Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

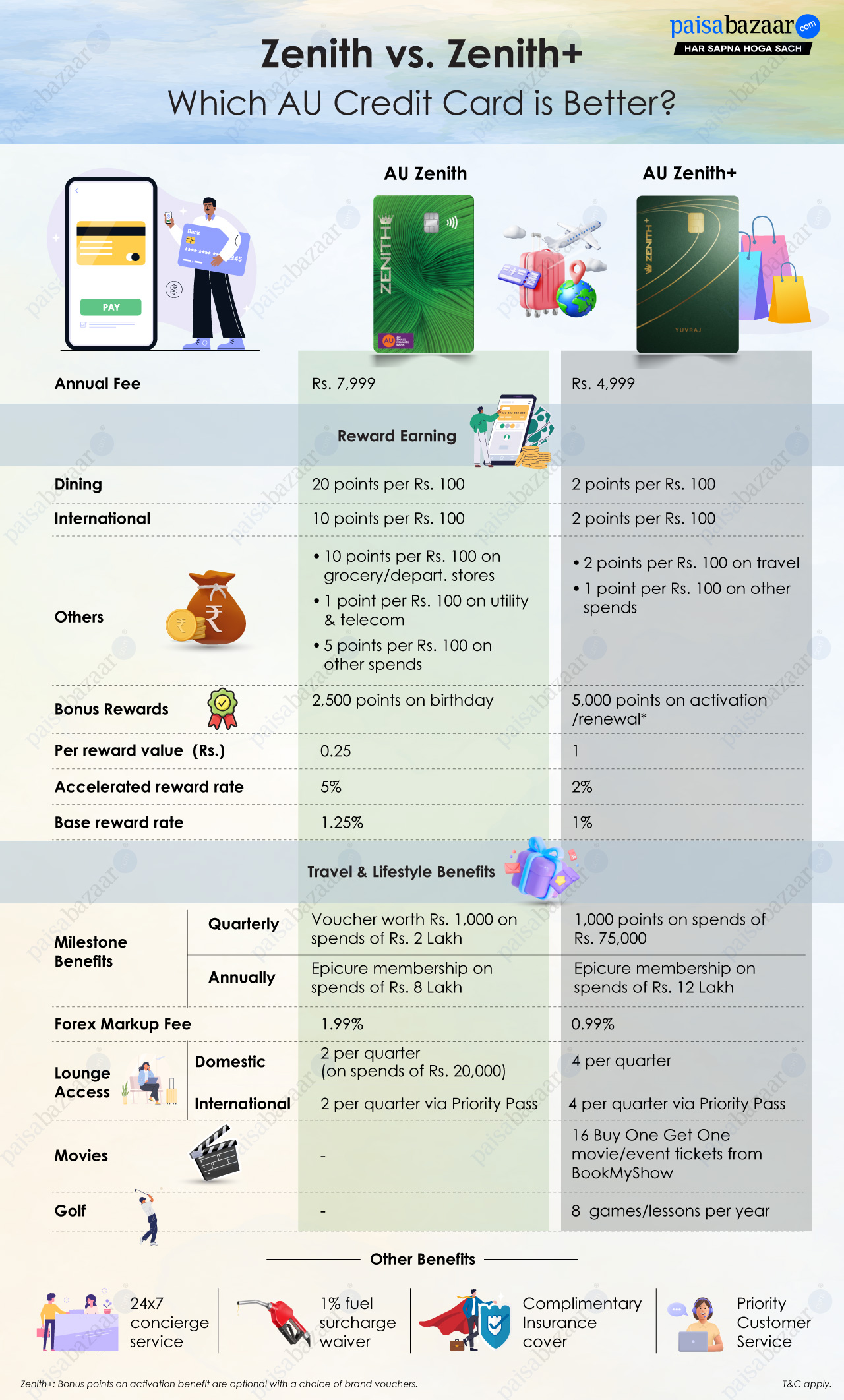

AU Small Finance Bank’s two premium credit cards — AU Zenith and AU Zenith+ — are gaining popularity due to their rewards programs and lifestyle benefits. While AU Zenith+ is considered to be a premium ‘metal’ variant of AU Zenith, it falls short when it comes to the rewards program. However, AU Zenith+ makes up for it with its premium travel and lifestyle benefits.

So, if you’re confused about which card to choose and wondering whether “Plus” is truly a premium upgrade over AU Zenith, here’s a detailed comparison to see how these two cards stack up against each other.

Rewards Program: AU Zenith’s Edge Over AU Zenith+

Rewards Program: AU Zenith’s Edge Over AU Zenith+Both cards offer accelerated rewards on dining and international spends, along with a base reward rate on other spends, including insurance and utilities, as per the below details.

| Particular | AU Zenith | AU Zenith+ |

| Dining | 20 reward points per Rs. 100 spent | 2 reward points per Rs. 100 spent |

| International | 10 reward points per Rs. 100 spent | 2 reward points per Rs. 100 spent |

| Other Spends | – 10 reward points per Rs. 100 spent on grocery & departmental stores

– 1 reward point per Rs. 100 spent on insurance, utility & telecom spends |

– 2 reward points per Rs. 100 spent on travel

– 1 reward point per Rs. 100 on other spends |

| Reward Redemption Options | E-vouchers of top brands, Merchandise, Mobile/DTH recharges and Flight/Hotel bookings & more | |

In terms of core reward benefits, Zenith comes out as a stronger option due to 3 main reasons:

However, Zenith’s redemption value is lower at Rs. 0.25 per reward point, compared to Zenith+, which allows reward redemption at a 1:1 ratio. Yet, despite the lower redemption value, Zenith Card still pulls ahead, as its high reward earning rate compensates for it by offering a value back of up to 5%, whereas Zenith+ offers up to 2%.

