Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

One of the many reasons consumers are apprehensive of owning a credit card is the fear of being caught in a debt spiral. However, credit card debt emerges only out of irresponsible credit behavior. Also, if you find yourself stuck in a credit card debt, strategizing your next financial moves at the right time will help you recover gradually.

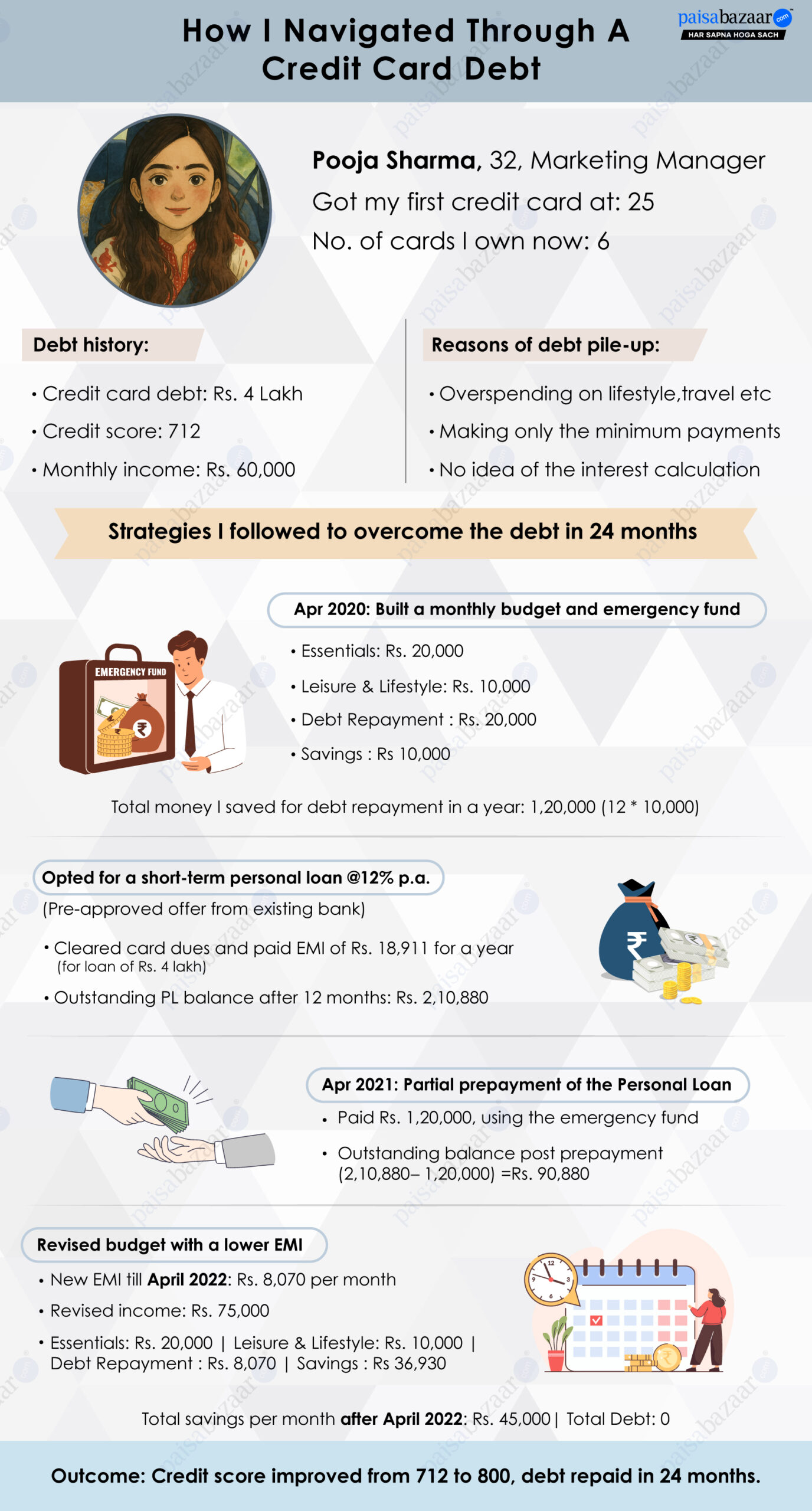

On this page, we discuss the credit journey of our employee Pooja Sharma (name changed) who smartly navigated through debt. In her credit age of seven years, Pooja, a 32-year-old marketing manager, landed herself in credit card debt. However, better late than never, she identified the possible causes and impact of her being caught in the debt spiral and started focusing on the breakthrough.

Pooja started using credit cards seven years ago when she was 25. In two years of her juggling multiple credit cards and the mismanagement that followed, she landed in a credit card debt of Rs. 4 Lakh with a lowered credit score of 712.

Realizing that she was quickly falling into a debt spiral, Pooja soon created a debt repayment plan and gradually came out of credit card debt, rebuilding her credit score and eventually her finances. Here’s the roadmap she followed:

April 2020: Begins with Monthly Savings & Short-term Personal Loan

1. With a monthly income of Rs. 60,000, Pooja built a monthly budget for savings, expenses, and emergency funds, inclusive of a debt repayment amount.

2. As per this budget, Pooja aimed at saving Rs. 1,20,000 (12*10,000) in a year, and based on the monthly capacity to repay the debt, she opted for a short-term personal loan (Pre-approved offer from existing bank) that would allow debt repayment in EMI.

Outstanding balance: Rs. 4 Lakh

Rate of Interest: 12% p.a.

Tenure: 24 months

Monthly EMI: Rs.18,911

One year Later- April 2021: On-time EMI Payment, Partial Prepayment with Savings

3. Pooja paid this monthly EMI for a year, leading her remaining outstanding balance to Rs. 2,10,880

4. To further close the debt quickly, she used surplus savings of Rs. 1,20,000 to prepay the outstanding amount partially.

Outstanding balance post prepayment (2,10,880−1,20,000) =Rs. 90,880

Now, based on the new amount, she got a lower EMI liability for the remaining tenure (12 months) of Rs. 8,070

Considering an increase in income from Rs. 60,000 to Rs. 75,000, her revised budget was:

5. Pooja then paid the new EMI (lowered) for a year.

April 2022: Debt-free

Pooja eventually got rid off the debt. Post this period here monthly savings were Rs. 45,000 and total debt stood at 0.

With the credit card debt repaid in 24 months, Pooja’s credit score improved from 712 to 800. She now owns six credit cards, knows card usage better and maximizes benefits and saves on her day-to-day and leisure expenses.

Tips to follow for a debt-free credit experience:

If, out of financial emergencies or other reasons, you are caught in a debt trap, here are a few suggestions:

Maintaining a strong credit profile is largely dependent on responsible credit behavior while dealing with credit cards. Though maximizing card benefits is important, it is crucial to ensure that you do not yield the perks at the cost of overspending. Aim to keep your credit utilization in check and avoid falling into a debt trap. Wise usage eventually leads to a debt-free credit journey and a strong financial profile.