| Mathematical, Geometry and Colour Boxes | 12% | 5% |

| Product | Current GST | New GST |

| Air Conditioners, Dish Washing Machines | 28% | 18% |

| Televisions (LCD and LED), Monitors, Projectors, Set Top Box | 28% | 18% |

| Solar Water Heater and System | 12% | 5% |

| Utensils, Table, Kitchen or Other Household Articles of Aluminium | 12% | 5% |

| Product | Current GST | New GST |

| Bio-Gas Plant and Waste to Energy Plants / Devices | 12% | 5% |

| Solar Power-based Devices, Solar Power Generator, Solar Lantern / Solar Lamp | 12% | 5% |

| Wind Mills, Wind Operated Electricity Generator | 12% | 5% |

| Ocean/Tidal Waves Energy Devices, Photo Voltaic Cells | 12% | 5% |

| Product | Current GST | New GST |

| Ultra-High Temperature (UHT) Milk | 5% | Nil |

| Condensed Milk, Cheese | 12% | 5% |

| Butter, Ghee, Butter Oil, Dairy Spreads, etc. | 12% | 5% |

| Chhena, Paneer (Pre-packaged and Labelled) | 5% | Nil |

| Product | Current GST | New GST |

| Talcum Powder, Face Powder, Hair Oil, Shampoo | 18% | 5% |

| Soap, Shaving Cream & Lotion, Aftershave Lotion | 18% | 5% |

| Tooth Paste, Dental Floss | 18% | 5% |

| Tooth Powder | 12% | 5% |

| Product | Current GST | New GST |

| Namkeens, Bhujia, Mixture, Chabena, etc. Ready for Consumption | 12% | 5% |

| Jams, Fruit Jellies, Marmalades, Fruit Puréeor Pastes | 12% | 5% |

| Pastry, Cakes, Biscuits and Other Bakers’ Wares | 18% | 5% |

| Pasta (Spaghetti, Macaroni, Noodles, Lasagne, Gnocchi, Ravioli, Cannelloni; Couscous) | 12% | 5% |

| Product | Current GST | New GST |

| Chocolates and Other Cocoa Preparations | 18% | 5% |

| Sugar Confectionery | 18% | 5% |

| Lactose, Maltose, Glucose and Fructose, Artificial Honey, Caramel | 18% | 5% |

| Sugar Boiled Confectionery | 12% | 5% |

| Product | Current GST | New GST |

| Tender Coconut Water | 12% | 5% |

| Fruit/Nut/Vegetable Juices | 12% | 5% |

| Soups and Broths Preparation | 18% | 5% |

| Soya Milk Drinks | 12% | 5% |

| Milk Beverages | 12% | 5% |

| Natural/Artificial Mineral/Aerated Waters (Not containing added sugar or other sweetening matter nor flavoured) | 18% | 5% |

| Product | Current GST | New GST |

| Thermometers for Medical, Surgical, Dental or Veterinary Usage | 18% | 5% |

| Medical, Surgical, Dental or Veterinary Instruments and Apparatus | 18% | 5% |

| Clinical Diapers, Napkins and Napkin Liners for Babies | 12% | 5% |

| All Drugs and Medicines Intended for Personal Use | 12% | 5% |

| Product | Current GST | New GST |

| Petrol, LPG, CNG & Hybrid Cars of Engine Capacity up to 1200cc and Length up to 4000 mm | 28% | 18% |

| Diesel & Hybrid Cars of Engine Capacity up to 1500cc and Length up to 4000 mm | 28% | 18% |

| Three-wheelers | 28% | 18% |

| Motor Vehicles for Goods Transport | 28% | 18% |

| Tractors for Agriculture | 12% | 5% |

| Road Tractors | 28% | 18% |

| Motorcyclesup to 350cc Engine Capacity | 28% | 18% |

| Product | Current GST | New GST |

| Biofertilizers, Bio-pesticides, Micronutrients | 12% | 5% |

| Sulphuric Acid, Nitric Acid and Ammonia | 12% | 5% |

| Sprinklers, Drip Irrigation System, Mechanical Sprayers | 12% | 5% |

| Agricultural, Horticultural, Forestry Machinery & Parts | 12% | 5% |

| Harvesting/Threshing/Composting Machinery | 12% | 5% |

| Product | Current GST | New GST |

| Hotel Accommodation (up to Rs. 7,500 per unit per day) | 12% | 5% |

| Physical Well-being Services, Gyms, Yoga Centres | 18% | 5% |

| Beauty Parlours, Barbers, Salons | 18% | 5% |

Don’t know your Credit Score? Check it here for FREE. Check Now

The Government has imposed higher GST rates on some commodities as well. These items fall mostly under sin-goods or goods that are not needs. Below-mentioned is a list of some products where consumers will have to pay higher GST rates.

| Product | Explanation | Current | New |

| Pan Masala | Gutka, Flavoured Tobacco | 28% | 40% |

| Beverages | Aerated Water, Flavoured/Sugar Added | 28% | 40% |

| Carbonated Beverages | Fruit Drinks, Fruit Juice, Caffeinated | 28% | 40% |

| Tobacco Products | Cigarettes, Cigars, Tobacco Substitutes | 28% | 40% |

| 4-wheelers | Dimension Exceeding 4000mm | 28% | 40% |

| 2-wheelers | Engine Capacity above 350cc | 28% | 40% |

| Artificial Menthol Items | Items Other than Natural Menthol | 12% | 18% |

| Solid Fuel | Coal, Peat, Lignite | 5% | 18% |