Given below is a comparison of how much you can save through each of these cards:

| Category | Monthly Spends (in Rs.) | Rewards Earned via AU Zenith | Rewards Earned via AU Zenith+ |

| Dining | 10,000 | 2,000 | 200 |

| International | 30,000 | 3,000 | 600 |

| Travel | 20,000 | 1,000 | 400 |

| Grocery | 10,000 | 1,000 | 100 |

| Departmental Stores | 10,000 | 1,000 | 100 |

| Insurance | 5,000 | 50 | 50 |

| Utility | 10,000 | 100 | 100 |

| Other Spends | 20,000 | 1,000 | 200 |

| Total | 1,15,000 | 9,150 = Rs. 2,288 | 1,750 = Rs. 1,750 |

Due to a higher reward earning rate, AU Zenith cardholders will earn 9,150 reward points worth Rs. 2,288 (at a redemption value of 1 RP = Rs. 0.25), whereas Zenith+ cardholders will earn 1,750 reward points worth Rs. 1,750. Therefore, even with a 1:1 redemption ratio, Zenith+ falls behind in terms of overall value back, primarily because of the significantly higher reward earning rate of the Zenith Card.

Both cards offer travel benefits, including complimentary lounge access, low forex markup fee, and more. Here’s a detailed comparison of these benefits to help you understand which card offers better value in this segment:

| Particular | AU Zenith | AU Zenith+ |

| Forex Markup Fee | 1.99% | 0.99% |

| Domestic Lounge Access | 8 domestic lounge visits per year* | 16 domestic lounge visits per year* |

| International Lounge Access | 8 international lounge visits per year via Priority Pass | 16 international lounge visits per year via Priority Pass |

| Airport Meet & Assist | – | 4 complimentary airport meet & assist services per year |

| Railway Lounge Access | 8 railway lounge access per year | – |

*This benefit is offered on spending Rs. 20,000 in the previous quarter.

While both cards offer similar travel benefits, Zenith+ stands out by offering a higher frequency of domestic and international lounge access, along with a lower forex markup fee of 0.99%, compared to 1.99% on the Zenith Card. Despite a lower annual fee, Zenith+ offers airport meet-and-assist services, enhancing its overall value for premium travellers. Though Zenith+ does not offer complimentary railway lounge access, it should not be considered a major drawback as it offers better overall travel benefits.

| Particular | AU Zenith | AU Zenith+ |

| Joining/ Annual Fee | Rs. 7,999 + Applicable Taxes | Rs. 4,999 + Applicable Taxes |

| Joining Fee Waiver | On spending Rs. 1.25 Lakh within 90 days of card setup | – |

| Annual Fee Waiver | On annual spends of Rs. 5 Lakh | On annual spends of Rs. 8 Lakh |

| Movie Benefits | – | Up to 16 free movie/ event tickets via BookMyShow per year |

| Golf Benefits | – | 8 complimentary golf games/ lessons per year |

| Annual Milestone Benefit | Complimentary Taj Epicure Membership on on annual retail spends of Rs. 8 Lakh | Complimentary Taj Epicure membership on annual retail spends of Rs. 12 Lakh |

| Other Milestone Benefit | Brand vouchers worth Rs. 1,000 on quarterly retail spends of Rs. 2 Lakh | 1,000 reward points on monthly retail spends of Rs. 75,000 |

| Welcome Benefits | – | Luxury brand vouchers or reward points worth Rs. 5,000 |

| Bonus Rewards | 2,500 bonus reward points on completing one retail transaction on birthday | 5,000 bonus reward points on card renewal fee payment |

At a comparatively lower annual fee of Rs. 4,999, the Zenith+ Card offers better lifestyle benefits, including free movie tickets, complimentary golf games, and luxury brand vouchers as welcome benefits, making it a preferable option for consumers seeking an all-rounder card with decent lifestyle benefits.

Although both cards offer similar benefits, the major differences lie between their rewards program and travel & lifestyle benefits. The Zenith Card is ideal for consumers who are more focused on earning rewards, while the Zenith+ Card is a better choice for those seeking extended travel and lifestyle benefits, such as complimentary lounge access, a low forex markup fee, free movie tickets, airport meet-and-assist, etc.

However, keep in mind that a higher reward earning rate should not be the sole criteria when choosing a card. You should analyze whether the overall benefits of the card align with your lifestyle or not. If the travel and lifestyle benefits offered by the Zenith+ Card meet your needs, it would be a better option. On the other hand, if you want to maximize benefits through the reward points, the Zenith Card would offer better value back.

Choose AU Zenith if:

You are more inclined towards earning rewards and want to maximize benefits through reward points

Choose AU Zenith+ if:

You are seeking an all-rounder card with extended travel and lifestyle benefits